Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Yield curves, Shanghai shipping from space, get rich slowly & more

|

22nd April 2022 |

| This year’s Anzac Day will mark the first unrestricted marches, dawn services and reunions since the start of the pandemic. Together (and in-person), old, young and new Australians will remember the price we pay for living in a free and peaceful society.

On this day, we remember the servicemen and women who risk and, at times, sacrifice their lives for us when our individual and sovereign democratic rights are threatened. This year, it seems to have extra relevance as we enjoy the right to vote next month whilst Ukraine must deal with a very different political system at work. “At the going down of the sun and in the morning,

|

|

| US Earnings

With the first quarter now in the rearview mirror and the next Fed meeting not until May, the focus is now on Q1 earnings. According to IBES data from Refinitiv, earnings in the US are expected to have grown 6.4% year on year, led of course, by energy with an earnings growth rate of 240%. Other bright spots include industrials and materials, all sectors that tend to shine in times of high inflation. Regardless of these bright spots without the energy sector, S&P earnings are expected to be just 1% above their year-ago level. The darling stocks for much of 2020 and 2021, namely technology, communication services and consumer discretionary, are now down the bottom of the earnings growth totem poll. Even with some upside surprise, ‘Q1’ 2022 is set to mark the slowest pace of earnings growth on the S&P since ‘Q4’ of 2020, when economies were emerging from their Covid driven slow-downs. Inflation You may be sick of hearing about it, but inflation is going nowhere fast as central banks concede it is not as transitory as once believed. Just as we thought supply chains were beginning to righten themselves and inventories replenished, sanctions and supply chain disruptions due to Russia’s invasion of Ukraine have sent commodity prices soaring and with it, expectations that prices will remain higher for longer. Looking at the S&P GSCI commodities index (a broad-based index that represents the global commodities market), prices across a broad range of commodities have increased nearly 28% in the last six months, with nearly half of that since Russia’s invasion on February 24th.

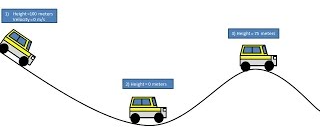

In particular, both the price of wheat and energy products have soared, signalling that food and energy costs will most probably continue to rise, bolstering the argument that inflation will remain elevated for some time. At some point, without wage adjustments, we will start to see consumer demand erode (everyone has their limit). Of course, wage rises could start a whole cycle of inflation that will be much harder to rein in. Interest rates The market’s obsession with interest rates continues. The Fed made its move in March, but the RBA has been a little more cagey. April’s minutes, however, gave us a better indication with regard to their position, particularly the expectation that inflation will break the top end of their 2-3% target band when the numbers come out for Q1 next week. If this is the case, interest rates will begin to rise sooner than previously predicted. One could say that the RBA is a little late to its own party here – the money markets have been factoring in 2-4 rate hikes in Australia through 2022 for some time now. In the US, the Fed is sticking to its Hawkish narrative, indicating 3-4 rate hikes this year, clearly showing its determination to get inflation under control quickly. It is now highly likely the May meeting will also be used to announce the start of the balance sheet runoff. Jerome Powell has also signalled that if inflation shows no sign of moderating, the Fed might also step up the pace of tightening with a hike of 50 basis points at one of the upcoming meetings. As the odds of further rate hikes increase, the yields on the 10-year treasury minus the 2-year treasury have turned negative, signalling a yield curve inversion. Many experts view this as an ominous signal and recession indicator (more on this below). In our view, further tightening of financial conditions driven by the Fed’s hawkishness as well as by the fallout from the Russia-Ukraine war should be sufficient to cool down the US economy through the year (without the need for the aggressive hiking outlined in its most recent meeting). The spillover from the war is likely to be bigger, further-reaching and more durable than is currently believed, especially in a scenario of further escalation. In our view, as the shock works its way through the system, the Fed’s eventual hiking path is likely to be shallower, with recessionary risks potentially higher than the central bank currently believes. The Feds around the world have got a tough balancing act to maintain. If one used an analogy, it is like finding the perfect speed to drive a car down a hill to ensure you don’t go above the speed limit yet retain enough momentum to tackle the next hill without slowing too much.

China An additional risk to markets is China. The slowing down of their domestic economy as a result of their zero-covid strategy (much of the country is locked down) and the continued unravelling of the property construction/lending bubble is having a negative impact on the demand for raw materials. China has already cut off most imports from Australia. This said, iron ore is still holding up, gas is increasing, and there are even signs of a re-opening of the coal trade (purely as China has very few other options available). As we have written before, how President Xi chooses to deal with Putin is also a major risk. China has already extended its ‘no limits’ pact in offering to import more from Russia, presumably by paying in the Chinese currency RMB or gold instead of US dollars. How this will affect Australian export markets remains to be seen. Of perhaps bigger importance will be its impact on the global monetary system. The US sanctions imposed on Russia demonstrate the power of the US dollar and the power of the US government to cause serious economic damage to a country by unilaterally cutting off access to US dollar reserves (the US dollar accounts for 60% of global foreign exchange reserves). In comparison, China is now the second-largest economy (or largest, depending on the measure) and the largest buyer of most commodities, but the RMB accounts for less than 3% of global reserves (primarily as the RMB is not freely exchangeable). Some experts are taking the view that US-Russian sanctions may have strengthened China’s resolve to reduce global reliance on the US dollar. With Xi moving quickly to arrange for payments in RMB and/or gold – for example, wheat from Russia and oil from Saudi Arabia. The end of the US dollar’s dominance is not under threat, but it may lead to the emergence of a rival Chinese RMB bloc with China and its main trading partners and allies. One outcome may also be China selling down its $3 trillion hoard of US treasuries (it has already reduced from $4 trillion in the past 3 years). This would have two negative outcomes – the first being lower bond prices and even more losses in bond markets, and the second would be a gradual loss of standing of US debt as a ‘risk-free’ asset. Of course, the US knows what the Chinese are doing and will inevitably deploy countermeasures to ensure their dominance prevails. These developments take many years, but we need to monitor them as potential medium-term risks to investment portfolios. |

|

|

| Ask an investor what they would most like to know in advance, the timing of the next recession is probably high on the list. The correlation between the ups and downs of the stock market and the ebb and flow of the economy is not exact, but there is clearly a link. Recessions spell bad news for investors. Seeing them coming would be very useful.

One of the indicators investors use to identify turning points in the economy is found in the bond market, specifically in the ever-shifting relationship between the yields offered by long and short-dated government bonds. Put them together on one chart, and we have what is known as the yield curve. And it’s the shape of this curve that is of most interest, with Aficionados claiming that it has predicted every recession since 1955, with only one false signal during that time (source: Federal Reserve Bank of San Francisco). Why does the indicator work? In short, the yield curve shows the interest rates that buyers of government debt demand in order to lend their money over various periods of time. A simple way to look at the yield curve’s importance is to think about what it means for a bank. The yield curve measures the spread between a bank’s cost of money versus what it will make by lending it out or investing it over a longer period of time. If banks can’t make money, lending slows, and so does economic activity. The US yield curve in particular — thanks to the central position of the US dollar in the global financial system — acts as a kind of barometer of investors’ collective wisdom about the future path of the world’s largest economy. Why are we suddenly talking yield curves? Earlier this month, after flirting with the milestone for several days, the bond market’s yield curve inverted for the first time since 2019 – A response attributed to investor worry around the Fed’s hawkish approach to rate rises. Russia’s invasion of Ukraine, which sent commodity prices spiralling higher, has added to the inflationary pressures faced by the Fed and its counterparts around the world. However, soaring energy costs are also expected to sap growth rates, raising questions about how high the Fed can push rates before it has to stop. In effect, the inversion of the curve implies that some investors think that, after a period of rapid tightening, the Fed will be forced to reverse course. While markets have become nervous about what a yield curve inversion means for economic growth in the future, it is worth noting that Fed bond-buying — along with quantitative easing programmes from other central banks around the world may have muddied the yield curve’s predictive powers. In this article, Fidelity International’s Investment Director Tom Stevenson explains. |

|

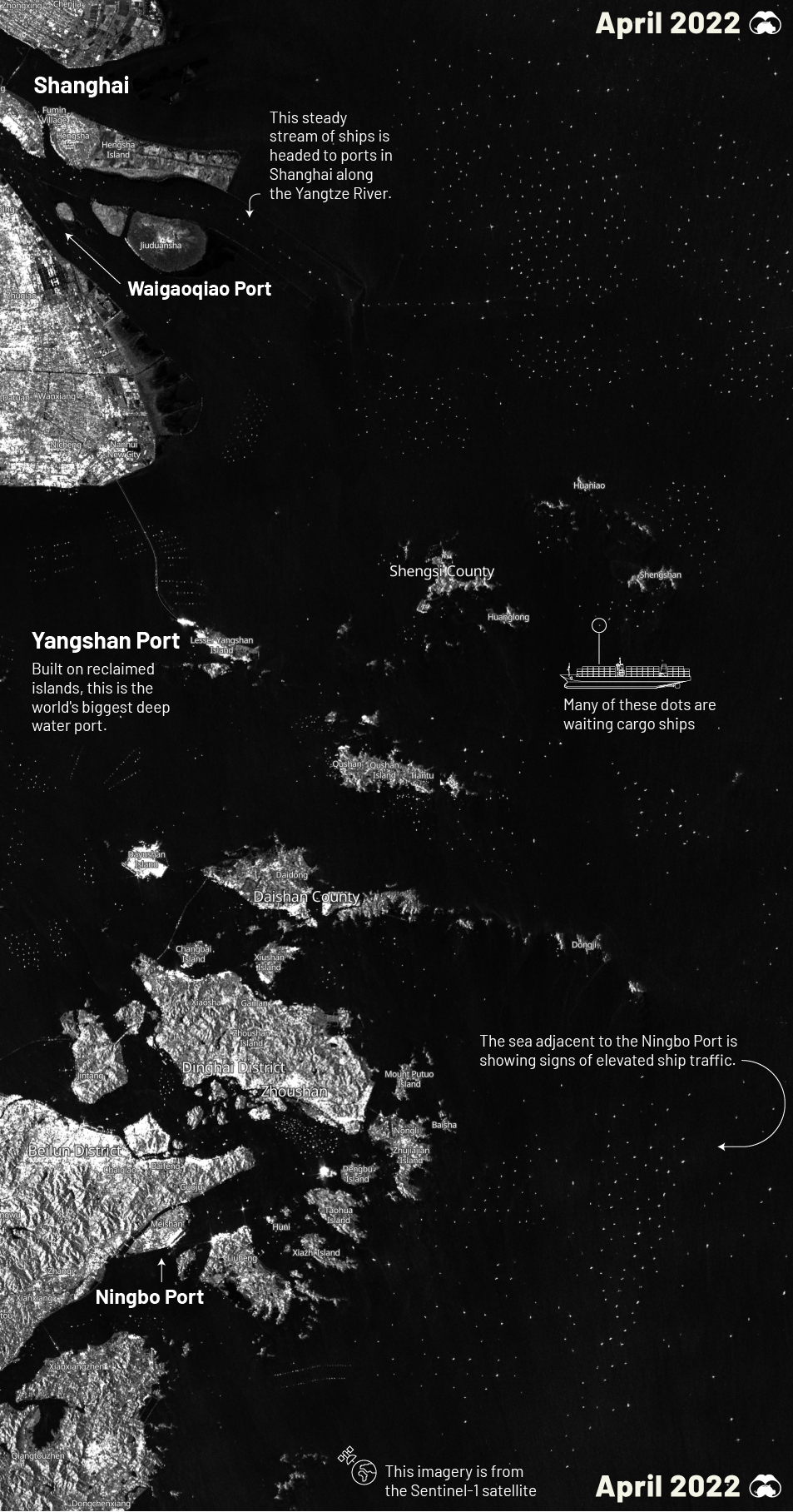

| Mapped | Shanghai’s supply chain standstill, as seen from space

China’s strict “zero COVID” policy has led to widespread lockdowns as they deal with one of its worst outbreaks since Wuhan in December 2019. These cautionary measures have had far-reaching impacts on China’s economy, especially its supply chain and logistics operations. Our chart of the week shows satellite imagery captured by the Sentinel-1 satellite, which shows the current congestion at Shanghai’s port as of April 14, 2022 (click through to view a larger version). The majority of the white dots are cargo ships, many of which have been stuck in limbo for days. As of April 19, over 470 ships are still waiting to deliver goods to China. If you’d like to check out the Shanghai ports most up-to-date traffic, this live map by MarineTraffice provides real-time updates. |

|

In 2006, J.D. Roth founded Get Rich Slowly to document his quest to get out of debt. Over time, he learned how to save and how to invest and eventually realised an early retirement. These are his thoughts on the Seven Enemies of Success. Remarkably simple, practical advice for all of us.

|

|

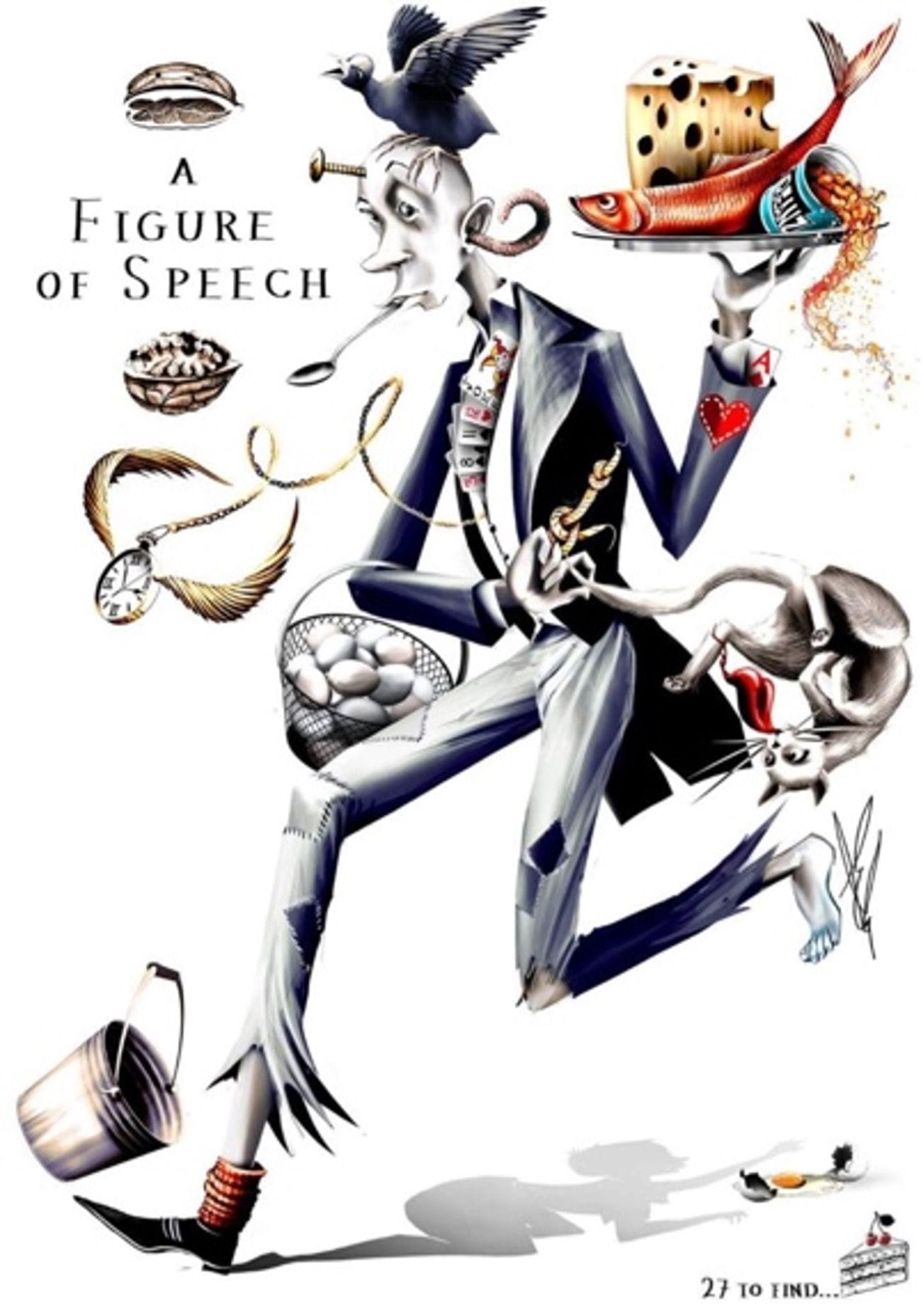

| Bored of that 1,000 piece jigsaw? Well, here’s a new challenge to keep you busy. Can you identify 27 well-known figures of speech in this picture? We’ll do the first one for you – The Cat’s Got His Tongue. Just 26 to go! Look out for the answers in our next View.

|

|

| Used by Australian diggers in the First World War, the game of two-up was used to relieve boredom (the simplicity of a couple of coins and a piece of wood — made it a popular game in the trenches). Today it is a game that is synonymous with Anzac Day — and with good reason.

In most parts of Australia, two-up — or Swy, as it’s sometimes called — is illegal on every day of the year except the anniversary of the Gallipoli campaign. But, despite its illegality, it was widely regarded as the fairest of gambling games, and at the time of the First World War, the verbal command for the coins to be spun was not “come in spinner” (as it is now) but “fair go”. Indeed, the important Australian concept of the “fair go” was in part cemented by its role in the game. To make up for the past two years of muted ANZAC events, this year, Australians will have two extra days to polish their two-up technique as the game is legalised for the entire long weekend. Please note: This is not a recommended investment strategy. Here’s your quick guide to the rules. |

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |