Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Mid-year market & investment outlook, Foreign investment in Australia, 1559 times per day, Age pension changes and more

30th June 2023

An article by business columnist Robert Gottliebsen published in the Australian yesterday, summarised beautifully recent discussions we at FinSec have been having around inflation and interest rates – so much so the comment “did we write this?” was made.

It is a conundrum that lies in the Reserve Bank of Australia’s (RBA) ability to use conventional interest rate mechanisms to bring inflation below the four per cent mark. While we briefly touched upon this subject in our last missive, we believe it merits further attention and discussion.

We are detecting signs in the business community, confirmed by the latest inflation data, that indicate that today’s elevated interest rates will remain for longer than markets and conventional forecasting are predicting. And, of course, may even go higher.

Consumer spending has suddenly dropped (this is to be expected when interest rates rise); companies are now confirming this, and it will later show up in the statistics. Normally, when there is a sharp turnover fall, companies slash labour and other costs to adjust.

But in the last three years, there have been acute labour shortages and so there is no longer the opportunity to shed labour in response to a sales fall unless a new range of productivity investment can be engineered.

At the same time, costs are still rising sharply, led by industrial relations activity and energy policy, so companies believe they have no choice but to simply pass these costs on. And they can.

The drop in sales is from those suffering mortgage stress; this doesn’t necessarily affect the affluent, the younger segment of society or even retirees – as we pointed out in our last View, large segments of these consumer markets are immune from the impact of interest rate rises and some even benefit.

In this environment, headline inflation has fluctuated, but the underlying inflation rate of around six per cent is holding remarkably steady.

Accordingly, small interest rate rises may not do the inflationary reduction job we need.

In our view, the restructured Reserve Bank will likely not throttle the economy with substantially higher rate rises, so we may begin to live with inflation around the four per cent mark or above.

While restraint will be delivered, if the current explosion of costs continues in the corporate sector, current interest rates will not prevent those costs from being passed on to customers, so high rates may remain in place for some time to come. The flow-on effect is of course, further mortgage stress and a reduced standard of living for many.

Happy EOFY

We concede that EOFY is undoubtedly a more exciting and significant time of year for us in the financial advice profession than it is for the broader population. Pension payments, super contributions and trust distributions have dominated our landscape in recent months, and at this point, we would hope and expect all those payments have successfully landed where they need to!

The new financial year brings with it a raft of changes across your financial world, including a rise to the super guarantee (SG) rate, expansion of the eligibility requirements for the Federal Government’s Home Guarantee Scheme, age pension (more on this below) and more. If you are uncertain as to the impact on your financial situation, please speak with your adviser today.

Mid-year market & investment outlook

The end of June marks the middle of the year, and with this comes a flurry of fund manager updates and their mid-year predictions for markets and the global outlook. Below serves as a summary of these insights.

- Portfolios will pivot from defence to offence sooner than expected

- The global economy is late in the cycle, representing the looming downturn. Typically this is when investors turn to defensive assets. but;

- With global challenges so well telegraphed and most likely already priced in, investors are likely to pivot towards the offensive much sooner than expected.

What does this mean for different asset classes?

- Equities

- Quality matters more than ever

- Active management will be key in order to focus on sound balance sheets, good governance, stable cashflows etc.

- Volatility will remain as high inflation and increasing rates are worked through

- On the defensive – Healthcare and biotech are attractive in a late-cycle economy. Europe’s lower valuations also provide a margin of safety against an earnings slowdown.

- On the offensive – Technology companies are showing a greater divergence between the ‘winners and losers’, with profitable small and midcap companies expected to outperform the broader market. Europe’s cyclicality should also be a valuable tailwind.

- Fixed Income

- Bond yields are at levels not seen in a decade and will be useful for both income and diversification.

- Within credit, yields are even higher with a focus on resilient investment-grade businesses that are more likely to weather a downturn.

- Alternatives

- Liquid alternatives could be a key strategy. Defensive when their typically uncorrelated returns provide the potential to limit losses and reduce overall volatility, and offensive when performance dispersions are created in these environments.

As we have said before, there are no crystal balls in investing. We expect volatility in the coming months which, while making us anxious, will also present opportunities. More than ever, quality funds management, disciplined diversification and patience will reward investors.

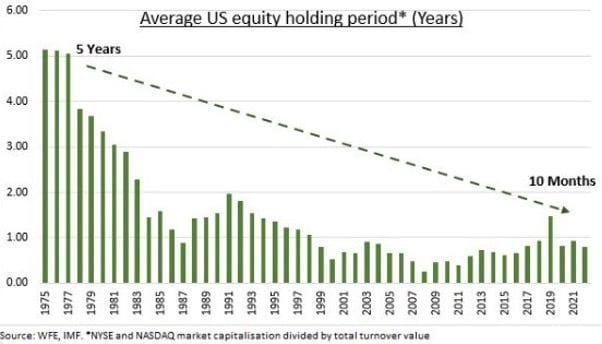

Chart of the week #1

The average holding tenure of US equities has fallen dramatically, from five years in the mid-1970s to only around ten months today (and other New York Stock Exchange data suggests it could be as short as six months). Investors buy and sell as they react to headlines – As Buffett’s famous quote says:

“The stock market is a device for transferring money from the impatient to the patient.”

Today, about 70% of market turnover is estimated to come from high-frequency trading (HFT) and day traders, in and out on the day based on algorithms or trading systems looking for daily wins without leaving exposures overnight. Here, the winners and losers generally cancel each other out.

And when a fad hits the market, such as the current focus on AI, the momentum takes on a life of its own. It is supported by social media and frenzied news stories. Even when the market’s overall economic fundamentals are poor, such as facing signs of a recession, high inflation and rising interest rates, the market can still rise – it has happened before, and it will happen again.

This chart illustrates the clear relationship between frothy markets and time in the market. Day traders and those trying to ‘time the market’ get burnt when markets are down. Those who remain are the ‘disciplined’ long-term investors. We also note the role of technology here and its impact on the ease of trading.

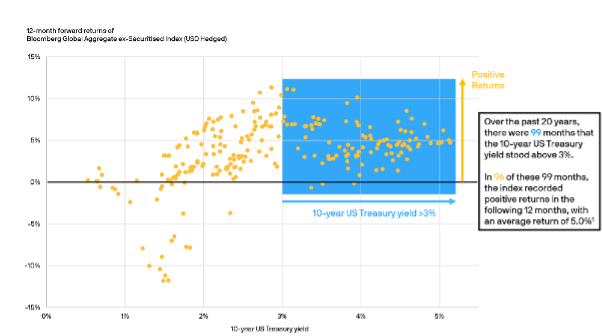

Chart of the week #2

Our second chart looks at 12-month forward returns of the JPMorgan Global Bond Fund (the Class A Units’ benchmark index). Over the past 20 years, there were 99 months in which the 10-year US Treasury yield stood above 3% (at the time of writing, it stands at around 3.7%).

In 96 of these 99 months, the index recorded positive returns in the following 12 months with an average return of 5%.

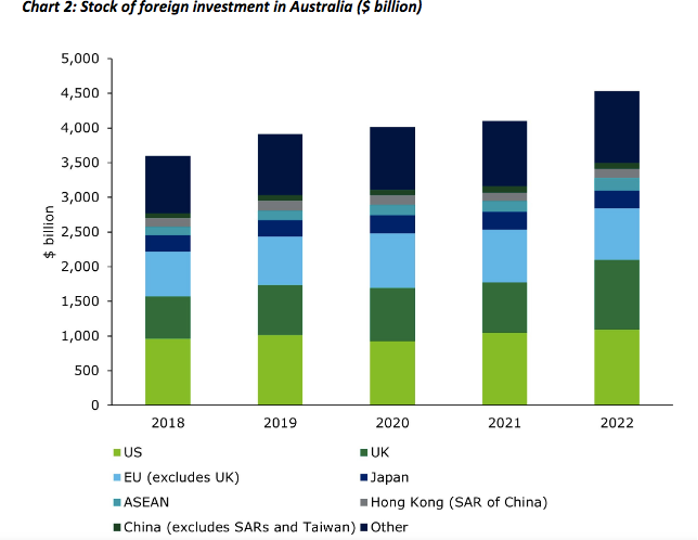

The strong performance of foreign investment somewhat goes against the narrative that we are entering an era of deglobalisation amidst increased geopolitical tensions and the economic shocks of recent years. Digging into the ABS data, though, we can see that most of the growth in foreign investment in 2022 came from geopolitically aligned countries.

The US remains our largest source of foreign investment, increasing by $43 billion (4.1%) in 2022. Meanwhile, the UK is now a close second, following a $285 billion (a whopping 39.5%) increase in its Australian investment holdings. This increase was likely supported by the signing of the Australia-UK Free Trade Agreement and the AUKUS security package (end of 2021).

China’s already low level of investment in Australia fell by $6.3 billion (6.9%) in 2022 as Chinese investors faced an uncertain climate amidst stricter investment screening in Australia. China now accounts for less than 2% of Australia’s stock of foreign investment, while disinvestment transactions involving China totalled $12.2 billion in 2022.

Weak economic conditions, alongside a rising wave of policies around the world that look to boost domestic production and “friend shore” key supply chains, cloud the outlook for foreign investment. This should not spell an end to globalisation, though. Given our domestic challenges, it will remain as important as ever that Australia is an open and attractive destination for foreign capital.

This month in history

In June 1986, Standard & Poor’s (S&P) began calculating the value of the S&P 500 stock index every 15 seconds. In doing so, it became the first exchange to deliver ‘real time’ data. This has since become the norm, with real-time information now readily available to investors and analysts through various platforms and technologies.

The jury is still out on whether the ability to check the market 1,559 times per day makes for better investment outcomes. Mmm …

Super health check

The ATO has introduced the ‘Super Health Check’ initiative. It consists of five steps to get on top of your super.

- Check your contact details

- Check your super balance and employer contributions

- Check for lost and unclaimed super

- Check if you have multiple super accounts and consider consolidating

- Check your nominated beneficiary

The best way to perform these checks is via the ATO online services through myGov.

You just need a myGov account linked to the ATO (once linked you can also use the ATO app). More information on the ‘Super Health Check’ is available on the ATO website here. As always please do not hesitate to contact us for help.

SCAM ALERT: Malicious emails with fraudulent “AMP – Promotional Offer”

This week we received notification from the AMP that malicious emails impersonating the AMP have been sent from the address @amp-corporate.com – This security breach may affect some of our clients.

A Threat Actor has sent malicious emails attempting to impersonate AMP staff using the email format “firstname.surname @ amp-corporate.com”.

This is not a genuine AMP email address. These emails are not authorised or sent by AMP.

The malicious emails have the Subject line: “AMP – Promotional Offer”

The attachment to these malicious emails is of a high standard resembling a financial product offer. However, this attachment is fraudulent and is not an offer by AMP.

If you receive a malicious email of this type, please report it to the AMP (as detailed below).

The AMP Cyber Defence Centre (CDC) is now investigating instances of these malicious emails to prevent them from continuing to be sent by the Threat Actor.

What you need to do

Please report any malicious email you receive from the Sender “@amp-corporate.com” OR with the Subject line above.

Do not click on any link in the email or open any attachments.

Drag and drop the unopened email into a new email and send it as an attachment to hoax@amp.com.au

Age pension changes – July 1

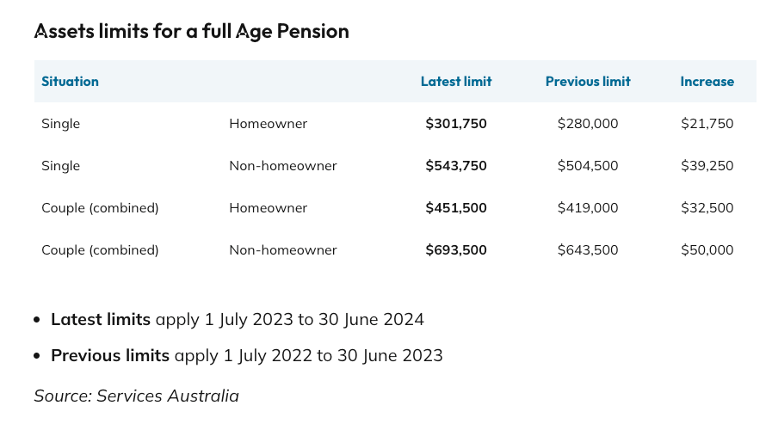

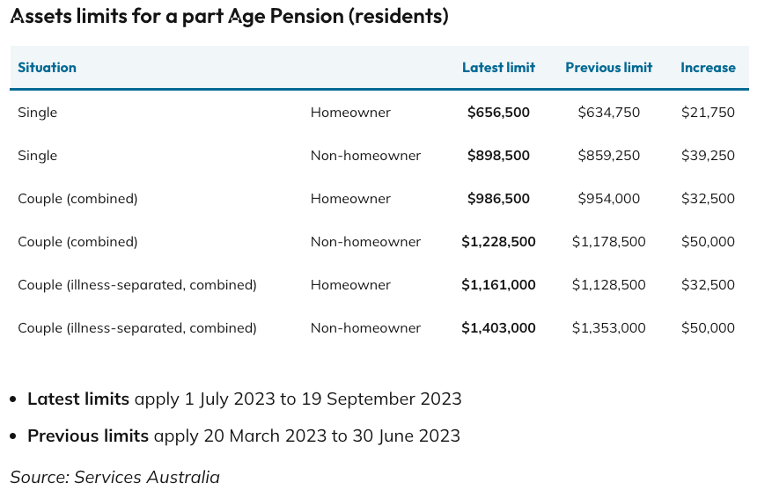

With inflation high and indexing of pension eligibility levels from 1 July, many more people will qualify for at least a part-age pension, with assessable assets for a couple now nearing or over $1 million (refer to tables below).

Even if the pension itself is not significant, the pensioner concession card just might be.

Pensioners in all Australian states will now receive cheaper medicines on the Pharmaceutical Benefits Scheme (PBS), a bigger refund for medical costs when you reach the Medicare Safety Net, hearing services through the Hearing Services Program and discounts to redirect mail through Australia Post. Other benefits may be available but are managed by State Governments or the individual provider. We recommend that if eligible, you enquire into concessions on things such as bulk billing doctor’s fees, council rates, water rates, electricity, emergency services levy, funeral assistance, assistance with glasses, driver’s licence and motor vehicle registration, personal alert systems and public transport.

Note: You will also need to pass the income test and age and residency requirements.

For more information, please contact your adviser.

Friday Funny

And finally, on a lighter note…

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.