Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Vaccines & your insurance, Evergrande, Toast and Emerging market themes

|

Issue: 1st October 2021 |

| Over the course of the last 12 months, the world has progressed through three broad phases of a recovery. The first, occurring in Q2 and Q3 of last year was around the growing understanding of the COVID virus and its management through containment measures. Large cap, growth biased stocks benefited at this time. The second phase, around Q4 of last year, centred on positive news on the efficacy of multiple vaccines, Biden elected as President and the anticipation of more money printing. This helped to lift cyclical sectors like small cap stocks and emerging markets. This month we entered the third phase – the reflation phase. The recovery is now being priced by other asset classes including commodities and fixed income.

What to expect next? Earnings growth for companies has been strong, however, we cannot ignore the actions of Central Banks that continue to support valuations. Thankfully, Central Banks seem likely to ‘taper’ their support instead of a sudden withdrawal, reducing but not eliminating the probability of valuations decreasing sharply. It is now widely accepted that the Fed, along with the Reserve Bank of Australia (RBA) will start to reduce monetary support over the next 2 years. The result of which will likely be a headwind to investment markets. Whether the return to ‘normal’ and pent-up demand/savings is enough to offset this will ultimately dictate the direction of market returns over the next 12-24 months. Investment Implications Investors should expect to see lower levels of equity returns relative to what has been experienced over the past 12 months. Changes in Central Bank support may be met with bouts of volatility, particularly when announcements differ to market expectations. While some sectors have provided handsome returns since the start of the crisis, others have some way to go in a relative sense. For these sectors the key consideration is whether the changes brought on by the crisis can be considered ‘temporary’ or structural and likely to persist post pandemic. In the short-term, we expect to see more volatility over at least the next month or so: we’ve still got a way to run on the Evergrande troubles (more on this below); the US debt ceiling is far from resolved; tax hikes are likely on the way in the US; supply constraints are continuing to weigh on growth and contribute to inflation; and seasonal share market weakness usually runs into mid-October. As we begin the lead up to the end of the year there is plenty keeping markets and investors on their toes. |

|

| As lockdowns endure across Sydney and Melbourne, the countdown is now on to reach those precious 70% to 80% fully vaccinated levels that will offer the return of greater freedoms usually taken for granted – not anymore… We know these are tough times and we hope all our friends and family in lockdown are out of their dilemma soon.

We share again, the Guardian tracker on the roll-out across the nation, including estimates as to when we may reach the 70% and 80% milestones. For those of you interested in keeping track of the global vaccine roll-out, we again share the Financial Times rolling tracker. Recently, we have had a number of calls from clients enquiring about the validity of their life insurance if vaccinated for COVID. The rumour mill strikes again! Please rest assured that despite falsifications suggesting otherwise, taking a COVID-19 vaccine will not invalidate your life insurance policies. The false rumours predominantly circulating on social media incorrectly suggest the covid vaccine is an ‘experimental medical treatment’ and therefore having the vaccine is a ‘self-inflicted injury’ which could void life insurance policies. As Financial Services Council (FSC) CEO Sally Loane stipulated in a recent media release, “To be clear – the COVID-19 vaccine is not an experimental treatment. Receiving approved treatment from a qualified medical professional at an approved medical facility is not a self-inflicted injury”. “One of the main reasons why people hold life insurance protection is to provide peace of mind for themselves and their families. The FSC would like to reassure Australians that when they get vaccinated, their life insurance will be there for them, completely unaffected”. As always, if you are at all concerned and would like to discuss this matter in more detail, please do not hesitate to contact us. |

|

| Evergrande, which epitomised the borrow-to-build business model and was once China’s top-selling developer, has run into trouble over the past few months as Beijing tightened rules in the property sector to rein in debt levels and speculation.

Global investors have been on tenterhooks in recent weeks ahead of Evergrande’s payment obligations over fears its difficulties could pose systemic risks to China’s financial system and possibly spill over to other markets. It is a complex issue that has many interwoven elements. The big question is, is Evergrande too big to fail and will China bail it out? Not in the Lehman league Many have suggested that this is China’s Lehman Brothers moment. In our view, the challenges facing Chinese developers and their lenders is not likely a crisis of this magnitude, and there is a strong case for a Chinese government bail-out. Our thoughts following:

Crucially, the CCP has no motive to undermine the housing market. The populace has most of its wealth invested in property and, it is its most significant driver of the economy. Hence, we expect the Government will pull levers necessary to stabilise the market. What we are likely to witness over the coming months is an epic clash between a leader with supreme powers determined to change the course of his nation and the economic constraints imposed by the heavy debts of the companies driving it.

|

|

| Chinese companies are taking on ever-increasing levels of debt in a bid to maintain the countries expected growth. Arguably, the result is growing financial fragility. Like its more advanced rivals from the US to Japan, China has seemingly created a financial system that is in constant need of government support and stimulus, as the Evergrande crisis illustrates.

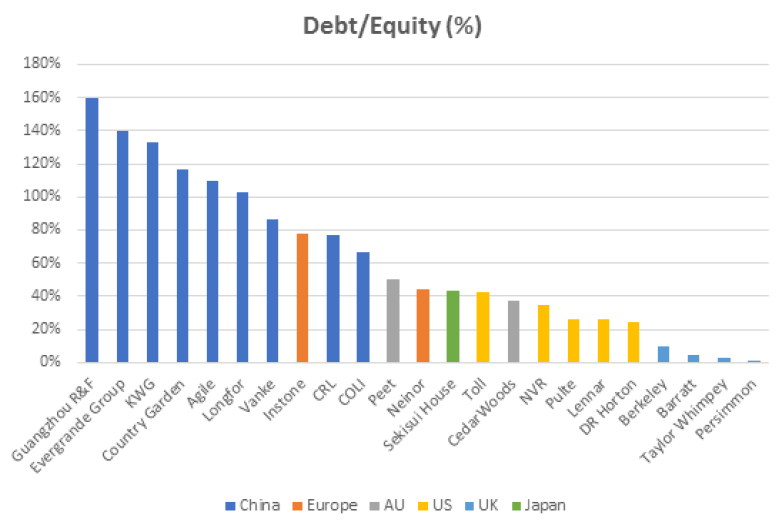

Indeed, policy tightening is a major contributing factor to the timing of Evergrande’s troubles, but principally because it was already in a self-inflicted precarious financial position, as the chart below illustrates. Our chart of the week provides a rather frightening insight into the debt to equity levels of the world’s largest, publicly-listed residential property development companies.

|

|

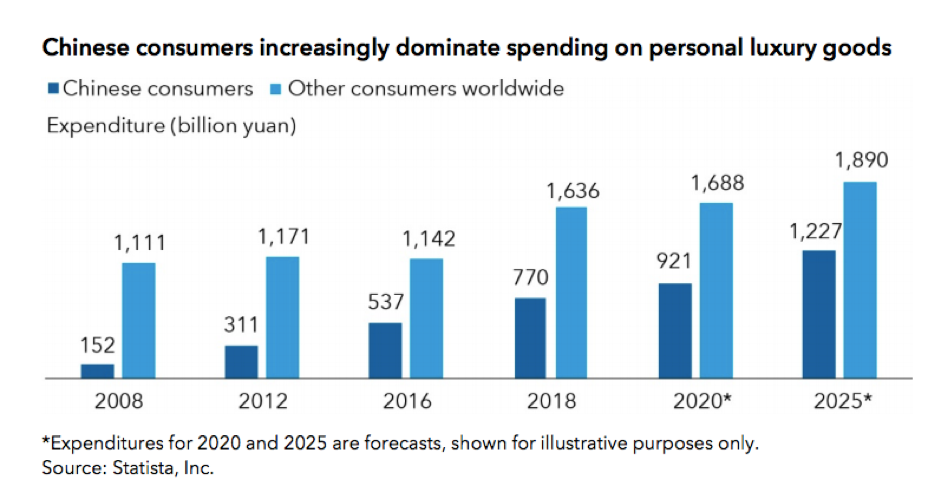

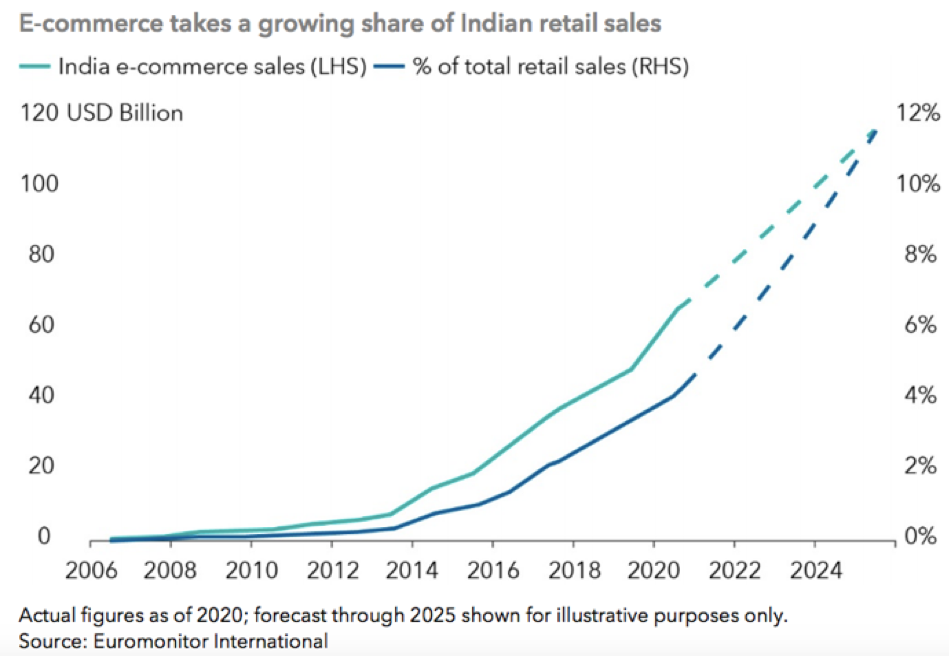

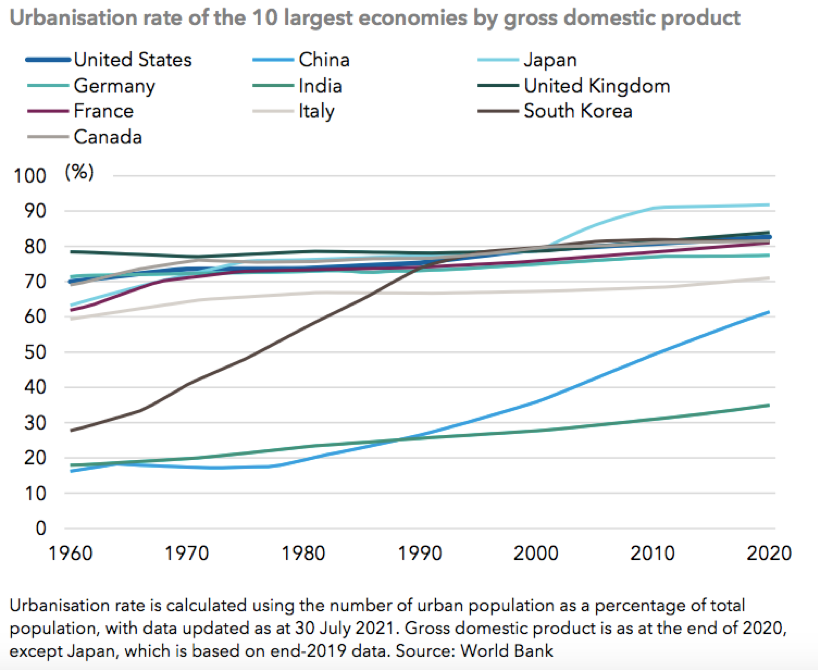

| Emerging markets are expected to grow from 58% of global growth today, to 60% by 2025.

Major trends such as the revival in travel demand, the growth of digital platforms and the acceleration of mobile technology (now accessible by the majority of demographics) are responsible for spurring the prospects of these economies. According to fund manager Capital Group, these are the key themes behind the opportunities in emerging markets in the next 10 years.

Whilst many argue that this rate of urbanisation is slowing and the housing boom in mainland China is largely over, construction remains the single greatest driver of Chinese growth. We note in the wake of Evergrande that contingent to this construction will be the CCP’s efforts to balance the economy and wider contagion impacts.

The full paper can be accessed here. |

|

| Last week the continued strong appetite for investment in technology businesses has seen shares of Toast, a US restaurant point of sale platform, surge 56% on their opening day of trading on the New York Stock Exchange with market capitalisation topping US$30 billion. (More information on the Toast IPO can be found here).

The impact of this opening day rally saw the three co-founders of the business join the billionaire club, with each owning shares worth over US$1 billion. Steve Fredette, Aman Narang and Jonathan Grimm are among a long and growing roster of tech founders who have joined the three-comma club in 2021. Some may argue this is an alarming sign of overexuberance and foolish behaviour akin to the dot-com bubble, which popped in early 2000. Others will counter that we are in an age of technology revolution. The original dot-com bubble was built almost entirely on speculation, where today’s leading technology behemoths have revenues and profits on an enviable scale. The risk for investors is one of FOMO (Fear-Of-Missing-Out). While this revolution will crown many winners, it will also have more than its fair share of failures. More important than ever is the need for careful due diligence and prudence to make sure you are backing the next Amazon, not the next pets.com.

|

|

| From the desk of Brenton Moyle, our debt and financing specialist. A quick reminder that as the below statistics show, buyers are competing at unprecedented levels for property right now. Understandably lending institutions are also under pressure, if you are in the market, it is vital you get your finances in order

Almost 598,000 residential properties were sold in the year to August, which is the highest number of annual sales since 2004, according to CoreLogic. The August result was 42% higher than the year before and 24% higher than the 20-year average. Six states and territories recorded sales volumes above their 20-year average:

|

|

| While there is not much to laugh about in a fuel shortage crisis, we couldn’t help but have a giggle when the BBC sent reporter Phil McCann to a local fuel station to report on the UK’s petrol shortage. Fortunately, Brits were quick to see the funny side and get our pick for report(er) of the week.

“Phil McCann” Is the name of a BBC journo who has been covering Britain’s fuel shortage crisis. Clearly, he was born for the moment!

|

|

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |

|

|