Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Aus’s Inflation Profile, Banking Collapses, UK Budget, The Salt March and More

| Thank you for the feedback regarding our superannuation commentary last View. Whilst it’s a fact that the average Australian is not engaged with their super, it is nice to know our readers are far from average and highly engaged when it comes to understanding any changes and, more importantly, the implications thereof.

At this stage, there is little further to report on the proposed $3 million cap on super – submarines and bank collapses have pushed super down the line. And, although It hasn’t received the air time we expected, we will be weighing in on the franking credit conversation next issue. As they say, watch this space. The big news out of the last two weeks was of course, the demise of SVB (Silicon Valley Bank). Whilst we will take you through the ‘nitty gritty’ below, there are a few points we’d like to make upfront. It’s a reminder that buying shares in a company does involve implicit risk – even when that company is a regulated and influential financial institution with a market capitalisation of $US16 billion (as SVB had been two days before its demise). And given SVB was a hot stock in recent years – it was trading at more $US700 a share in late 2021 and made Forbes annual ranking of best banks five years in a row – it’s likely that lots of investors were on the register. As AFR’s Chanticleer concluded, the bank’s ultimate demise was emblematic of doing business in the social media age. When news of its trouble broke last week, many of the loyal tech-fuelled followers that helped the bank increase its assets from $US61 billion in December 2019 to $US189 billion in December 2021 quickly took to Twitter to warn peers to pull out their funds, accelerating the bank run – and that has implications for all of us. Also, in this issue … A look at Australia’s economic outlook, Warren Buffet’s first-ever known television interview, announcements from the latest UK budget (affecting anyone looking to transfer their UK pension to Australia), some unbelievable stats on the current refinancing of home loans in Australia and much more. We hope you enjoy this week’s read. |

|

|

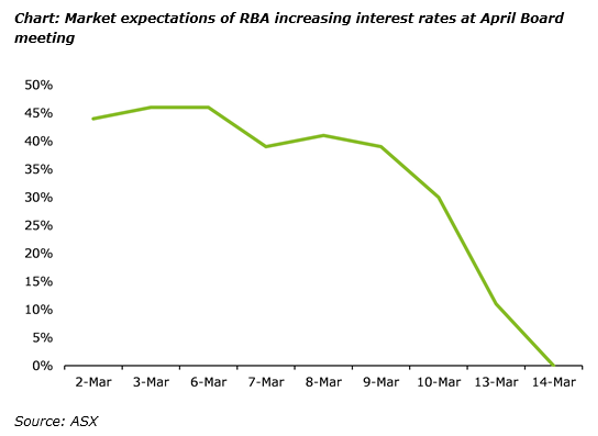

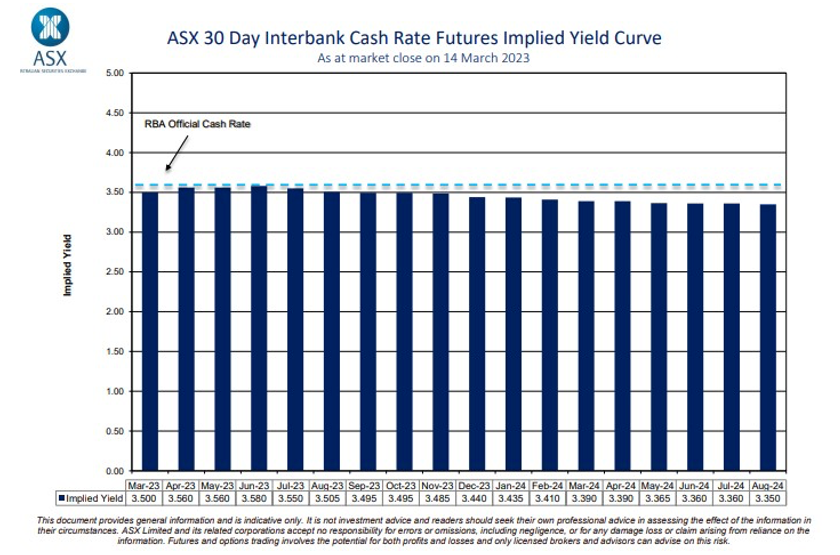

On interest ratesThe RBA kept the monthly hike cycle rolling (for now). Governor Lowe did indicate that a rate pause is on his radar and, with the collapse of Silicon Valley Bank, the market has decided there will likely be no rate hike in April.

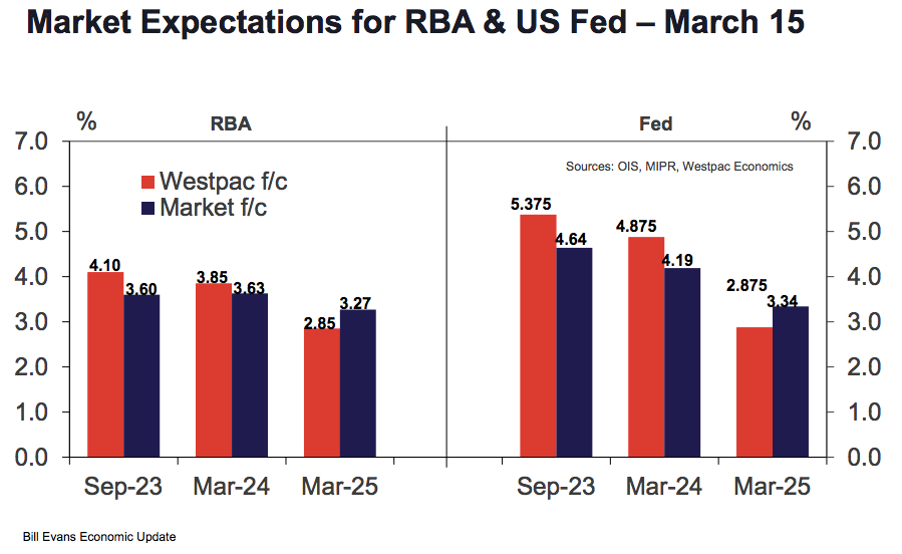

Similarly, markets believe the US tightening cycle is also nearing its end (chart below). A FinSec favourite, Bill Evans (Westpac’s Chief Economist), is predicting the RBA will peak at 4.1% in May, with cuts to commence around February 2024 (off the back of the economy slowing in the second half of this year.)

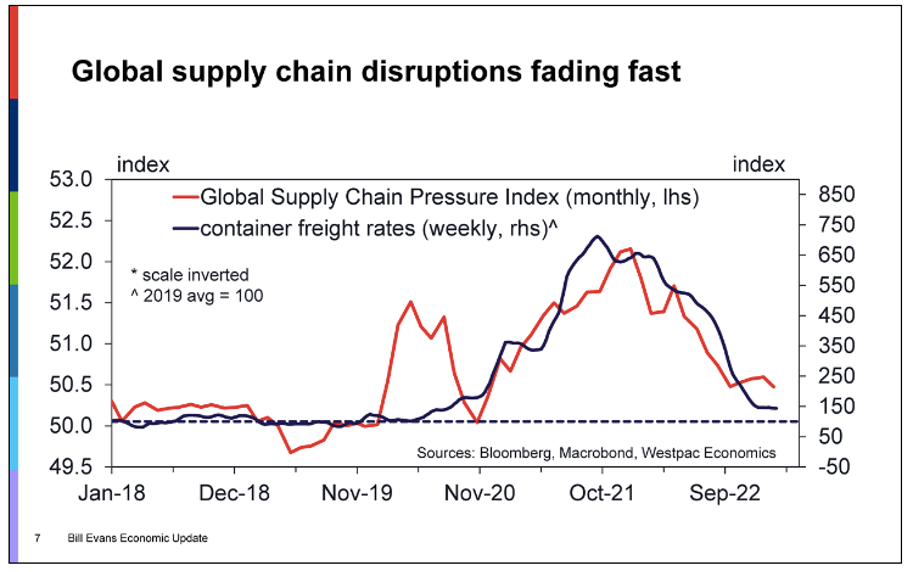

On inflationWe are seeing some early signs of inflation coming down, but Central Banks still need to remain on high alert. In the US, the Silicon Valley Bank collapse has seen the focus shift to financial stability, which could set the Fed’s plans back for a while. In thinking about inflation, the equation involves both supply and demand. The supply side is best exemplified by global supply chain disruptions. Before Covid, you could move a ‘box’ between Sydney and Singapore for around $3,000. This price got up to around $15,000 and is now back to less than $3,000. The supply chain shock that was affecting our imports and acting as a major component of inflation is now acting as a correction to that inflation (blue line in the chart below).

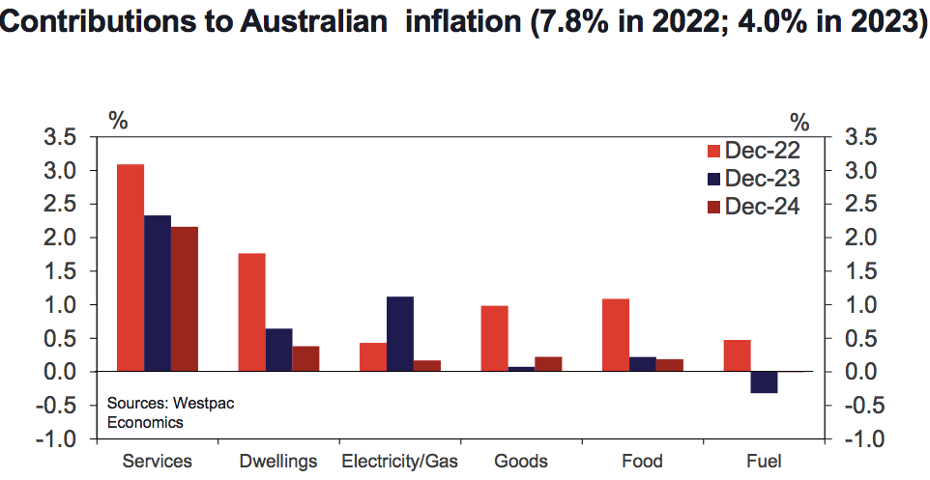

In forecasting the outlook, we look at both supply and demand components. This is a particularly good chart from Westpac Economics.

It shows:

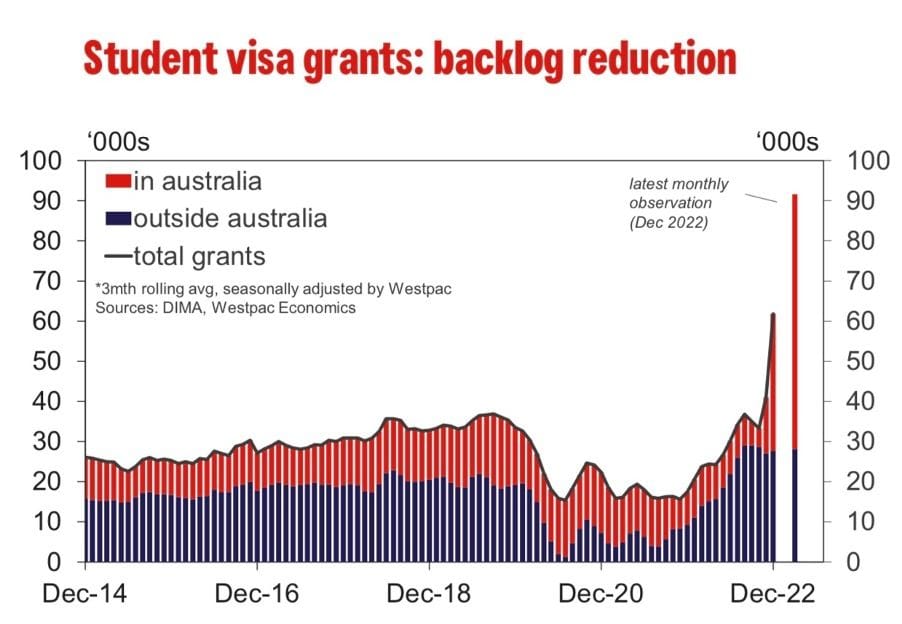

Based on this profile Westpac Chief Economist Bill Evans predicts a inflation will fall to 4.0% in 2023 and down to 3.0% in 2024 (which is at the top of the RBA’s band). Whilst inflation does look like it is beginning to roll over, there are certainly no signs yet that it has become embedded into wages. In an antagonistic way for the RBA (who are trying to hike rates to slow domestic demand via higher unemployment), the latest February report saw 65K new jobs created (and mainly full-time) and unemployment falling back to 3.5%. Hours worked increased, and the under-utilisation participation rate also increased – all good news… Except perhaps for the RBA trying to avoid wage inflation. On immigrationMore good economic news in the fact that despite Chinese rhetoric, overseas students are now heading back to Australia in numbers.

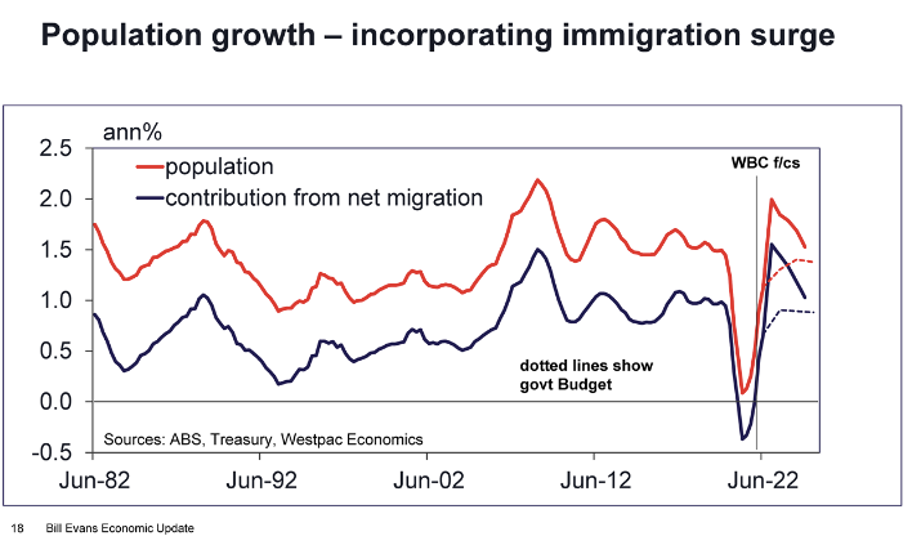

Immigration before Covid was running at around 250K people per year. It is estimated that in 2022 the numbers will come in around 400K, and 350K in 2023. So, whilst we had a ‘hole’ of around 500K from 2020 and 2021, we’ve backfilled by half (source – Bill Evans, Westpac Chief Economist) The outlook for population (remembering the 3p’s of a strong economy ‘population’, ‘participation’ and ‘productivity’) in Australia is looking strong.

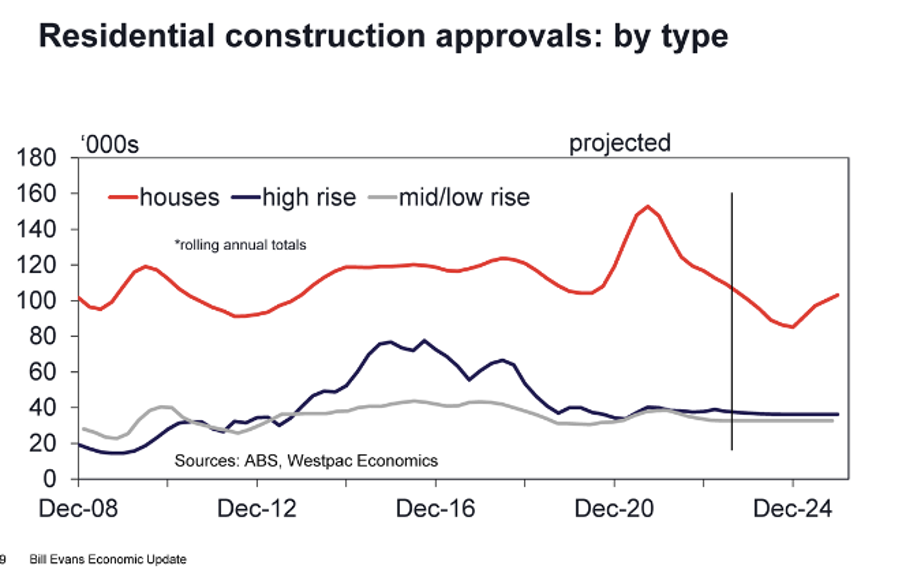

On housingOn the flip side is housing, where we are seeing a collapse in both building approvals and new lending. Builders don’t want any more work (demand hangover from the homebuilders period), and big developers are finding it very hard to get contractors and builders, not to mention the servicing of their debt and associated cash-flow struggles.

New lending peaked during Covid as people took advantage of incredibly low interest rates. It’s now down 35% in the last 12 months (January to January). Mmm… we can feel the ‘perfect storm’ brewing. A huge lift in demand coming from the surge in immigration and a major collapse in housing supply. On recessionThose of us that have been around a while know what a real recession in Australia looks like. We had it in the early 90s when the unemployment rate went to 12%, commercial property prices fell by 60%, inflation was very high, and we had 17% mortgage rates. Yes, a softening in growth is expected, and it is possible that we will have a few negative quarters, a “technical recession”. But, the foundations of Australia remain reasonably sound – the labour market is strong, and we can see the inflation profile coming down (as outlined above). On this basis, it is highly unlikely we are going to see a recession anywhere near previous magnitudes. We’re not sure the US and Europe will be so lucky. Given the size of their economies, we expect the impact on markets will be ongoing volatility for some time to come. |

|

|

| Less than one month ago, Silicon Valley Bank (SVB) was America’s 16th largest bank. It held approximately USD$170 billion in client deposits. On the 8th March, SVB announced an emergency capital raising as a result of having sold over $20 billion in assets at a loss to fund customer withdrawals. The next day, customers collectively tried to withdraw a further $42 billion, and SVB literally ran out of money. The regulator took control on Friday, 10th March.

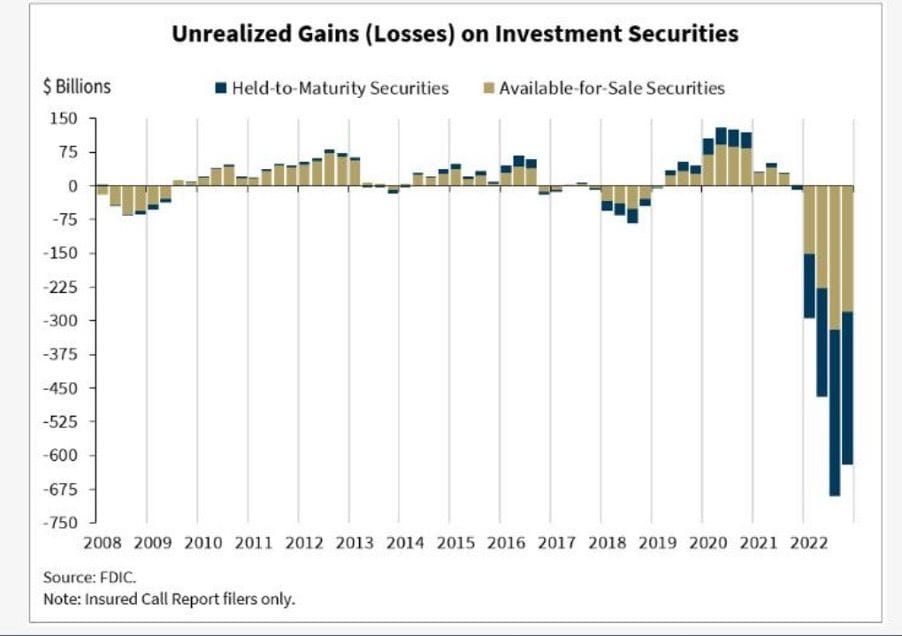

By Sunday night, just four days after the panic set in, US regulators had devised a plan to effectively guarantee all customer deposits. So SVB account holders will ultimately suffer no loss. Regulators also plan to make a facility available to act as a circuit breaker against the potential for other US banks to suffer the same fate, following the failure of a second, smaller, crypto-focused bank days later. Contrary to deposit holders, owners of SVB shares and bonds will not be so lucky. It is almost certain they will lose the entirety of their investment. While the circumstances surrounding the collapse are mostly specific to SVB, one weakness is common to many other banks. Almost all financial institutions, as part of their assets, hold some bonds and other fixed-interest investments where the rate of interest they receive is set for the life of the investment, which in many cases is 5 years or more. As interest rates have risen over the past 12 months, the value of those fixed-rate investments has fallen. This makes sense. If you bought a 10-year bond paying 2% per annum at the start of 2022, and the going rate for new 10-year bonds in 2023 is now 4.5% per annum, then you’re going to have a take a loss if you want to sell that 2% 2022 bond in today’s market. Very simply, that old 2022 10-year bond is paying 2.5% less than the current market for the remaining 9 years of its life. So today’s buyer is going to want to pay about 22.5% less for it now (2.5% pa x 9 years of the remaining term). The chart below shows the impact of this on US banks. It shows the difference between US bank fixed interest investments’ original cost and their current market value.

If they had to be sold today, those investments would collectively be worth around $600 billion less than their original cost. Of course, so long as the banks don’t have to sell those investments today, the losses will remain unrealised. They will just earn the original, low-interest rate on them until maturity. And it will all be alright. There seems to be little risk for depositors in Australian banks. Not only is regulation here much stricter, but the banks are also better managed. Incidentally, banks in Australia have quite a different risk profile. They have much less exposure to long-term bonds, and much more exposure to Aussie housing. It explains why we put so much emphasis on interest rate discussions and their implications for residential property (which dwarfs all other asset classes in Australia). The main implication of SVB is on rate expectations both here and in the US. At end of February 2023, barely two weeks ago, the futures market was pricing cash at 4.35% by October. Not only has the cash rate moved up to 3.6% since then, but the futures market is now down to 3.5% by August and across all future maturities. Due to a perception that central banks will feel too much stress has been placed on banks and other borrowers, the market now thinks the next movement may be down. While the likelihood of a pause has significantly increased, the loss of a relatively-small, poorly-managed US bank should not cause a dramatic policy swing in Governor Philip Lowe’s thinking. In the chart of cash futures below, all the bars from June 2023 onwards were well above 4% at the end of February, and now they are all below the cash rate of 3.6%. It’s an extraordinary change due to the collapse of a US bank few of us had heard of a week ago.

|

|

| The Berkshire Hathaway annual letter was released last month. There’s not much new in there this year. So instead, here’s Warren Buffet’s first known TV interview from 1985. The quality isn’t great (it was nearly 40 years ago), but it was penned as his ‘most iconic interview ever’, and it’s still worth watching. There are some timeless investment lessons in there. |

|

|

Some big announcements in last week’s UK Budget for pension transfers to Australia.

The announcement: From 6th April 2023, the Lifetime Allowance charge (a tax by any other name) will not apply to anyone over the current limit of 1.07M pounds. For the next 12 months, anyone transferring will still have to go through the benefit crystallisation calculation as before; however, if a charge would have applied, it is simply recorded with no payment required. The reasoning behind this? A good question, but seemingly without an answer right now – We are currently seeking clarification. From 6th April 2024, all lifetime allowance limits and charges will be abolished altogether. This is good news for those with large UK pension balances. However, it must be noted that this is a conservative UK government. The Labour government has already stated that should they be elected (UK news channels broadly predict this will occur by January 2025), they will bring back the lifetime allowance rules and limits. More information on the Lifetime Allowance can be found here.

From 6th April 2028, the eligible age for transfer will increase from 55 years of age to 57 years of age. More information on the current eligibility rules can be found here. Whilst this change may seem a way off yet, we do suggest that those who stand to lose the most (those nearing 50 years or over) commence the process sooner rather than later to avoid being caught out.

|

|

|

| According to the retirement income covenant (RIC), ‘accumulation’ is sooo yesterday! It’s now all about decumulation. Intrigued?

To understand just how much the future of retirement is changing, we recommend watching this 20-minute video as presented to South Australian Leaders by our own Managing Partner, Andrew Creaser. |

|

|

| These numbers highlight the intense competition lenders are currently facing in the $2 trillion Australian home loan market as people (particularly those coming off fixed rates) rush to find the best deal.

If it has been a while since you had your existing home loan ‘stress tested’, we advise that there has been no better time than now! As always, ‘buyer beware’ – seek the expertise of a trusted specialist. Some of the common refinancing pitfalls to be aware of include:

We do have a dedicated finance broker on the team, so please don’t hesitate to contact Brenton Moyle with any questions you may have. We also offer a free home loan’ health check’ for FinSec clients and View subscribers. To take advantage of this offer, please click here. |

|

|

| In March 1930, Mahatma Gandhi began the Salt March, a 24 day nonviolent protest against the British taxing of salt. Gandhi started with 78 volunteers. The march spanned 387 kilometres, and growing numbers of Indians joined them, peaking at over 50,000 marchers. Gandhi gave interviews and wrote articles along the way. Foreign journalists and three Bombay cinema companies shooting footage turned Gandhi into a worldwide household name. At the end of 1930, Time magazine named him “Man of the Year”.

Upon arriving at the seashore on 6 April 1930, Gandhi raised a lump of salty mud and declared, “With this, I am shaking the foundations of the British Empire.” He then boiled it in seawater, producing illegal salt. This sparked large-scale acts of civil disobedience against the salt laws by millions of Indians. Gandhi was eventually arrested for his actions on 5 May 1930. Over 60,000 Indians were jailed as a result of the Salt March. The protests against the salt tax continued for almost a year, ending with Gandhi’s release from prison in 1931. Though the British did not immediately relax the salt tax, the Salt March led to the Round Table Conferences of 1930-1932, a series of peace conferences between the British Government and Indian political personalities to discuss constitutional reforms in India.

|

|

|

|

|

|

| Congratulations to Sarah Day, the 2023 recipient of the BCD FinSec scholarship for an emerging leader in the NFP/For Purpose sector.

Sarah, Senior Sustainability Consultant at Edge Impact and Board Member of Shine Connections, was one of four shortlisted for the award and announced the winner at last week’s Behind Closed Doors(BCD) Connexions event. Through this scholarship, Sarah will join an inspiring group of female managers seeking professional development, peer coaching and being connected to a broader network of businesswomen around Australia. We wish Sarah all the best in her endeavours. Sarah’s biography can be found here. “I believe this opportunity will hugely benefit me as an individual to help tackle Australian agriculture’s biggest challenges, while building internal resilience and opportunities for future change makers.” – Sarah Day

Sarah Day (Recipient), Donny Walford (Managing Director BCD) |

|

|

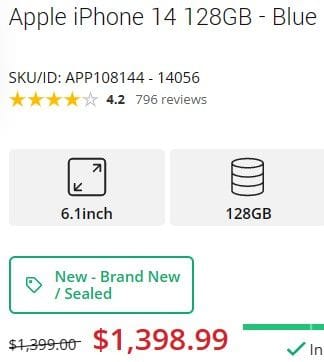

| One attribute of a great company is pricing power. Apple’s strength in this area is unquestionable, as this week’s spectacular ‘discount’ offer for a new iPhone 14 shows.

|

|

|

| You might be pleased to know that we are not gamblers at FinSec, and so our short answer to the above question is a resounding “no!”.

For a longer answer, you might be interested in this piece from blogger Thomas the Think Engine, who takes a close look at the Powerball odds. Spoiler alert, the answer is still no. But if you’re vaguely interested in the maths, then it’s a bit of fun.

|

|

|

|

|

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |