Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Inflation (again), productivity and wages, financial habits of dog owners, scam alert and more.

26th August 2022

Well, this is fun. Despite central bankers and economists continuing to warn a global recession is possible if inflation is not brought under control and consumers start to curb their post-pandemic spending, global sharemarkets have rallied strongly since the lows of mid-June.

It’s a rally that has been dubbed the “most hated” because it is precisely what governments and monetary authorities don’t want to see – a sign there is still plenty of liquidity in the system and consumers can handle even higher interest rates (as is reflected in Australia’s household savings mentioned below).

It is true that the US earnings season has yielded better results than expected. In Australia, it has been a similar story, with reports concluding that a fifth of ASX-listed companies to have reported so far have shown surprising reliance in the year ended June 30.

But for some excitable corners of investment markets, the rally feels more about defying central banks and trying to force a return to bull market conditions, irrespective of underlying earnings.

There are some positives though! Whilst inflation print numbers will continue to rise for two more quarters, actual inflation may be peaking now – fingers crossed! Note: we won’t see this reflected in the print numbers until the low figures from the back half of 2021 fall out of the annual numbers. All this said, we still need economic growth to slow materially to achieve a sustained slowdown in the inflation rate and this slowdown is not necessarily priced into earnings or even equity valuations (so there is a risk that equity markets may suffer another dip).

When it comes to investing, as always, it is a matter of being selective and disciplined!

Elsewhere this week… we look at inflation from a domestic perspective, wages and productivity, Labor’s three-point plan to end the superannuation wars’ and the most recent scams doing the rounds. We hope you enjoy the read.

Domestic Inflation

Thank you to all those that emailed in requesting more details on Chief Economist Bill Evans economic update (The View, issue 12 August 2022). The most frequently asked for information (in various reiterations) pertained to inflation on a domestic level. In particular, how is Australia positioned, and what is the longer-term outlook? As promised, his views are outlined below.

- The good news for Australia is that we have been saving.

Through the pandemic, households have accumulated $250 billion in savings, and Aussie corporates are sitting on around $170 billion of excess cash. It is considered quite a buffer, and as a collective, the nation is well positioned to absorb quite a bit of ‘pain’ should it need to.

- With a tight labour market, inflation control relies heavily on slowing interest sensitive sectors – house prices, consumer spending, construction prices and relying on supply chain relief.

- Australians put around $100 billion of their excess savings into offset mortgages over the last two years. It is unlikely should ‘the going get tough’ that they will draw down on these mortgages; rather, they are more likely to constrain spending in other areas.

- 75% of fixed-rate borrowings in Australia are set to mature at the end of 2023. These will roll over at higher rates, effectively reducing people’s discretionary income and constraining spending.

- Transitory inflation is easing.

Supply chain issues are improving – The below diagram shows the global input costs of semiconductors (used in the manufacturing of most devices) and timber (crucial to Australia’s construction industry).

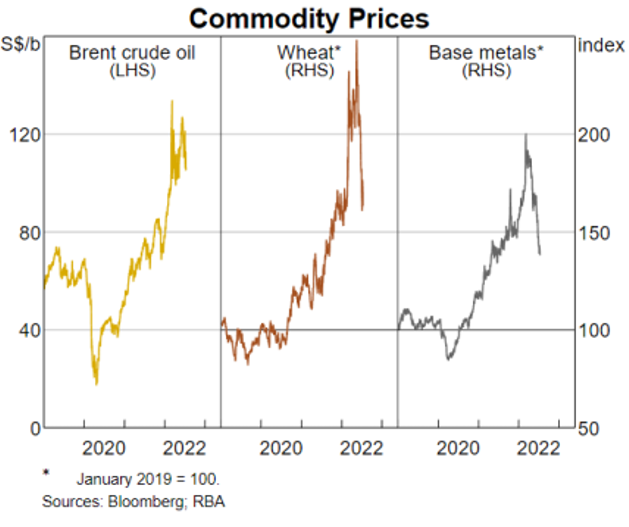

Commodity prices are also improving.

The hope is that inflation in Australia is currently peaking – we won’t see this reflected in numbers until the end of the year – however it is expected to remain sticky (albeit at far lower rates ) over the medium-term.

To revisit Evan’s key takeaways, please click here.

Chart of the Week

Regular readers of the View know that when it comes to a healthy economy, we are sticklers for the 3Ps – Productivity, Population and Participation.

And, it would seem they have also become the flavour of the month for much of the media ahead of next month’s Job and Skills Summit.

More recently, it has been the highly publicised views of the Australian Council of Trade Unions (ACTU) boss Sally McManus who claims that wage growth is at a low ebb because workers are not getting their fair share of business productivity gains.

However, the official analysis published by the productivity commission paints a very different picture. It shows that (when compositional and quality effects are considered) real wages have actually outpaced labour productivity in the six decades to 2020.

Arguably, this analysis considers a broader narrative and in doing so a more accurate picture. It gets our pick for chart of the week.

SA Leaders

For some years now, we have been members of the South Australian Leaders organisation. As a part of this membership, we are granted the opportunity to present as an ‘Industry Expert’ at different times throughout the year. Last week our Managing Partner, Andrew Creaser, spoke to a full house on global markets, spelt out a few economic truths and discussed how financial advice can help in protecting your position.

Whilst much of the presentation is based on content from previous Views, it does make for a great synopsis.

Labor’s Super Plan to Move Beyond Superannuation Wars

Some of the most powerful people in Australia’s economy broke bread on Monday at the annual Superannuation Lending Roundtable, hosted by the Financial Review.

The line-up included Treasurer Jim Chalmers, former prime minister Paul Keating, big bank chief executives and a raft of super fund and investment house bosses.

Chalmers used the event to kick off his new “three-point plan to end the superannuation wars”, under which the government wants to see Australia’s $3.3 trillion in super savings funnelled towards initiatives deemed to be in the national interest, most notably, financing the energy transition and addressing housing shortages.

Impact investors are understandably very happy about the plan to put environmental and social justice problems high on the agenda. The funds and many other experts also think it is a great idea … in theory – They worry that using super to achieve social outcomes could jeopardise the retirement savings of Austalian workers.

So much for the cease-fire!

The good news is in Chalmers’s own words.

“We won’t be messing with the fundamentals of super: not sole purpose, not preservation and not the trajectory of the superannuation guarantee.”

Unfortunately, it is behind the paywall. However, an edited extract of remarks made by Treasurer Jim Chalmers can be found here.

Scam Alert

Scams and fraudulent activity are once again on the rise, and unfortunately, no one is immune to this activity. According to one local IT provider, there are two particular phishing scams currently doing the rounds – we’ve provided a quick summary below.

The CFO Scam

An email that appears to be from the CFO or other high-ranking executive requesting a wire transfer. In one known case, the email was from a legitimate sender with an invoice in a relatively small amount with a change of bank details (the fraudulent account). The next time the recipient received a genuine invoice from the company (in a much larger amount), the payment was automatically paid into the new account already pre-loaded into their payment system – AKA the scammer’s fraudulent account.

The only way to prevent this type of scam, known as “spear-phishing”, is to always have human interaction if a company or supplier states they have new bank details, i.e. pick up the phone and call the person who is requesting the change.

The “Mum and Dad” scam

This scam involves an SMS or WhatsApp message stating a reason why a known contact is messaging from a different number, e.g. “my phone is damaged, and I’m having to use an old one”.

The scammer will generally use casual language, use emojis, and pose as family… here’s an example (real) transcript:

Scammer: “Hey Dad, my phone is broken. I’m using an old phone until mine is repaired”

Victim: “Which child is this?”

Scammer: “This is your eldest and cutest. I will probably have my phone back next week, it will be fine”

Victim: “Are you ok?”

Scammer: “Yes, I’m ok. How about you? Just a little bit stressed”

Victim: “Yes I’m ok too, have a good day and I’ll see you later”

Scammer: “Could use your help actually”

Victim: “Yes of course. What do you need?”

Scammer: “I don’t have banking apps on this phone and my bank have frozen my access to stop fraud or whatever (annoying), but I need to pay some bills straight away. Can you please help me dad?”

Victim: “Sure, I’ll send you the details.”

Scammers will try to catch you off guard. They may pretend to have a connection with you. Never provide your personal, banking or superannuation details to strangers who have approached you.

Remember that the most common scam method is via email, phone or text messages. But there are other ways.

Never click on hyperlinks from external, untrusted sources.

Do your own authenticity checks, even if you think it is from a trusted organisation.

If it doesn’t feel or sound right, it’s probably not right. Trust your instincts.

Wealth Wisdom

In times of heightened volatility, many investors feel the need to tinker with their portfolios. This desire to act rather than stay put is known as the action bias and is one of the most common ways retail investors shoot themselves in the foot.

The action bias is so costly because, more often than not, the action taken is the opposite of what should be done. Your average investor is more likely to buy than sell after markets have had a good run, and they are more likely to sell than buy when the markets are falling. In other words, the average investor buys high and sells low – not quite a winning formula.

Warren Buffet once said, “The most important quality for an investor is temperament, not intellect”. Although the temptation to act is at its greatest when volatility is heightened, patient investors who can sit on their hands tend to be rewarded handsomely in the long run.