Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Lower for Longer, Bonds, A Visit from Magellan

Fed Says Lower for Longer

US Fed Chair Jerome Powell had a busy week of last, with appearances at the Senate Banking Committee as well as the House Financial Services Committee.

He has been very strong on the message that inflation remains soft and that the Fed is committed to maintaining easy-monetary policies until the economy has recovered further from the effects of the pandemic.

“The economy is a long way from our employment and inflation goals, The Fed will therefore continue to support the economy with near-zero interest rates and large-scale asset purchases until substantial further progress has been made,” a standard that Mr. Powell said “is likely to take some time” to achieve.

Powell noted that the pandemic “has also left a significant imprint on inflation” and on balance it is not a threat to the economy. “Overall, on a 12-month basis, inflation remains below our 2% longer-run objective.”

Historically, the Fed would impose preventative rate hikes when it saw unemployment drop, thinking that a stronger job market would push up prices. Now, it has adopted an approach in which it will allow inflation to average above 2% for a period of time before moving to tighten policy.

The prevailing view remains that until wage growth can counteract a rise in interest rates and the impact on household budgets, it will be a case of lower for longer. Regardless, markets will have moments of anxiety around inflation and consequently we anticipate some volatility in the short-medium term.

Chart of the Week

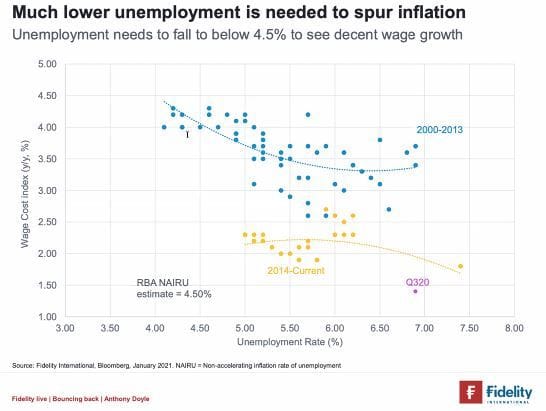

This week’s chart of the week shows just how far away we are from meeting those employment goals in Australia.

In a similar theme to the FED, the RBA said this week:

“The Board remains committed to maintaining highly supportive monetary conditions until its goals are achieved. The Board will not increase the cash rate until actual inflation is within the 2 to 3% target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.”

As this chart from Fidelity shows, wage growth in the blue dots from 2000 to 2013 was far stronger than in the yellow dots from 2014 to now, and in late 2020, wage growth was tiny and unemployment nearly 7%.

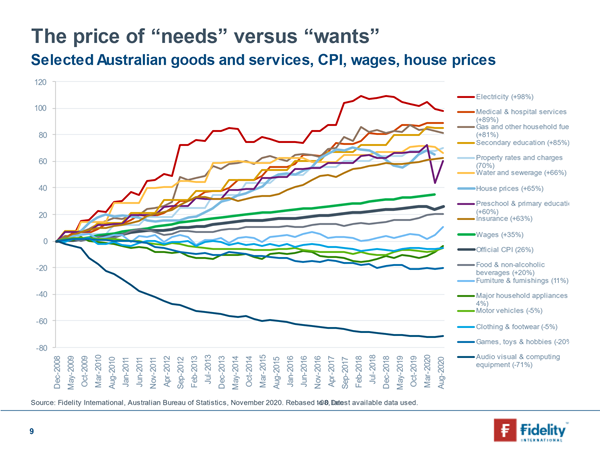

The next chart shows essential versus non essential costs and the impact this has on household budgets. Whilst inflation measures are one dimensional, real household costs have still gone up. What to make of that…

A visit from Magellan

This week we had a session with Magellan’s Head of Global Strategy, Arvid Streimann to discuss their portfolio position and a broader macro update. The below serves to form a summary of discussions and provides an insight into our investment committee’s approach over the forward period.

In Summary: We remain largely optimistic about the vaccine-led recovery for financial markets around the world, but we’re not betting the house on it. Too many investors seem to be ignoring the risk of a bumpy recovery that could result if the virus continues to mutate and vaccine efficacy and rollouts aren’t straightforward.

Whilst we stop short of calling the current environment a bubble, we do draw comparisons with the dot com boom at the end of the 1990s. i.e. there’s clearly a speculative frenzy in certain assets on the market. What we’re seeing is the classic fear of missing out.

We don’t believe the pandemic has set in train a permanent shift in market dynamics, or that any rise in inflation will be a structural change. Instead, we expect a low inflation world will re-emerge in the next 18 months. This said, if and when the Fed raises rates ‘hold onto your hats’.

Key Macro Investment Risks:

COVID-19

- Vaccine rollout key to domestic and international re-opening

- Risk that mutations delay or prevent effective vaccine rollout

- Covid-19 risks have reduced, but not disappeared

Economic outlook

- Policymakers will continue to support the economic outlook

- Upside inflation shock more likely to be temporary

- Chinese growth outlook still relatively attractive

- Covid-19 will have medium/long term impacts

Politics

- Weak Democrat sweep a positive for equity markets

- Potential for a cyclical improvement in the US-China relationship

- US-China deals will probably involve concessions from both sides

Bitcoin it’s not a currency, it’s not a capital asset… So what is it?

It is a reasonable question given the complexities of Bitcoin and the amount of interest it’s attracting of late. We provided a brief commentary on the subject in the last View, however enquiries are still running hot, and it would seem many of you still have more questions than answers. Which, when it comes to Bitcoin is somewhat the point…

Bitcoin could keep going up for a long way yet, but just as the crowd can push something to euphoric extremes, whether it be Dutch tulips, nifty fifty stocks, dot com stocks or Bitcoin – it can also drive it to collapse if people decide it’s not worth much. And, Bitcoin has form. After it peaked at A$24,000 in December 2017, it dropped to A$10,000 by February 2018. After recovering to A$16,000 in July 2019, it dropped to A$8,000 by March 2020.

Bitcoin may be the purest ever example of a speculative bubble.

As for Elon Musk’s advocacy, there is no denying that the price bump has been good news for Musk in the short term. At one point, Tesla’s Bitcoin investment had gained more than US$1 billion in value. But can the enthusiasm be sustained? Not, if the price of Bitcoin drops towards its fundamental value of nothing. We enjoyed this excerpt from an article titled ‘This year I stand to make $200 million more than Elon Musk’.

“If Bitcoin were to lose half its present value which is not unlikely, given its extremely volatile past behaviour Tesla will lose around A$1 billion. As Elon Musk owns about a fifth of Tesla, he would then be down A$200 million. In contrast, I own no Bitcoin so I will lose nothing, which means I will have done A$200 million better than Musk.”

For those seeking a more technical perspective, Economist Shane Oliver’s article on the subject found here is worth a read.

Things that make you go mmm…

Senator Andrew Bragg has called out the ABC over its commercial content-sharing agreement with The New Daily an online newspaper wholly owned by Industry Super Holdings.

Speaking to the Senate this week, Mr Bragg warned, “How can you be impartial if you’re doing deals with the super fund lobbyists..?”

Mmm… as a taxpayer-funded broadcaster whose charter is founded on journalistic independence we feel the ABC may need to think long and hard about their responsibility here.

Quote of the Week

In a world of free money and speculative investing the fear of missing out can be extreme and so what better time to reflect on the sage advice of Warren Buffett.

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

“Our favourite holding time is forever.”

“Never invest in a business you cannot understand.”

“Price is what you pay. Value is what you get.”

“Predicting Rain Doesn’t Count, Building Arks Does.”