Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Responsible investing, Elon Musk, Rivian, Wearable tech and More…

|

Issue: 12th November 2021 |

| Climate change concerns and energy woes dominated the global economy these past few weeks as nations attended the UN’s Climate Change Conference (COP26). In something of a conundrum, Global leaders were tasked with presenting a compelling case to continue their aggressive fight against climate change right when the demand for fossil fuels (and energy prices) has never been higher.

None-the-less climate change affects us all and the need to work together is essential – A big challenge for the 54 Member states of the Commonwealth when 32 of them are classified as ‘small states’ and, we can only imagine may find it hard to get their message across in large international fora on their own. Surprisingly the biggest show of unity came from China and the US. Whilst they are at odds on many issues, they announced an agreement to boost climate cooperation. The terms of the deal weren’t groundbreaking — but the fact that agreement occurred at all is notable. In Australia, after being slow out of the blocks with our COVID-19 vaccinations we reached a meaningful milestone surpassing Israel’s rates, the poster child for the vaccine rollout. States began to launch and fulfil re-opening plans and Prime Minister Scott Morrison announced plans to reopen the international border. It is hard to believe that after more than 600 days Australian residents now have the freedom to move beyond international borders without permission and that by years end we will welcome (vaccinated) tourists back to our shores. In response business confidence reported for October was well up with the largest monthly gain since mid-2020 and well above the long-run average. Unemployment was also a big theme in recent weeks as Australian media outlets react to PWC and Deloitte’s report coining a post-COVID easing era as ‘The Great Resignation’. The consultants published that almost 40% of workers in Australia are planning to change jobs within the next 12 months, following the phenomenon seen already in the US. As the debate rages on the jury is still out on whether this is just a short-lived phenomena or a true threat to Australian employment stability. Only time will tell. The focus on China continues as investors keep their eyes on the property sector, looking for any further indications of instability after September’s Evergrande “almost-crisis”. Despite missing another payment to debtors this month, China’s central bank has assured that Evergrande’s situation is controllable. However, with half of the world’s distressed dollar-denominated debt tied up in China’s real estate sector, investors are understandably on tenterhooks. In recent weeks, analysis was released from multiple research houses that benchmarked the top 30 property firms in China against the country’s three redlines (the project name for Xi’s deleveraging policy rolled out in January). Despite findings that more than two-thirds of this sample have breached at least one of these “lines”, China’s central bank announced their continuing view that the industry is stable and Evergrande was a unique case. Mmm… ‘nothing to see here boss’! We continue to monitor for signs of validation for this view. |

|

| World leaders are now home, having made their appearances at the COP26 climate summit in Glasgow, but now the real work begins. Not just by their teams left to put a workable framework around targets for achieving net-zero carbon emissions, but by stakeholders globally of which the investment management sector, as custodian to the current and future wealth of so many, is a critical one.

When it comes to global warming, there are, of course, many views – as financial advisers, it is not our place to weigh in on them. Rather, our job centres around successful investing. In our view, successful investing goes hand in glove with identifying and owning for the long-term, companies that can sustainably generate excess returns on capital for years to come. It is within this assessment of a company’s ‘quality’ that ESG (Environmental, Social, Governance) factors play an important role. Tasked with identifying these companies are our chosen fund managers consisting of (teams of) skilled analysts that undertake detailed research and investigation into the companies and/or securities in their chosen market. This process typically involves numerous visits and meetings with company management, customers, suppliers, competitors, regulators, etc., in addition to detailed analysis into the company’s financial accounts, regulatory filings, tax statements, patents, litigation, and anything else relevant to the company’s operations and prospects. It also includes an in-depth investigation into each company’s ESG policies and practices. Environmental Issues From a business risk perspective, the types of environmental risks or opportunities that managers will consider when measuring the future operations of a company include pollution, climate change, resource depletion, ecosystem change, waste disposal, the use of toxic chemicals, the formal license to operate in communities and other environmental issues. Climate change is a particularly important environmental issue for global businesses and investors to consider. To help evaluate business risks specific to climate change, different fund managers will deploy different strategies. For example, most of the managers in our portfolios are a signatory of CDP’s (Carbon Disclosure Project) climate change program granting them access to a companies’ detailed climate disclosures including data on carbon emissions and climate change mitigation activities. Responsible investing will have a growing influence on markets in the decades ahead. While not the only factor to consider, it is a significant theme driving portfolio decision making and you can expect to hear more from FinSec on how we factor this into our own methodologies.

|

|

| Elon Musk has already become the world’s richest person on the Bloomberg Billionaires Index based on the rise of Tesla, the hyped electric-car maker (interestingly, it is his involvement with SpaceX, rather than Tesla that has seen Morgan Stanley predict his rise to trillionaire status).

AFR’s Dana Hall has covered Tesla for a decade, and the arc of the company from “scrappy Silicon Valley start-up to most valuable car maker in the world has been remarkable”. Along the way, Musk has broken the mould of what it means to be a modern CEO and has arguably escaped scrutiny — from smoking marijuana on a podcast, taunting Jeff Bezos, being sued for securities fraud, juvenile swipes on Twitter, to political potshots at President Joe Biden. People seem to love him for his brashness, and both the Tesla and SpaceX boards (seemingly) go along with it. On Monday, Musk exercised 4.5 million stock options in Tesla (worth $US5 billion) to reportedly pay capital gains tax. Not, however, before heading to Twitter for a poll asking his followers for guidance, “much is made lately of unrealised gains being a means of tax avoidance, so I propose selling 10 per cent of my Tesla stock” – it was a clear yes. Musk will have followers believe that his sell-off was all their doing; however financial filings released late on Wednesday are reported as showing that these plans have actually been in place since mid-September. According to Forbes he pays very little (if any) income tax. Mmm… No profit, no tax. In another show of narrative control, Musk recently changed his Twitter handle to ‘Lorde Edge’, some speculate that the name change is a precursor to a big announcement, while others say it is a play on “edge-lord,” as in a person who affects a provocative or extreme persona. And, this was not the first time he has changed his name on Twitter. In June, his handle was changed to ‘Elon Musk, the 2nd.’ Previously his name was changed to just ‘-1’. Why? We have no idea! “Musk has shown himself to be quite the Internet provocateur – and this just shows the sheer level of attention played to his ability to do the outrageous. This highlights the influence he commands, and he is clearly having fun with it. He seems to have fun pushing buttons.” Forbes reported For his own sake and that of his employees, we can only hope that Musk doesn’t founder. In the past, there are cases where he has proven to be his own worst enemy: self-sabotaging in times of stress or displaying a heightened sense of self when things are going well. As AFR’s Dana Hall so eloquently put it, “at 50 years old he has many years left to pursue his dreams of colonising Mars and ushering in a clean energy revolution. The biggest risk, at this juncture, may be his own hubris”.

|

|

| Still on electric cars, this week Rivian became the world’s biggest IPO of 2021 to become the second most valuable US automaker —ahead of Ford, about even with GM and just behind Tesla.

The latest beneficiary of investors’ fervour for greener auto technologies, the IPO allowed Rivian to raise approximately $12 billion to fund growth, and that figure could rise to $13.7 billion if the full over-allotment of shares is exercised. This makes it the biggest US IPO since Alibaba Group Holding Ltd went public in September 2014. Wall Street’s biggest institutional investors are betting on Rivian to be the next big player in a sector currently dominated by Tesla. On its first day of trading (yesterday), the companies shares closed at $100.73, marking a nearly 30% jump from its offering price and giving it a valuation of roughly $86 billion. With impeccable timing, Rivian’s IPO comes against the backdrop of the Cop26 climate summit and the raft of pledges made by governments, automakers and airlines to cut greenhouse gas emissions from global transport. Through some of our international fund managers, our clients have been exposed to the Rivian IPO – this is one we’ll continue to watch with interest.

|

|

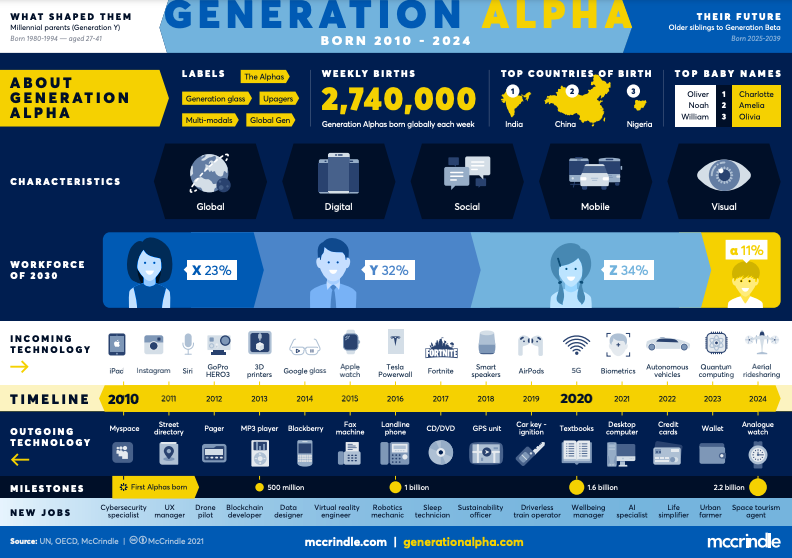

| Generation Alpha: The new kids on the block

There is a generation that comprises more than one in seven people (doing the heavy lifting is China, India and Nigeria). Within the next four years, they are set to outnumber the Baby Boomers, and most of them will live to see the 22nd century. We’re talking about Generation Alpha, the current generation of children who began being born in 2010. They will live longer, work later into their lives and will be more formally educated than any generation before them. By the time Generation Alpha have all finished being born, they will be the largest generation in the history of the world. Interested to know more of what to expect of the Alpha generation.? This infographic from McCrindle Research is a good start. |

|

| On Wednesday the S&P 500 dropped 0.8%, the Dow industrials 0.7% and the Nasdaq 1.7% after word that the US October consumer-price index was up 6.2% from a year earlier.

Prices on longer-term Treasury securities (bonds), generally the most sensitive to inflation expectations, fell, as did those on short-term Treasurys, which tend to anticipate interest-rate moves (in this case a rate rise). The market action suggests investors are preparing for both higher inflation and an aggressive Fed over the next two years. It’s a similar story around the globe. The transitory debate rages on For the past year, most experts have agreed that rising inflation is transitory, and central banks have so far stuck to their promises of ultra-low rates for longer. But, over the last month, worries that inflation may now be more perpetual have been building. There is even talk about the risk of 1970s-style’ stagflation’ (high inflation with no economic growth). In the transitory camp still sit many economists. They argue that once the world opens up, supply chain issues will ease, wage pressure will dissipate (the return of immigrant workers and waning savings will force people back into the workforce) and together with the momentum from COP26, oil and gas prices will begin to fall. Prices may not revert to those of old, but they will plateau, and with this, inflation will disappear. The million-dollar question is how central banks will react over the coming year, and it would seem bond traders are pushing them to the brink!

|

|

| We’ve covered semiconductors, Robo taxis and augmented entertainment. This week we tackle wearable technology in part 4 of our Capital Group series, ‘a guide to the world in 2030’.

With a global pandemic, it may not have made as many waves in 2020/21 as it had done in previous years (after all, it’s designed to be worn when we were out and about), but equity portfolio manager Mark Casey believes that in 2030, wearable technology will not only shape our world, it will blur the lines of reality. For my look into the future, I’m reminded of the Babel Fish from “The Hitchhiker’s Guide to the Galaxy,” a great science fiction novel. The Babel Fish was a small, bright yellow fish. If you put it in your ear, it would feed off brainwaves around you and let you understand anyone who spoke to you, even if you weren’t familiar with their language. In 10 years, I think there will be devices powerful enough to make realtime translation a reality. Perhaps wireless earbuds translate the voices and smart glasses do the same with foreign text. Devices like these could transform the tourism industry, giving people more confidence to travel to and possibly even live in countries where they don’t know the native language. Improvements in machine learning, smart wearable devices and augmented reality could enable other helpful features. Imagine if your smart glasses had an overlay that provided — each time someone approached you — that person’s name (provided you’d previously met) and when and where you saw that person last. The Apple Watch and Google’s Fitbit are quite useful already, and I’m excited to see what new features they and their competitors deliver between now and 2030. The driving force behind this growth will be the ongoing rollout of mobile network generations. It’s been typical for a new mobile network standard to take the spotlight every decade or so. By this reasoning, 6G networks will be the flavour in 2030, and it’s not just about faster data transfer speeds. Faster speeds mean more data and access to far richer and more diverse data sources. Samsung has already spoken about plans to create a smart shirt that can detect early warning signs of lung disease and other illnesses, and company Neviano has already created connected swimsuits that detect the strength of ultraviolet light, sending warnings to the wearer’s smartphone app if levels are too high. Just as the last generations (3G and 4G) made streaming music and streaming video a practical, everyday possibility, 5G is expected to offer speeds up to 100 times greater than previous standards – the impact of 6G on all areas of tech, and by extension, on our lives makes seemingly unfathomable ideas a distinct possibility.

|

|

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |

|

|