Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Volatility, Powell packs a punch, Magellan and more

|

| The new year began much like the last two ended, in the grip of daily Covid updates. 2020 gave us Wuhan, the Ruby Princess, lockdowns and a new normal. Despite the hope for better in 2021, Delta proved the undoing of NSW and Victoria, and even with the vaccine rollout, Omicron is still making hay the world over.

It is easy to slip into negativity and fixate on the uncertainties that remain, however, whilst we acknowledge these challenges we remain optimistic. The past two years have emphasised the value of togetherness, relationships, and resilience. We know there will be more twists ahead but nothing we cannot overcome. Having had to pivot and work from home, return to the office only to be sent home again… our observation was that culture, communication and comradery were the major victims of not being together and we are hopeful that we can all remain in a ‘business as usual’ state through 2022. We very much look forward to welcoming you all to our offices in 2022 (albeit in masks for now). To our interstate clients, we are hopeful we can travel to you once again and enjoy the value that human to human meetings offer. We hope you enjoy the read, our first View for 2022! |

|

| January into February has been a wild month for money markets. Equities went from hitting record highs at the beginning of January to falling into ‘correction’ territory with double-digit losses, only to come back through the beginning of Feb.

These wild swings in the market are, of course, against the backdrop of a significantly shifting economic landscape and continued uncertainty as Covid continues to throw up new challenges. For markets, the three big stories lie in:

In isolation, any one of these things would cause market movement but put them all together, and volatility is certain. Experts remain at odds in judging if markets have yet peaked, but they have certainly enjoyed the incredible liquidity ride since the GFC (now 13 years ago). Today and as a result of the higher inflation numbers, things look set to become more challenging. Quantitative Easing (QE) As we’ve previously commented, the inflation issue is predominantly a supply-side issue. We now know that people in lockdown (particularly when stimulus is involved) tend to have an insatiable demand for physical goods. So, as just-in-time manufacturing tries to meet the demand of global lockdowns, supply chains struggle. These channels are now healing but probably won’t return to 2019 levels easily. We are starting to see new orders falling in the PMI surveys and inventories building which is encouraging, but the world is not there yet, and it is causing some policy reaction from central bankers who are now receding away from the policies that were designed to get us through the pandemic. Now that vaccination targets have improved, more people have had Covid (particularly offshore), and Omicron appears to be less severe; we hope that the worst of the health crisis is behind us. This doesn’t mean we discount the danger of new variants or further restrictions; however, the QE policies of 2020/21 are no longer fit for purpose, and equity markets are having to come to terms with this. Interest rate hikes We have the inflationary issue, yes the issue is predominantly from the supply side, which we’ve ascertained won’t dissipate for some time. However, central banks can curb demand and that will have an impact on economic activity and in turn, quell inflation. The world is tremendously interest rate sensitive; we have gorged on low rates for some time now (in Australia, 36% of spending goes on debt servicing). We probably won’t need to turn the interest rate lever far in order to change people’s consumption habits. Fiscal spending Politics! Looking to the US who are coming into their midterms (back half of 2022), the moderate Democrats are starting to consider their re-election viability and, in doing so, are starting to break away from the more hardened left. What this means is Biden, who in the past has had a paper-thin ability to pass legislation in the Senate via reconciliation (at 50/50), will begin to find these endeavours more and more challenging (for instance, ‘Build Back Better’ is seemingly now dead in the water – harpooned by a single West Virginian Senator). And so, some of these fiscal programs that would probably result in quite heavy inflationary outcomes may begin to recede away. From a market perspective, there is a lot to navigate. In our view, 2022 with the combination of little to no QE, some rate hikes (potentially more than markets are currently suggesting) and the withdrawal of fiscal spending will have a big impact on the potential for volatility. It is important to remember however, that volatility and market corrections are very normal. For example, the US stock market has dropped at least 10% (on average) every 11 months for the last 100 years. We read somewhere this week that if someone predicts a 10% (or more) decline in the stock market, they’re really just stating: “Everything is normal and this happens, on average, every 11 months.” |

|

| Just a quick note to remind our readers why in Australia we focus so much on the US?

The short answer is because it dominates global equity markets, comprising about 56% of total global equity market values, versus the next biggest, Japan at 7%, China at 5% and the UK at 4%. Australia squeezes into the Top 10 at about 2% of the global market cap. The US is not only the largest foreign investor in Australia but also the place where Australians invest most overseas. What happens in the US markets and in their economy as a whole affects Australia (and the rest of the world), be it for good or bad. As the adage goes, “when the US sneezes the world catches a cold.”

|

|

| In late January, the US Federal Reserve signalled that it will commence widely anticipated interest rate increases from March.

Whilst the announcement was in-line with market expectations, the additional comments from Fed Chair Powell that followed left investors a little less comfortable. Powell revealed that inflation has become “slightly worse” since the Fed last met in December. He added that raising the Fed’s benchmark rate, which has been at zero since March 2020, will help prevent high prices from becoming entrenched. Some economists have signalled surprise at the likely intensity of rate hikes sketched out by Powell, who said the economy is stronger now than in 2015 when the Fed began to raise rates slowly. The fear is that the Fed is signalling to raise rates at a far quicker pace than previously anticipated. “I think there is quite a bit of room to raise interest rates without threatening the labour market,” Powell stated, suggesting that the Fed is now comfortable with a more aggressive approach believing it won’t risk their employment targets. Despite an initial positive reaction to the Fed announcement, US markets, which were open for trading at the time, took a sharp downturn once Powell’s comments were digested. Our View The key item is rates will be rising from March, as anticipated. The alternative would be to artificially maintain lower rates for longer and risk inflation reaching levels that would be difficult to reign in. Ultimately, the Fed is taking a more pragmatic line. The path of adjusting from emergency monetary policy settings back to normality was never going to be a smooth one, and a measured approach is essential during this period.

|

|

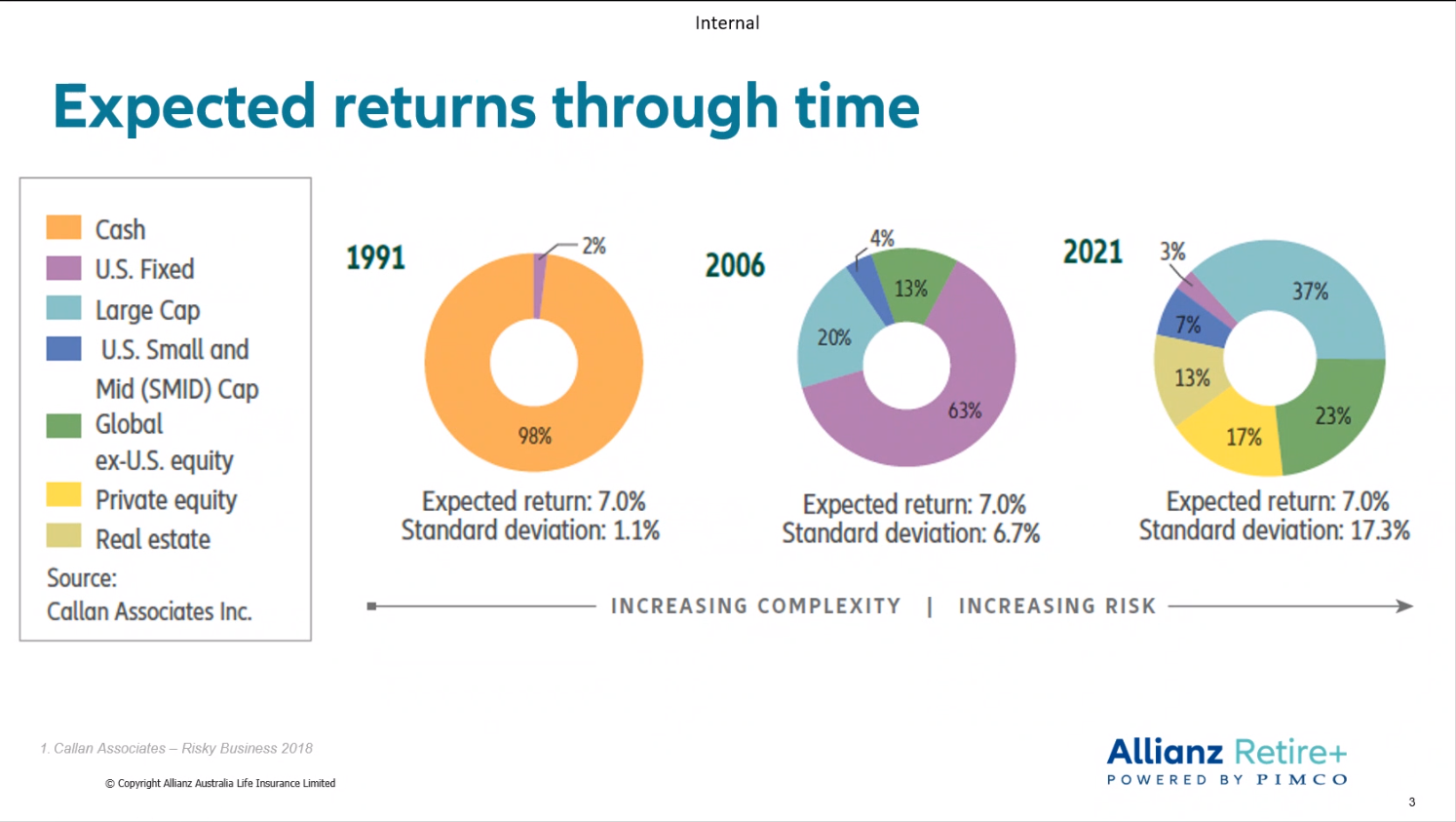

| What does a 7% return over the last 20 years look like?

In 1991, all it took was cash in the bank. 2006 required a more diversified portfolio. Fast forward to today, and it is fair to say fund managers have their work cut out for them. A 7% return requires an active exposure to just about every asset class (except cash…), but with this comes a three-fold greater risk.

|

|

| As most of you will have read in this week’s news cycle, Hamish Douglass, Chairman and Chief Investment Officer of Magellan, will take a medical leave of absence for the foreseeable future.

The announcement comes after a tumultuous year for Douglas after a period of intense pressure and focus on both his personal and professional life. First and foremost, we wish Hamish good health and hope to see him resume his duties as he sees fit, at some point in the future. Please rest assured that we continue to monitor this situation closely. As it stands, we are comfortable with the contingencies Magellan have put in place and in particular, the ongoing management of their investment funds. We are in close contact with members of the Magellan team on an almost daily basis, and should our position change, our clients will be notified accordingly. This week we were lucky enough to talk with two of Magellan’s global fund managers (an interview that was originally scheduled with Douglas) to discuss their go-forward strategy and the team’s views on the key drivers for markets in 2022. The questions pondered include:

A video recording of this Q&A session can be found by clicking here. |

|

| Last Friday, we held our first Kaizen day for 2022.

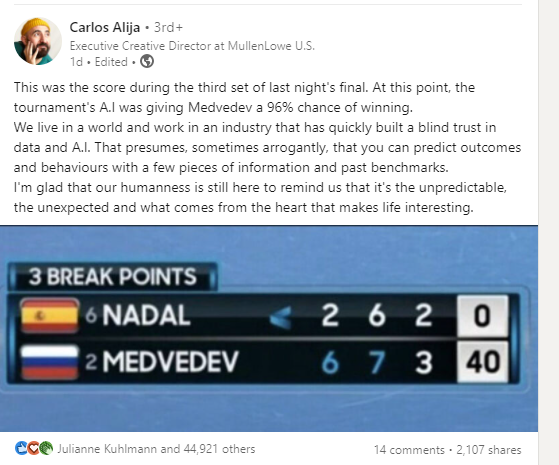

Kaizen, the Sino-Japanese word for incremental improvement, is not only the name of our own licensee but also serves as an important pillar of how we at FinSec endeavour to operate. As a team, we hold ‘Kaizen days’ once a month, and as the name applies, the day is about training, process improvement and innovation. As the team discussed the importance of technology and using big data to enhance our offerings, we took stock of a recent Facebook post. There is no doubt that our ‘tech stack’ is an important enabler; however, it can never replace ‘humanness’.

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |

|

|