Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Etymology of superannuation, Grant Hackett OAM, Reshoring of supply chains, Family feuds and More

21st April 2023

It’s that time of year again! In a few weeks, on 9 May 2023 at 7.30pm, Treasurer Jim Chalmers will deliver the Federal Budget for 2023/24. Last year, an earlier ‘election budget’ was presented in April by Josh Frydenberg, and then Chalmers handed down a light interim Budget in October 2022. The next one will be more substantial, delivered by a Treasurer who has signalled his time in office will not be wasted.

“No man ever steps in the same river twice. For it’s not the same river, and he’s not the same man.” Is the Greek philosophy (Heraclitus) quote Chalmers used when describing his core mission.

It will be the biggest day of the Treasurer’s career but he is no stranger to the process. He has worked on or responded to 16 budgets in government and opposition, and has specified three objectives:

“First, an orderly energy and climate transition …

Second, a more resilient and adaptable economy in the face of climate, geopolitical and cyber risks, unreliable supply chains, and pressures on budgets from an ageing population.

Third, growth that puts equality and equal opportunity at the centre.” (Capitalism after crises, The Monthly, Jim Chalmers)

From a financial services perspective, there has been a lot of groundswell around large balances in super (the government wants to see fewer) and a push for retirees to spend their savings.

Research by the Financial Services Council shows that retirees in Australia are currently drawing down 17 per cent less income in retirement from their super “than is considered optimal”. The worry is that the current reluctance to draw down enough money during retirement is leaving the sector exposed to attracting new taxes, and they are calling for an urgent policy rethink.

Greater access to financial advice, the removal of inhibitors to the release of better retirement products, and potentially stricter means test rules for pensions are just some of the measures up for discussion.

As debate flares about what the objective of superannuation should be, the pundits seem to agree on what it shouldn’t be: a taxpayer-funded inheritance scheme.

The bottom line is that without reform to ensure that superannuation operates as efficiently as possible to raise retirees’ living standards, the system will continue to be targeted by vested interests arguing for higher taxes on retirement savings.

For those interested in the thinking, a recent report from think tank the Grattan Institute, titled ‘Super savings – Practical policies for fairer superannuation and a stronger budget’ can be found here. Remember, these are only recommendations. Stephen Jones did come out this week and say the only changes “this government” intends to make have already been announced. Whether he means “this government” in the context of “this parliament” and we may see more changes after the next election remains to be seen.

Markets & Economy

The chain pulling the markets around over the past year has been tightly linked in the following sequence:

Inflation is prompting Central Bank policy ? Central banks are driving interest rates ? interest rates are impacting consumer spending ? consumer spending is steering the economy ? the economy will shape corporate earnings ? corporate earnings will guide market performance.

This relationship has been on display in the last couple of weeks, with the release of the latest consumer price index (CPI) in the US and retail sales reports sharpening the focus on the relationship above, which continues to be dictated by inflation conditions.

Last week brought encouraging news on the inflation front in the US, not so in the UK, but further progress will be required before Central banks or the financial markets can take a victory lap. Nevertheless, equities added to their year-to-date gains last week as stock prices cheered the move in consumer prices and continue to price in a soft landing. We hope they are right.

On inflation

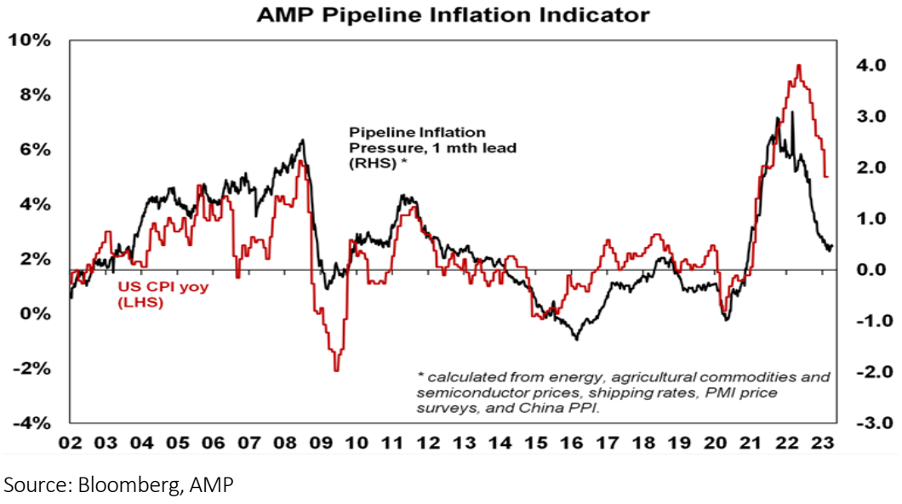

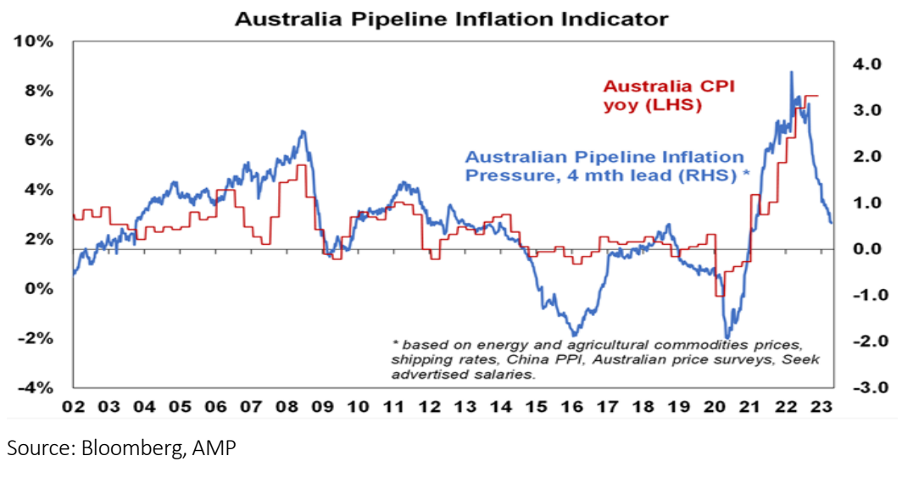

Inflation is still too high, but it looks to have peaked. US inflation led on the way up, and it looks to be leading on the way down. It has fallen to 5% year-on-year from a high of 9.1% in mid-last year. Supply bottlenecks have improved, freight costs have fallen, and slowing demand is reducing demand-side inflation. While core services inflation excluding shelter (rent), remains sticky, it is starting to slow; shelter inflation also looks to have peaked.

In Australia, inflation is lagging the US by about six months and looks to have peaked in the December quarter. There is likely more upside in electricity prices and rents and based on the US experience underlying measures of inflation may take a bit longer to peak.

On banking

Quick action by US and Swiss authorities have settled the banking problems seen in March. However, the banking strains likely have further to run as tighter monetary policy impacts borrowers and hence the quality of loans. The banking strains also look to have increased bank funding costs and pressure on margins and appears to be resulting in tighter lending standards. The Fed estimates its impact as the equivalent of 0.25%-1.5% Fed rate hikes.

On rate hikes

The combination of easing inflation pressures, the de-facto monetary tightening flowing from banking strains in the US and Europe and increasing evidence of cooling economies and labour markets suggests that major central banks are at or close to the top on interest rates:

- Several central banks have paused monetary policy tightening in the last month or so – including the RBA, Bank of Canada, Bank of Korea and the Singapore Monetary Authority.

- The ECB has continued to tighten but has softened its tightening bias.

- The sticky core US inflation evident in March likely leans the Fed towards at least one last 0.25% rate hike at its May meeting. But with falling job openings, a mixed jobs report for March and rising jobless claims, the minutes from the last Fed meeting indicate that the Fed’s staff expect bank stress to contribute to a “mild recession” – experts are touting “it will be a close call”.

- In Australia, with the labour market being a lagging indicator and economic growth and inflation likely to continue to slow, the view is that we are either at or very close to the peak in rates ahead of cuts later this year or early next.

On recession

While the risk of recession has receded in Europe (with lower gas prices), it remains high in the US with various leading indicators – including inverted yield curves (where short-term interest rates are above longer-term yields).

Over the last 50 years, all US recessions have been preceded by inverted yield curves as is the case now – but the lag can be up to 18 months, and it can give false signals. However, if the Fed soon stops tightening, a US recession could still be averted, or it could be mild, which would limit further downside in US shares.

On geopolitics

Whilst geopolitical threats have increased in recent years with the loss of global faith in liberal democracy, commentary and mainstream media have moved on, and it is easy to forget that we continue to move towards a new multipolar world. So far this year, geopolitical issues have not had a major impact on markets, helped by the absence of significant elections in major countries and the stalemate in Ukraine. But risks remain around China and Taiwan, Iran’s progress towards nuclear weapons, Russia/Ukraine and the possible return of Trump in next year’s US election. An escalation in any of these troubling scenarios will no doubt spook markets again.

According to demographer Bernard Salt’s latest research:

- The early years are considered a lottery (dependent on opportunities, education, stability, support etc.)

- In your twenties, the top priorities are building skills, getting qualifications, and selecting a life partner.

- The thirties and forties are all about having children, buying a house and your career.

- The fifties are rightly concerned with planning for retirement.

- Our sixties is all about enjoying the fruits of our labours.

Wisdom comes with the opportunity to view life looking back at where you have come from. As Salt so eloquently put it, “the view of life from the edge of life is very different to the view from the middle”.

Chart (Tables) of the Week

We subscribe to countless investment missives, meet with a number of financial experts and fund managers on a weekly basis, and live and breathe markets on a daily basis.

If we could distil our learnings into one statement, the following comes to mind:

The short term is unknowable, but the long term is inevitable.

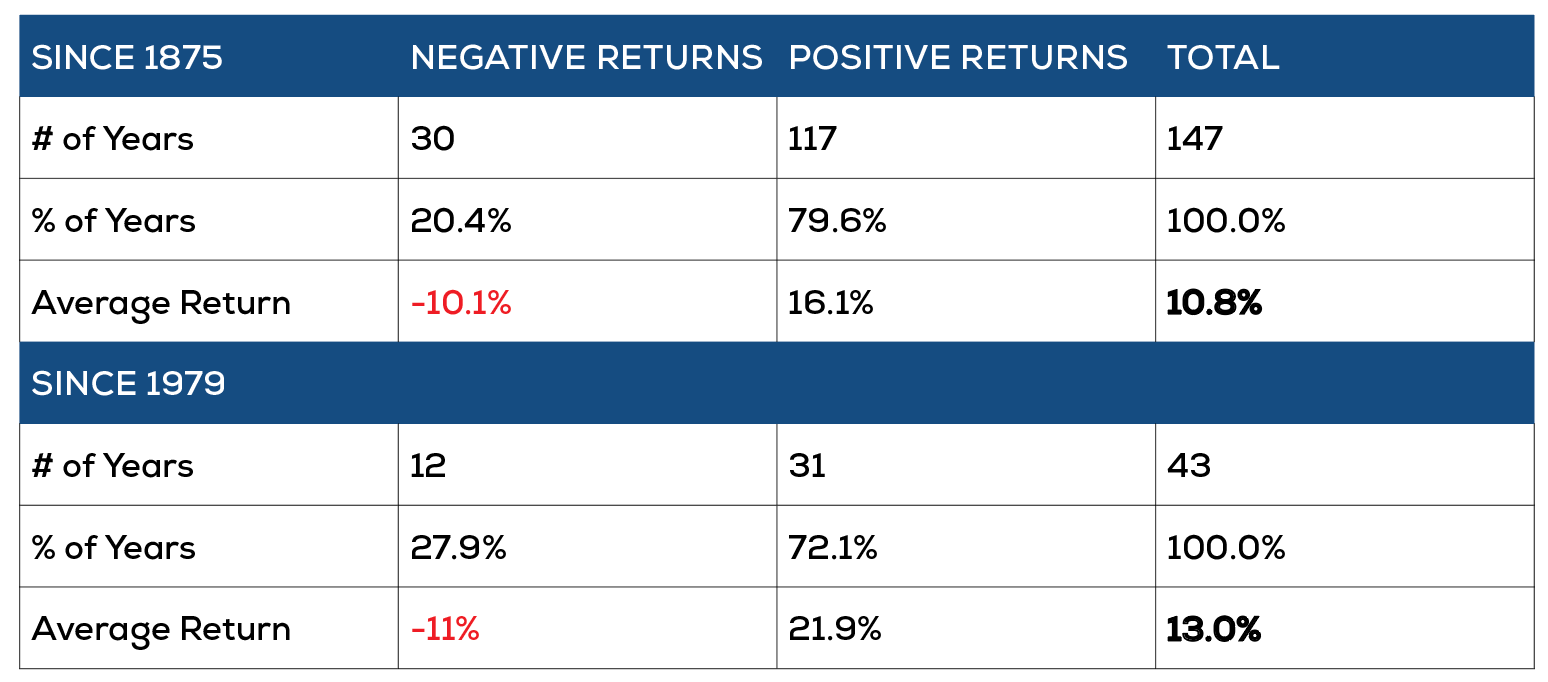

This week we share one of our all-time favourite investment tables.

- The long-term is inevitable.

The calendar year 2022 marked the 147th year of trading on Australian exchanges (under various guises). During this period, the market (dividends plus share prices) has risen 117 years and declined 30 years. So 79.6% of the time, the market rises. One in five years, on average, the market declines.

When the market rises, it does so by an average of 16.1%, and when it declines, the average is minus 10.1%. When combined, we see that over the past 147 years, the market has averaged a return of 10.8% per annum.

Since we have become more sophisticated and introduced the Accumulation Index in 1979, the data points to an even stronger outcome. Over the 43 years since 1979, the market has risen by an average of 13.0% per annum. And this is despite some seriously scary episodes, including the 1987 stock market crash, the 1997 Asian Financial Crisis, the GFC and the fastest fall on record, Covid-19.

Chart of the week #2

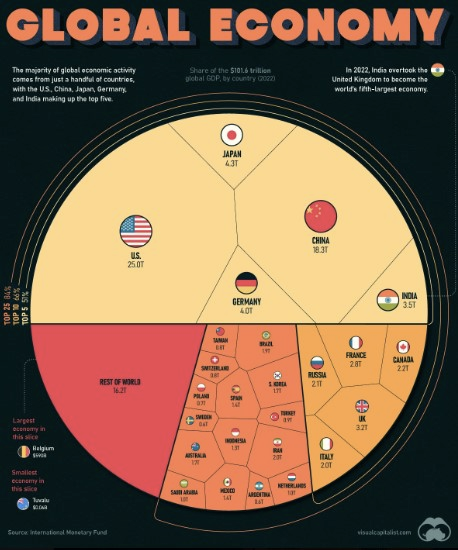

For anyone wondering why analysts focus so much on the US, this chart shows of the US$100 trillion in global GDP (according to the IMF in 2022), the US contributes 25%. Find Australia and you can probably see why we only make the news in the US when a shark bites someone or a large golf tournament comes to town…

Click here to enlarge.

The Etymology of Superannuation

Ever wonder where the word superannuation came from? Its origin, in fact, dates to the 1600s, when ‘superannuated’ meant ‘to declare obsolete’. It comes from the Latin ‘superannuatus’, meaning ‘to be too old’ (super = over and annus = year). We don’t use the word in its old meaning much anymore, but it used to be common to say something was ‘superannuated’ when it was obsolete due to age or disrepair. E.g. we have superannuated our fax machines, our iPods and our VCRs.

In fact, the word has gone full circle. Where it meant impaired or disqualified or obsolete due to old age in 1690, it graduated to ‘retirement and pension because of age’.

Today, it means money to live on in the golden years, for fit and healthy 60-year-olds who expect to live another 30 years – There is nothing outmoded or old-fashioned about that!

Quote of the Week

“Never forget the parable about the six-foot-tall person who drowned crossing the stream that was five feet deep on average.

Surviving on average is a useless concept; you have to be able to survive all the time, including – no, especially – in bad times.”

Howard Marks, famed investor and founder of Oaktree Capital Management.

The excerpt is taken from his latest ‘memo’ lessons from Silicon Valley Bank. Rather than merely recounting the developments, Marks discusses their significance. He argues that it likely doesn’t portend a wave of banking failures but may amplify pre-existing wariness among investors and lenders, leading to further credit tightening and additional pain across a range of industries and sectors. It’s worth the read and can be found here.

Capital Group – Trend #2

In this week’s instalment of Capital Group’s ’10 investment themes for 2023′, we look at the reshoring of supply chains.

Supply chain disruptions during the pandemic and mounting geopolitical tensions prompted many companies to rethink their global sourcing capabilities. The strategy now focuses on balancing efficiency, reliability and security — with the intention to diversify by reshoring and onshoring manufacturing.

There’s a common misconception that this trend will displace China as the world’s largest manufacturing base. Rather, many companies are shifting to a “China +1 strategy” by maintaining operations in the country while adding facilities elsewhere. Incremental investments in China will focus primarily on the domestic market, while additional investments in other locations will serve the rest of the world.

Southeast Asia, Mexico, India and the United States are some of the top relocation destinations. Companies that facilitate this transition — like Japanese automation enablers or REITs in India — may be well positioned to take advantage of this trend.

Source: Winnie Kwan, equity portfolio manager, New World Fund®

It could take a decade for companies to fully transition, but the process is certainly underway. The reshoring of supply chains will create new opportunities across industries and is one of the more important investment themes of the 2020s.

Shameless Photo Op!

As one of Australia’s greatest distance swimmers of all time (Olympic champion and world record holder) Grant Hackett OAM needs little introduction. However, few would know him as the CEO of the investment and life insurance company Generation Life.

It was with great pleasure that we welcomed Grant to our office this week, where he presented on the latest innovation in lifetime income products. As we’ve touted in previous Views (and for anyone that has watched Managing Partner Andrew Creaser’s latest video will know), this is a space we are incredibly excited about. A copy of Andrew’s video can be found here.

Shamelessly, we did use the occasion for a quick photo opportunity….

Kurtis Phillips – Para Planner, Andrew Creaser – Managing Partner, Scott Noell – Partner, Michelle Humphries – Front of House, Grant Hackett OAM, Sharon Paul – Financial Adviser, Patrick Iwanoswitch – Financial Adviser

How to avoid a family feud over finance

They say not to mix family and business. But when it comes to the business of personal portfolios, estates and inheritances, that’s pretty much impossible.

Planning for the inevitable is essential for all families that wish to avoid conflict, but perhaps even more so for so-called blended families. A growing number of family members are in dispute because some were disinherited when wills were not updated after a remarriage.

Other families have taken steps to include their new status but haven’t factored in technical details, such as whether a property is owned as “joint tenants” or “tenants in common”. In a recent AFR article, the experts listed these simple tips.

- The only way to dispose of property through your estate is if the title is registered in your name as sole proprietor or “tenant in common”. Conversely a “joint tenant” leaves nothing in the estate rather, the share will go directly to the surviving proprietor. ( a title search typically costs around $30) ;

- An alternative strategy is to create a “life interest” in the property (or other assets such as investments) for the surviving spouse, meaning the estate assets will be held in trust for the benefit of the new partner, and they will be able to live in the property (or receive income from investments) for the remainder of their lifetime. After they pass away, the estate assets can then be distributed to the will maker’s children; or

- “Bequeathing a right of interest” effectively provides a roof over the surviving spouses’ head until they find somewhere else to live.

With blended families on the rise (they now account for 4% of Australian families), this area of planning is considered a ‘bombshell’ for many modern families. It reflects the importance of seeking professional advice and (even though it can be super awkward) having frank conversations about money with family members before it is too late.

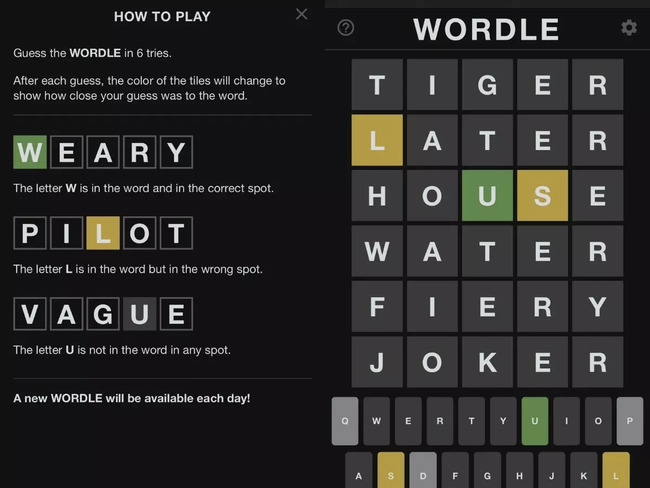

And finally… Game of the month.

“And so selling…was a way for me to walk away from that. I didn’t want to be paying a lawyer to issue cease and desists on the game that I’m not making money from. It felt like it was all going to get really, really complicated in a way that just [made me] pretty stressed out, truthfully.” – Josh Wardle

Who is Josh Wardle? Well, he invented Wordle. The game that’s taken the world by storm. If you haven’t tried it, it’s addictive.

You can play it here. The game has a single daily solution, with all players attempting to guess the same word. So if you’ve already solved today’s puzzle, don’t spoil it for your friends.

The game was developed by Josh, who is a Welsh software engineer, with help from his partner, Patak. Josh initially created the game for himself and his family to play, only making it public in October 2021. It went viral by December 2021, and the game was purchased by the New York Times in January 2022. The opening quote explains why. The price has not been disclosed, but Wardle has confirmed it was at least $1 million.