Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – What to make of the market sell-off, SMSF BDBN ruling, Outcome bias and more

17th June 2022

As no doubt you will be aware, there have been significant declines on the US share markets over the last week and again last night, leading to substantial declines on the ASX.

The US market index (S&P500) is now down -23.5% so far this year, and the NASDAQ is down more than 30%, meaning they are now in a bear market, customarily defined as a drop of 20% or more. At the time of writing, the Australian ASX All Ordinaries is down by around -16.5%.

The latest falls deepen fears of an economic downturn as monetary policy tightens to fight inflation. US figures for May (released on June 10) showed inflation is running at 8.6% (annual) and at high levels around the world: 9% in the UK, 8% in Europe, and 5% in Australia.

Drivers include several concurrent economic forces; temporary supply constraints due to Covid restrictions, weather events and the impact on food supplies, and the Russia-Ukraine war, with central banks everywhere stepping up the pace of interest rate hikes in an attempt to curb inflation. The exception is in China, where the economy is in a severe slowdown due to the property/construction collapse and severe Covid lockdowns.

But, of course, there are some longer-term factors at play here too. US inflation has been running above 5% since the middle of 2021, and oil prices were above $80 from October 2021. Even before Covid and the Russia-Ukraine war, inflation was the result of more than a decade of government deficit spending and central banks running ultra-low interest rates and money-printing (‘QE’) since the 2008-9 GFC (significantly ramped up to fight the fall-out from the pandemic) – In fact, it is estimated that the West has increased the monetary base of their economies by 30%.

With inflation running hot and central banks forced to move faster than they once anticipated, rate hikes are now alarming investors who have become accustomed to ultra-low rates for the past decade. And, with the media adding further fuel to the fire, markets are certainly showing their sensitivity.

Below we unpack the three most common questions our clients have been asking.

- How high will interest rates go? Our view: We sit in the same camp as many economists and fund managers – In the US, up to around 3-3.5%; in Australia, we believe they will settle around the 2.25 – 2.75% mark.

- Will rising rates and inflation cause an economic recession? Our View: It is a possibility, just as it has done in past cycles – we’ve certainly been here and survived before. Currently, it looks like a 30% chance of a ‘hard’ landing (central banks go too hard, too fast and push the economy into recession, either by accident or deliberately) and 30% chance of a soft one (a combination of just enough demand destruction and a resumption of sufficient supplies of key inputs like energy to allow central banks to re-adjust policy after the front-loaded rate hikes).

- Should I be worried about my portfolio? Our View: We remain confident that high-quality assets recover after downturns, the market may re-value them from time to time (based on the economic outlook), but paper losses on growth assets within your portfolio are only crystallised if you sell.

Broad, indiscriminate sell-offs, like we are seeing now, usually turn out to be ideal times to buy good quality assets that are cheap after those (without the discipline) have sold them off in a general panic. Of course, knowing when to buy them requires courage, as it is rare to pick the bottom.

Looking at each question in greater detail:

1. How high will interest rates go?

- After listening to much commentary and speaking with several fund managers over the last few days, it is expected that interest rates in the US will peak around 3-3.5% by 2023 and around 2.5% here in Australia. At this time, the RBA will sit and let things settle to see how the economy plays out.

- The scale of the rate hikes is a situation borne of urgency to get to a more ‘normal’ rate level as soon as possible to ensure they have some monetary policy flexibility should the risk of a hard landing increase. As one fund manager, we spoke with today put it “the destination hasn’t changed; the journey has”.

- ‘Stickier’ than expected inflation is the leading cause of the current volatility in markets. Interest rates are being used to temper this; however, the Fed will need to be far more aggressive than Australia. Why? Inflation dynamics in Australia Vs US are very different.

- Where the US is talking inflation at 8 – 9%, we are looking at a peak of around 7%

- Australia’s wage growth continues to be very modest (outside of the artificial rise to 5.2% this week)

- The housing market is a key mechanism of the monetary market. In the US, the market is based on a 30-year mortgage rate, i.e. investors are already locked in. In Australia, fixed interest rates roll between 2-5 years, with many on variable rates. Accordingly, Australia feels the flow-on effect of interest rate movements much faster.

- Since the beginning of the year consumer confidence has fallen to near recessionary levels, the housing market is softening, business confidence has been falling for months so wallets may already be firmly in pockets. It is not unreasonable to think that we may look back on this current period as the peak in inflationary pressures.

In defence of central bankers who are now being accused of moving too slowly early on, their 2021 rhetoric of no rate rises in 2022 had not factored in the energy crunch resulting from Russia’s invasion of Ukraine and its subsequent impact on the price of just about everything. A sobering reminder that the cost of energy doesn’t just affect our power bills and the cost of petrol.

2. Will rising rates and inflation cause an economic recession?

- The risk of a recession in the US is rising – predicted for 2023.

- Let’s not forget the yield curve flip (it has inverted twice now) and is a good indicator that a recession is 12 – 18 months out (our previous article on the topic can be found here).

- There is a very active debate in the market at present around a soft landing Vs a hard landing.As mentioned previously, a soft landing would entail the Fed managing to slow inflation without a recession; a hard landing would mean they make good on their promise of “doing whatever it takes” and have to slow the economy to such an extent it causes a recession.Historical records of achieving a soft landing are ‘patchy – poor’; it is tough to bring down job demand without destroying jobs. Interestingly, the Fed’s latest forecasts have economic growth running at trend around 1.7%, but the unemployment rate rising by 50 basis points. We have never seen the unemployment rate rise by this much and not seen a recession.

- How big are recessionary falls normally? In equity markets, typically, it means around a 30-35% drawdown. Currently, the US market is sitting around -24%, so we’re two-thirds of the way there already (if indeed there is a recession). Equity markets tend to fall heavily but then rebound quickly out of recessions while the economy is still contracting, while companies are reporting losses or significant cuts to profits, and while dividends are being cut or cancelled.

- The 2020 global Covid lockdown recession was different as the sudden contraction in spending was caused by the lockdowns, not by rising inflation and interest rates. However, share prices did the same as they did in other recessions, falling heavily and then rebounding quickly.

3. Should I be worried about my portfolio?

- The opportunity that comes from a broad panic sell-off is that a lot of investors dump everything – good and bad. This is when the fads unwind, and the speculative stocks disappear as quickly as they appeared. But it is also when ‘good’ assets (real companies with profits, good management, positive cashflows and dividends, and ideally big margins and low debt levels) become much cheaper when they are sold off in the general panic.

- Most long-term investors (and fund managers) have a list of companies (and/or other assets) they would like to own but have been too expensive to buy. When prices fall across the board in a general panic, this is when they pull out their wish lists to see if targets are now cheap enough to be good value buys.

- It is the same for existing holdings. If they are real companies with actual profits, positive cash flows and dividends, then they are now suddenly cheaper (i.e. better value buying) than they were in the boom, before the panic.

- Recessions, inflation spikes, interest rate hikes, market panics and even wars are nothing new. There have been countless cycles and incidents in the past, and there will be countless more in the future. These events are inevitable for long-term investors, which is why our managers focus on assets that have weathered different market conditions in the past and are likely to weather them in the future.

SMSF BDBNs Ruled as Non-lapsing

This week the status of Self Managed Super Fund’s (SMSF) Binding death benefit nominations (BDBN) was decided by the High Court of Australia in its decision regarding the Hill vs Zuda Pty Ltd case.

The ruling has found SMSF BDBN can be non-lapsing and lasting longer than the three-year period stipulated in the Superannuation Industry (Supervision) (SIS) Regulations if the deed permits.

The case reached the High Court after an appeal to the Supreme Court of Western Australia to apply the three year time cap on a BDBN was dismissed.

Most significantly, this means:

- If the deed permits, members of an SMSF need not renew their binding death benefit nomination every three years;

- If the deed permits, various formal requirements, such as will-like execution, which apply to BDBNs in retail funds and industry funds, do not apply to SMSF BDBNs.

Regardless of the high court ruling, we advise that SMSF BDBNs should be examined regularly and particularly when significant events take place in relation to the member who made the nomination.

A Pay Rise – Artificial or Not…

Australian minimum wages will rise 5.2%, with minimum award wages to rise 4.6% from 1 July. Given this will directly impact about 22% of the workforce it will add about 0.5% to wages growth compared to the last financial year. The risk is that this will add to broader wage claims in the economy, hence to inflation expectations and the risk of a wage price spiral putting even more pressure on the RBA to raise rates.

Time will tell whether the Fair Work Commission has hit the sweet spot with these changes, but it is vital to ensure that people’s living standards are not compromised as the cost of living increases. The opportunity for the new government is to bring productivity and industrial relations reform to the front and centre so businesses can create capacity and efficiency to absorb the additional cost of wages, which in turn will take the pressure off the RBA on the inflation and rates front.

Finance 101 – The Outcome Bias

Imagine two financial thrill-seekers that take their life savings to the casino. They end up at the roulette table, with one betting the house on black and the other favouring red. One will walk out having doubled their money, whilst the other won’t have enough to pay for their bus fare home.

Although the subjects of our example made equally foolish decisions, we tend to view the unlucky gambler more harshly than the lucky gambler. This is a result of the outcome bias, where we judge the quality of a decision by its end result rather than by the process used to arrive at the decision. The bias is particularly dangerous for investors, as luck and randomness play an uncomfortably large role in investment performance, e.g. was your average Australian home buyer in 2012 smart or just lucky (10 years ago, the average house price was $519,768, compared with around $1.1M today)?

When selecting money managers, many investors use recent performance as a proxy for the quality of the product. The issue with this is that, in theory, a portfolio of equities chosen by your local primary school can outperform a portfolio chosen by esteemed investors such as Warren Buffett for weeks, months, or even years. In the long run, however, good luck tends to run out, so investors should place higher significance on the strategy and decision-making process of a manager than their short-term relative performance.

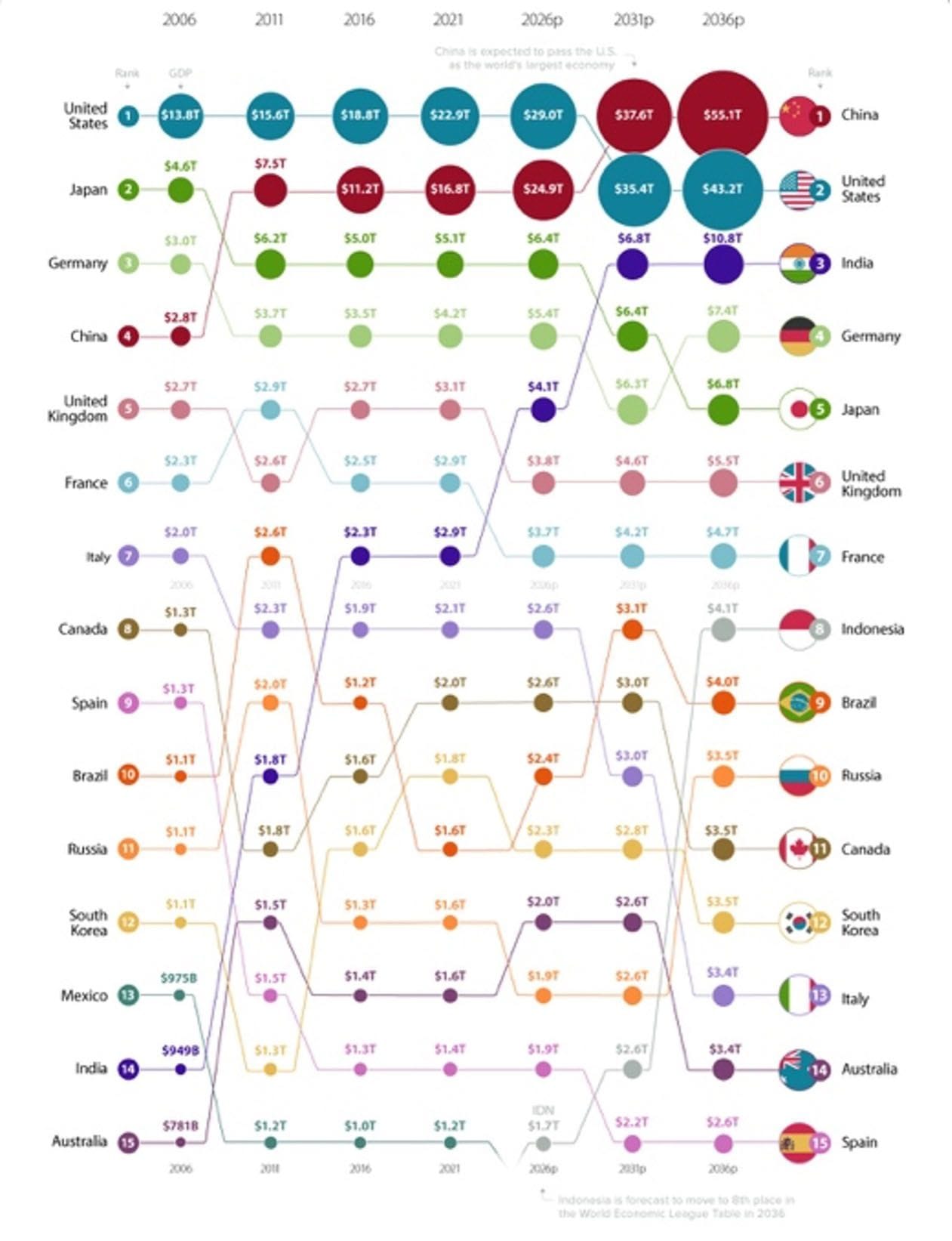

Chart of the Week

As the post-pandemic recovery chugs along, it is no real surprise that the global economy is set to see major changes in the coming decades.

For some time now, the world’s economic centre has been drifting from Europe and North America to Asia. This shift was kickstarted by lowered trade barriers, greater economic freedom (attracting foreign direct investment) and improvements in infrastructure and communications.

Despite China’s struggles under their “Zero-COVID” policy and its property construction woes, it is still expected to surpass the US (in terms of GDP) by the year 2030, an occurrence attributed to its ability to maintain positive growth due to the stability provided by its domestic demand and political structure.

India is primed for the number three spot in terms of GDP, with $10.8 trillion projected in 2031. Coming from a low base, the country has a lot more room to improve than other nations. Demographics are also working in the country’s favour. While the median age in many mature economies is shooting up, India has a youthful workforce. Interestingly, India’s median age is a full 20 years lower than Japan, which is currently the third-largest economy.

Our chart of the week visualises this coming shift in global economic power (2006 – 2036). Data is taken from the 13th edition of the World Economic League Table 2022, a forecast published by the Center for Economics and Business Research (CEBR).

Source Visual Capitalist

Entrepreneurs Will Always Find A Way!

One of our favourite sayings at FinSec (in fact, it adorns the front page of our website) is Albert Einsteins’ quote on thinking outside the square:

“If you always do what you always did, you will always get what you always got.”

We are privileged to call many entrepreneurs our clients, and their constant ability to innovate and adapt is a marvellous thing indeed!

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.