Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Buffet Indicator, More Crypto, Biden’s Extra Sugar and the Housing Bull

April has been another excellent month for equity markets.

The US hit new highs again last night with the S&P500 up 0.7% and similar advances for the Dow Jones. The Nasdaq underwhelmed slightly but still rose 0.2%. The three drivers:

- Positive economic data – GDP rose by 6.4%, and the number of people filing for unemployment benefits hit the lowest level since before the pandemic;

- Good profit results from some of the larger companies in the US – Over 80% of companies in the S&P 500 beat their earnings expectations, including the tech giants Apple, Amazon, Facebook, and Microsoft; and, of course

- Biden’s additional $1.8 trillion spending plan for families and education – That is in addition to his $2.25 trillion infrastructure proposal and the $1.9 trillion pandemic relief package he signed into law last month.

In Australia, the sharemarket fell away from a 14 month high (Friday) but still capped its seventh straight monthly gain in a row for the first time since 2019.

The party continues!

Australia’s leading measure of inflation grew modestly in the March quarter and is expected to remain below the central bank’s target band for some time. The Consumer Price Index (CPI) surprised with a smaller than expected rise of just 0.6% (despite an 8.7% jump in petrol prices) after a 0.9% increase in the December quarter, taking the annual rate to 1.1% (ABS). That is a long way from the Reserve Bank’s historical 2% to 3% inflation target over time, let alone the new one, which calls for inflation to be in the 2% to 3% range (on an underlying basis) for a long period of time.

It has been five-plus years since annual inflation has been within the RBA’s target range, and we are still a long way from that mark. We are experiencing continued improvement in the economy and a tightening job market which could eventually push prices higher. The key question is, will the Reserve Bank be able to maintain its resolve?

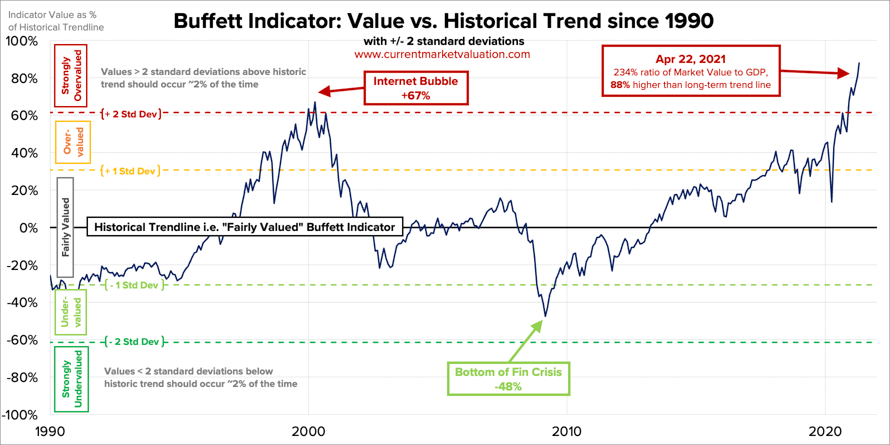

The Buffet Indicator

You’re in good company if equity markets have you baffled. Their giddy, albeit speculative behaviour, has many investors contemplating whether they should head into riskier assets to generate decent returns. A sound strategy if you own a crystal ball and can see when the market might fall. In the absence of the ball, all we can do is look to history as a guide, recognising the current set of circumstances is unique. After all, if we don’t learn from history, we are condemned to repeat it. So, where better to start than with Warren Buffett.

In 2001, Warren Buffett famously told Fortune Magazine that the stock market capitalization-to-GDP ratio is “probably the best single measure of where valuations stand at any given moment.” In comparing the size of the stock market to that of the economy, the theory is that the value of companies should not grow at a faster pace than economic growth for a long time period. The ratio has come to be known as the ‘Buffett Indicator’.

How does the Buffet indicator look today?

On April 22nd, the Buffet indicator was calculated at an extraordinary 234% – 88% above the historical average, far higher than the dot com bubble and 2.9 standard deviations above the historical average.

Whilst it has been trending higher for the last decade, in recent weeks, even that long-term trend fails to justify the metric’s frothy appearance. Of course, with the Federal Reserve holding rates near zero and buying bonds for the foreseeable future, an abundance of savings and fiscal stimulus set to trigger blockbuster growth in GDP and corporate earnings, suspicions that “this time is different” may hold true

Nonetheless, right now, the Buffett Indicator is flashing red! It re-enforces what most already know to be true – stock markets are richly valued, and many investors are likely paying highly optimistic prices for future corporate profits.

Of course, this is only one of many indicators, and we are sorely aware that any statistic can be manipulated to justify a range of arguments. However, importantly, it helps to conclude that there does appear to be more risk in the market than there has been for some time.

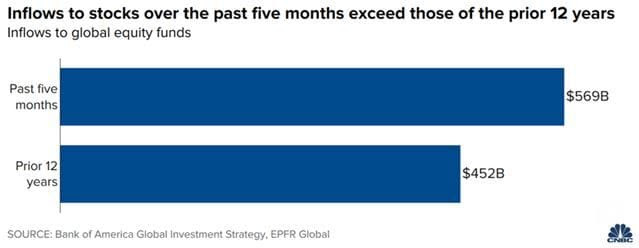

Chart Of The Week

While we have written much about the rapid increase in new participants who consider the stock exchange much like a casino, this chart from CNBC is a little scary. It shows inflows into global stock funds in the five months since November 2020 compared with those of the previous 12 years. A phenomenon summed up well by legendary investor Jim Rogers with this recent comment.

“There are gigantic amounts of money being printed. It takes a while to build a factory, but these days it takes 10 seconds to go online and invest”.

Casino analogies aside, we shouldn’t forget that with interest rates at zero (effectively), money has to go somewhere.

Biden Revving Up An Economy Already High On Sugar

The critical component driving markets is the stimulus packages from governments around the world. In this article, Investment Specialist, Michael Collins of Magellan analyses the consequences of President Joe Biden’s massive spending and his decision to inject a further $1.8 trillion (almost double the Obama stimulus post the GFC) into a US economy that is well beyond crisis, in a bet that the output gap is large enough to cope with any increased demand.

Drawing on comparisons from Bush, Trump and Obama days, Collins discusses whether the modelling on which Biden has based his bold approach will prove sound.

Warning, this article is a little on the long side – however, it provides an interesting and robust perspective. Click here to read.

3 Reasons Why The Long-Term Bull Market In Aussie House Prices May Be Close To An End

Driven by record-low mortgage rates, multiple home buyer incentives, economic and jobs recovery, pent up demand, activity associated with a desire to “escape from the city”, and an element of FOMO, the Australian housing market is booming. Forecasts for prices to rise 15% to 20% in total across this year and the next now seems the consensus.

While many homeowners cheer the news of strong growth, the cost of upsizing could prove difficult for many buyers, not to mention the long-suffering prospective first home buyers, who face an increasingly steep challenge of saving for their deposit.

Is there an end in sight?

According to Economist Shane Oliver, there is good reason to expect that the forces that have driven average Australian capital city property prices well above trend and well above price to income ratios seen in other comparable countries over the last two decades may be at or close to having finally run their course. His key points include:

- Australian home prices are currently in a cyclical upswing which likely has further to go into 2022.

- However, the longer-term bull market, that has seen above trend growth in property prices since the mid-1990s, may be close to an end as the long-term decline in interest rates bottoms out, property undersupply swings towards oversupply & the “escape from the city” phenomenon takes pressure off city property prices.

- This may at least take some pressure off average capital city property price growth in the decade ahead.

The full article can be read here.

More On Cryptocurrencies

If you are a regular reader of The View, you will know that we do not get cryptocurrency. The only mining we’re interested in is of the ‘iron ore’ variety and as for blockchain .. let us just say we are more comfortable with banks. Which is why it was somewhat of an ‘aha moment’ when we read this perspective earlier in the week. If you, like us, have more questions than answers when it comes to cryptocurrency, then you will enjoy this read in which Chief Investment Officer at fellow advice group Crestone discusses:

– What is it?

– Are they a store of value?

– Is it just a digital commodity?

– Can it become a means of exchange?

– Can it pass the sustainability test? And,

– Where could it potentially sit in a portfolio?