Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Inflation ‘to be or not to be’, Enduring your responsibilities and Extension to reduction in pension drawdown rates

Issue: 11th June 2021

Market Update

May was a month where every asset class worldwide seemed to be up around 1’ish’% (shares, bonds, commodities etc.). Not the radical gains experienced after the US election and early this year, but an expected pause as markets begin their re-balancing. Historically, when markets travel as fast as they have over the last 12 months, they tend to collapse a little under their own weight. Very similar to the GFC when we had a massive sell-off, followed by a strong rebound in the last months of 2009, only to stop at the end of 2009/early 2010. The same thing happened in 2011 with the US downgrade and Greek crisis. Then again, in 2015, with the commodity crisis. The driver of the rebounds may have been different in every case, but the reason for the pause after each surge is essentially the same. Central banks begin to wind back stimulus, talk about tapering Quantitative Easing (QE), and we are threatened with interest rate rises. Interestingly, in the last month, nearly every central bank in the world (excepting Australia and Japan) has repealed their 3 year zero rate promise, announcing they may have to raise rates sometime in the next 12 months.

In terms of where to from here, markets are now completely fixated on the outlook for interest rates. The big factor behind that is, of course, the inflationary outlook.

Inflation ‘To be or not to be…’

The possible resurgence of inflation is dividing economists, with prominent minds on both sides. On one side, we have the view that excess debt suppresses economic growth, without which demand can’t rise enough to generate inflation (or push up interest rates).

The other, arguably the more practical side of the argument is that inflation is evident across many sectors, particularly in the US, and the rest of the globe will follow suit. With Federal Reserve Chairman Jerome Powell labelling the US surge as “transitory”, a sub-set of thinking has emerged around short-term inflation and a period of policy-driven ‘reflation’.

Focussing on the US as the global proxy, below outlines the main reasons behind the view that the surge is temporary.

- Base effects – Put simply, last year prices were falling, this year they are rising, and the comparison makes the rise look much greater than it actually is. Notably, a big chunk of the yearly CPI increase comes down to second-hand cars and trucks (nearly a 30% increase over the year), airfares (a 25% increase), and other sectors that were obliterated by COVID.

- Energy prices – Energy prices are currently at elevated levels (disruptions and peak season); as we move through the rest of the year, they will come off.

- Fiscal stimulus – Cheques have been handed out in the US, and people are spending them. When the cheques dry up, as they are scheduled to do, it will relieve the pressure.

- Savings rate ‘normalises’ – Savings are higher than ever before. As normality returns, these balances will get run down, and savings balances will normalise.

- Bottlenecks in the supply chain – We have seen price pressures right across the board; manufacturing, in particular, has been badly affected. But, as prices rise, encouraging more supply, the bottlenecks will start to ease, and with this, the price pressures will follow suit.

- Excess demand for labour – The key to inflation will be whether these pressures flow into wages. Currently, the US is experiencing a tighter than normal job market; however, experts believe that around 6 million jobs would need to be added before we see a genuine shortage of labour.

Having moved past much of the pandemic fall-out so quickly, supply has not had time to adjust, and the demand driven by stimulus is moving quickly – These are forces that will fade. All this considered, it is expected that US inflation will start to ease over the course of this year and get back to more normal levels next year.

Giving further weight to the argument is the overnight US inflation data for May. The year on year rate was 3.8% which is the highest number since 1992. But bond yields fell! The US ten year yield, fell by 6bp to 1.43%. And the 30 year bond yield fell by 4bp to 2.3%. The US ten year breakeven inflation also fell to 2.35%, which is the markets’ expectation for average inflation over the next ten years.

This all seems counterintuitive. Inflation going up, but bond yields and inflation expectations going down… In our view, it all boils down to the market’s expectation that the current burst of inflation is transitory and not structural.

Chart of the Week

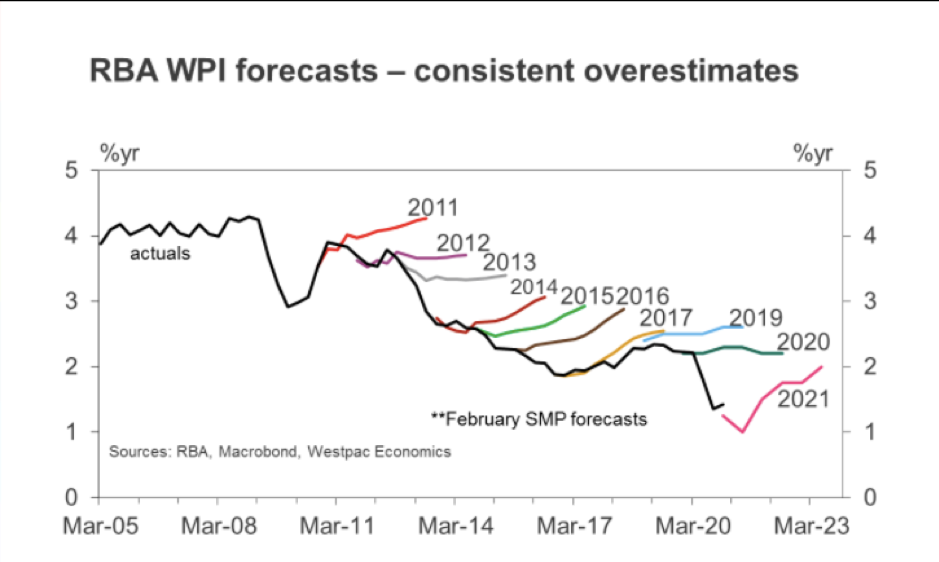

For those nervous about wage growth in Australia, our chart of the week may provide a little solace. It shows that the RBA’s record for forecasting wages growth is not a great one; in fact, they have overestimated every year since 2011. Why? The prevailing themes of technological progress, globalisation and under-utilised labour!

Market Musings

“We caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.”

These are the words of warning that AMC includes in bold on the front page of their prospectus.

AMC (a movie theatre chain) has become the top-traded stock on WallStreetBets, knocking previous meme stock Gamestop off its perch. A declining company that has not made a profit for two years. It only has 500 million shares on issue yet trades 750 million a day. Its market value is up from $US500 million to US$30 billion in a few months and is priced at 200 times revenue.

Reported as being owned by 3 million retail day traders, it paints a rather scary picture. The worry here (aside from people losing their money) is that when stock prices are divorced from fundamentals, it cements the public perception that markets can be manipulated – by a small group of insiders or a large group of determined traders – and therefore can’t be trusted. That could have long-term implications beyond what happens with AMC, GameStop or any other stock in the headlines.

In our view, the more that stocks swerve on factors seemingly unrelated to underlying business factors, the more likely regulators will feel the need to take action.

Extended: Temporary Reduction in Pension Drawdown Rates

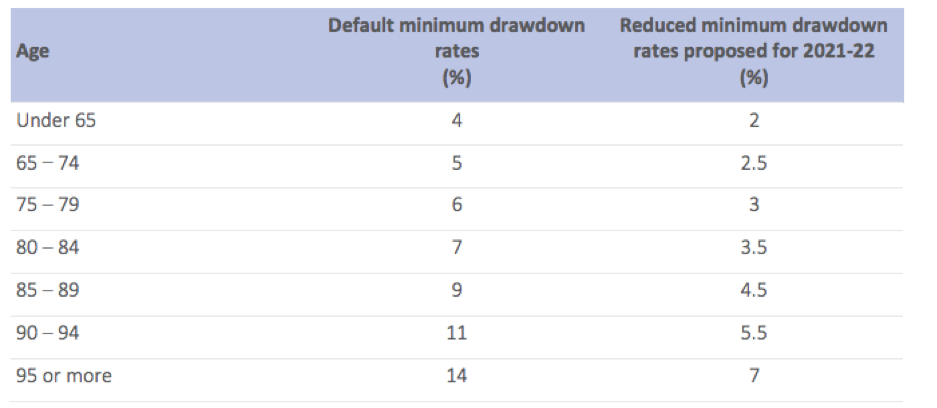

Last week the Government announced that the temporary reduction in pension drawdown rates by 50%, will be extended another year to 30 June 2022. This will make it three years with the lower minimums. These are minimums, not recommended levels, and a higher amount can be drawn if needed for your lifestyle.

Details

In its media release, the Government indicated that the temporary reduction in the minimum income drawdown requirement for superannuation pensions, which applied during the 2019-20 and 2020-21 income years, will be further extended until 30 June 2022. Once the enabling regulations are tabled, this measure will allow those whose circumstances permit to reduce income payments from their superannuation-based income streams to minimise the need to sell down assets in depressed markets.

In its media release, the Government recognises that “for many retirees, the significant losses in financial markets as a result of the COVID-19 crisis are still having a negative effect on the account balance of their superannuation pension”. For the 2021-22 financial year, the proposed minimum pension drawdown requirements will be:

Enduring your Responsibilities

For many who are not aware of what being an enduring power of attorney (EPoA) for a relative or friend may entail, it is easy to say yes when someone asks you to accept this role.

But, once you have taken on the position, it can prove to be quite a burden given the responsibility you may not have anticipated.

In this article, the Fin Review answers one readers ‘cry for help’. Agreeing to act for an elderly aunt and uncle with a self managed super fund (SMSF), she has found her duties increasingly difficult. It serves as an informative piece on an ill-informed subject. Click here to read.

As this article is behind the ‘pay wall’, we have summarised the key points below.

As a point of clarification, an enduring power of attorney role, which is a legal document allows a responsible adult to look after your financial affairs and this document endures despite any loss of capacity by the donor.

- As an EPoA, you are chosen for your trustworthiness, your ability to manage money well, your ability to stay calm in a crisis and your confidence to speak up on behalf of the person or persons who have asked you to accept this role and be available to do so.

- As an EPoA, you might be called upon to talk to doctors, lawyers and other advisers. Where an SMSF is involved, you can add dealing with an accountant or a fund administrator to this list.

- In all circumstances, an EPoA must act honestly, diligently and in good faith and with reasonable skill and care and be prepared to keep accurate records and accounts of their actions.

- When an EPoA makes a decision on behalf of a person who has appointed them, they must act on what they believe to be the wishes of the person or persons they are helping so far as it is possible to do. What this suggests is that you really need to understand what the person/s expect of you.

SMSF obligations

- As far as SMSFs and EPoAs are concerned, with the passage of time, there is a significant risk that some SMSF members may lose their capacity to administer their own affairs. In the absence of planning, this can result in major uncertainty and risk in relation to the control of an SMSF which comes with significant tax and regulatory responsibilities. It is imperative that that every SMSF implement an EPoA as a part of its personal succession plan

- In doing so you need to make sure that the EPoA actually becomes a fund trustee by being appointed as a director of the trustee company or an individual trustee (depending on the fund’s trustee structure).

- One very important consideration is making sure the EPoA understands they are fully liable for the fund just like any other trustee/director. That includes tax and regulatory responsibilities, including the potential for significant penalties to be imposed under the SIS Act.

Taking on the role of EPoA should be seen as an honour and a privilege; however, it comes with great responsibility. We advise talking with an estate planning specialist to ensure your duties and obligations are properly understood.

A Big Number!

The Australian superannuation system holds around 3 trillion dollars. President Biden’s stimulus package is upward of 2.5 trillion dollars. Google is worth more than 1 trillion dollars. You hear these huge numbers thrown out in daily conversations but do you ever stop to conceptualise just how big these numbers really are?

This is what a trillion looks like:

- One trillion dollar notes would stretch from the earth to the sun.

- If you were to spend $40/second, it would take 792.5 years to spend a trillion dollars.

- If denominated in $100 notes, $1 trillion would be enough to fill 4.5 Olympic-sized swimming pools, with a total volume of 398,000 cubic feet. For comparison, there is only about $625 billion worth of $100 notes currently in circulation, according to the US Treasury bulletin, which would fill about 2.8 Olympic swimming pools.

- One trillion seconds is equal to 31,710 years.

Stay safe and look after one another. Enjoy the weekend and as always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.