Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Reaching for resilience, Hyperloops, The oldest of them all, Mungar musings & more

15th July 2022

One of the tribulations of checking the junk folder of your emails is seeing how people are trying to scam you. Scammers typically sell things that are highly desirable but require hard work and patience. Want to lose weight? Forget going to the gym and adjusting your diet – drink this miracle water! Want to become rich? You can work hard and be sensible with your money, or you can make millions by taking up this once-in-a-lifetime opportunity!

Fitness and wealth (amongst many other things) all require effort and patience to build and maintain, which is why they are out of reach for so many. Scammers hope that their victim’s desire to achieve difficult things quickly with minimal effort will outweigh their common sense.

The reality is that fitness and wealth have striking similarities. The success of both comes down to behaviour – discipline, a plan/ strategy and no shortcuts. When things don’t go your way (i.e. you want to skip that gym session) is when discipline really comes into play.

Much like a personal trainer the value of a good financial adviser is not just formulating a strategy but helping their clients with one of the hardest tasks of investing – staying on track and sitting tight!

In this week’s View, we bring you the customary market update, a synopsis of PIMCOs 3-day secular forum, Hyperloops, the towns boasting the world’s longest living residents and some more Charlie Munger wisdom.

Market Update

Hopes for inflation easing were not helped on Wednesday night when US consumer prices rose 9.1% in June 2022 from a year ago, above expectations. It’s a 40-year-high driven by increases in gas, food and rent. The US market immediately priced in another 1% rise from the Federal Reserve later this month.

In a true show of susceptibility (to every piece of news out there), last night, the S&P500 dropped a further 2%, only to recover after comments by two Fed officials who said they would advocate for a 0.75% rate hike, effectively reeling the 1% conversation in. Whether markets can sustain momentum is in question with a disappointing start to the US earnings season in the first of figures released last night.

The fundamental consideration for equity markets is, of course, how these factors (high inflation and rising interest rates) will impact company profits and dividends. While profits and dividends are backwards-looking, share prices are based on investors’ future expectations. Share markets are falling this year in anticipation of rising costs and interest rates hitting consumer spending and company cashflows, flowing through to lower profits and dividends in the coming year/s.

If central banks can manage to pull off an allusive ‘soft landing’ and bring inflation back to target ranges without triggering economic slowdowns and big job losses, spending, and corporate profits, then the share prices of most companies are probably already over-sold at current levels. On the other hand, if the rate hikes do result in economic slowdowns that materially hurt profits and dividends, then share prices may have further to fall. Remembering as mentioned above, the market is looking ahead at least six months, it will inevitably rebound out of this slowdown, more quickly and more strongly than most people expect.

The Reserve Bank’s decision this month to increase the cash rate by 0.5% to 1.35% comes with the expectation of another increase next month. The decision was justified by the above-mentioned high global inflation – boosted by supply chain restrictions, the war in Ukraine, an unprecedented unemployment rate of 3.5% and capacity constraints.

But RBA Governor Philip Lowe is still confident in his expectation that inflation will peak late in 2022 and decline back to the 2-3% range in 2023. Promisingly, his comments (latest meeting) sounded slightly more relaxed about the need for future rate rises.

Evidence that perhaps the central bank is achieving its objective is the latest housing data, which shows auction clearance rates at their lowest level in two years.

An additional factor which we are sure is also now playing into the Reserve Bank’s thinking is the potential impact of a new Covid wave, with reports that the latest subvariant easily overcomes immunity from prior infections and vaccines and increases the risk of reinfection. The same variant is taking hold in the US and China, and whilst this is not good news at all, it could go some of the way to slowing the economy outside of central bank tightening.

Reaching for Resilience – Part 1

Fund manager PIMCO recently held its annual ‘Secular Forum’, bringing together their own investment professionals, a global advisory board and a handful of guest speakers for three days of intensive in-person discussions. Big names include:

Ben Bernanke, former Federal Reserve Chair and scholar at the Brookings Institution

Joshua Bolten, President and CEO of the Business Roundtable and former White House Chief of Staff.

Gordon Brown, former UK Prime Minister and former Chancellor of the Exchequer.

Mark Carney, UN Special Envoy on Climate Action and Finance, former Governor of the Bank of England, former Governor of the Bank of Canada.

Michèle Flournoy, U.S. defense policy and national security expert, former U.S. Under Secretary of Defense for Policy.

Ng Kok Song, former Group Chief Investment Officer of the Government of Singapore Investment Corporation

With the white paper hitting our desks this week, we have attempted to summarise the key takeaways for our readers below.

We note that, for the most part, these views reflect much of the commentary we have discussed through our own missive (the View) over the past few months.

1. Near-term cyclical horizon (six to 12 months)

- Recent macro data underscore views that the war and sanctions shock, along with the COVID-related lockdowns in China, are stagflationary: pushing inflation even higher in the near term and slowing economic growth in the major economies toward stall speed over the cyclical horizon.

- With current headline inflation elevated across the globe, major central banks seem determined to tame inflation first and worry about growth later.

2. Medium-term horizon (one to two years): Elevated recession risks

- Elevated risk of recession (US) over the next two years, reflecting geopolitical tumult, stubbornly high inflation (reducing consumers’ disposable income), and central banks’ intense focus on fighting inflation first.

- If and when a recession arrives, expect the monetary and fiscal responses to be more reserved and arrive later than in the last several recessions when inflation was not a concern and when government debt levels and central bank balance sheets were less bloated.

- The next recession is unlikely to be as deep as the Great Recession of 2008 or the COVID sudden stop of 2020, it may well be more prolonged and/or the following recovery may well be more sluggish due to a less vigorous response by central banks and governments.

3. Longer-term secular horizon (five+ years): Reaching for resilience

- A crucial longer-term consequence of the war in Ukraine and the responses to it is the widening of geopolitical fractures that could accelerate the move from a unipolar world to a bipolar or multipolar world.

- In a more fractured world, governments and corporate decision-makers will increasingly focus on searching for safety and building resilience:

- With the risk of military conflict more real following Russian aggression toward Ukraine, many governments (especially in Europe) have announced plans to increase defence spending and invest in both energy and food security.

- Corporate decision-makers are now focused on building more resilient supply chains through global diversification, near-shoring, and friend-shoring. These efforts were already underway in response to US-China trade tensions and because the COVID pandemic demonstrated the fragility of elaborate value chains.

- Moreover, in response to climate-related risks and the COVID crisis, most governments and many companies have already increased efforts to mitigate and adapt to global warming and to improve health security for their citizens and employees.

- This reach for resilience and the search for security may often come at the expense of short-term economic efficiency – the five major macroeconomic implications of this secular trend:

- Higher spending in areas, including defence, health care, energy and food security, more resilient supply chains, and climate risk mitigation and adaptation, to the extent that it won’t be matched by cuts in other areas. However, much of this additional spending may not help long-term productivity growth unless companies make additional efforts to increase productivity, e.g. through accelerated investment in technology and upskilling workers.

- The reach for resilience will likely be accompanied by more regulation and protectionism, which could weigh on long-term growth. Overall, it thus seems unlikely that output growth will be materially higher over the secular horizon than in the pre-pandemic decade.

- The quest for resilience and security introduces some inflationary tailwinds as companies build redundancies into their supply chains and bring them closer to home. To the extent that governments become more restrictive on immigration, labour markets become less competitive, potentially leading to higher wage pressures.The green transition, which should eventually lead to lower energy prices from cheaper renewables, may well push energy prices higher for a while as the supply of brown energy will most probably shrink faster (e.g. underinvestment in infrastructure) than the supply of renewables expands.

- A higher probability of private sector credit events and default cycles – Public sector and corporate balance sheets will likely be under pressure from rising spending needs on security and resilience, debt service costs will likely be higher, and the risk of a recession is real. Elevated inflation implies central banks may be less willing or able to support private sector debtors. Governments may also be less willing to help due to a further surge in debt levels during the pandemic and the need to finance rising pension and health care costs, given ageing demographics.

- A risk of financial deglobalisation and more fragmented capital markets over the secular horizon – a “capital war,” according to one of the forum participants. The weaponisation of financial sanctions and currency reserve holdings may well increase the home bias by public and private creditors in current account surplus countries and could lead to an ebbing of financial flows into the US dollar over time. However, given the lack of good alternative currencies with deep and liquid capital markets to the dollar, any such shifts are likely to be glacial rather than abrupt and likely lie beyond the secular horizon.

It would seem the world has firmly moved beyond one that was once characterised as the ‘New Normal’ of subpar but stable growth and inflation below central banks’ targets. During that period, many investors were rewarded for ‘reaching for yield’ and for ‘buying the dip’, anticipating central bank action and – during the COVID pandemic – fiscal policy support for risk assets. However, over the secular horizon, the probability that central banks will have the ability to suppress market volatility and support financial asset markets in the same way maybe lower.

Looking forward, investors will need to think ‘resilience’ when it comes to portfolio construction. Robust asset allocation and active management will be key in the face of a more uncertain environment for macro volatility, market volatility, and central bank support.

Tune in next View for Part 2 – where we unpack the investment conclusions, including what returns to expect over the secular horizon, bond risks, inflation protection, emerging markets, currencies and global opportunities.

Chart(s) of the Week

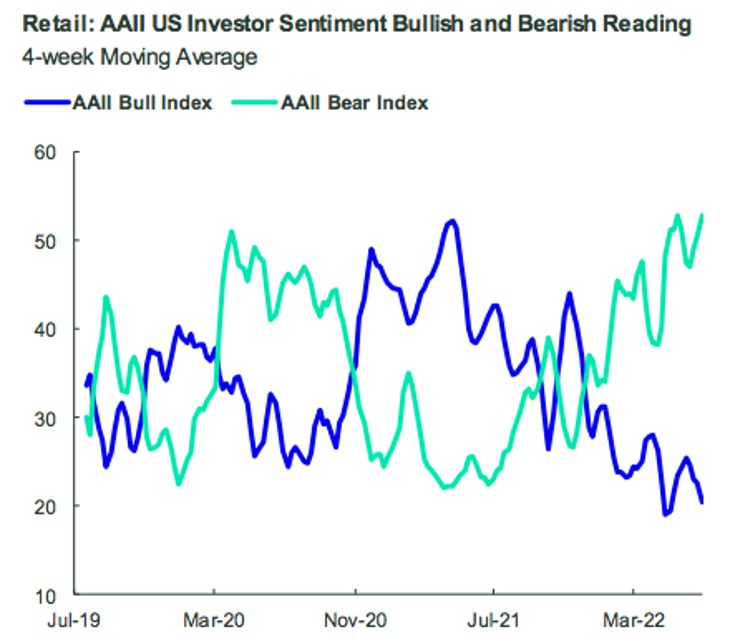

Showing not a lot of resilience at the moment is investor sentiment.

If Jerry Maguire said, “show me the money”, then it was Australian investors who collectively said, “take the money and run”. In June alone, investors took out more than $250 million from managed funds across every asset class. This ‘defensive’ movement is, of course, off the back of recession fears, rising inflation and the realities of higher interest rates.

As our charts of the week depict, bearish sentiment is not just an Australian phenomenon with the US reaching its highest level in over three years – surpassing the start of the pandemic.

Source: Bloomberg Finance, LP, AAII as of June 30, 2022

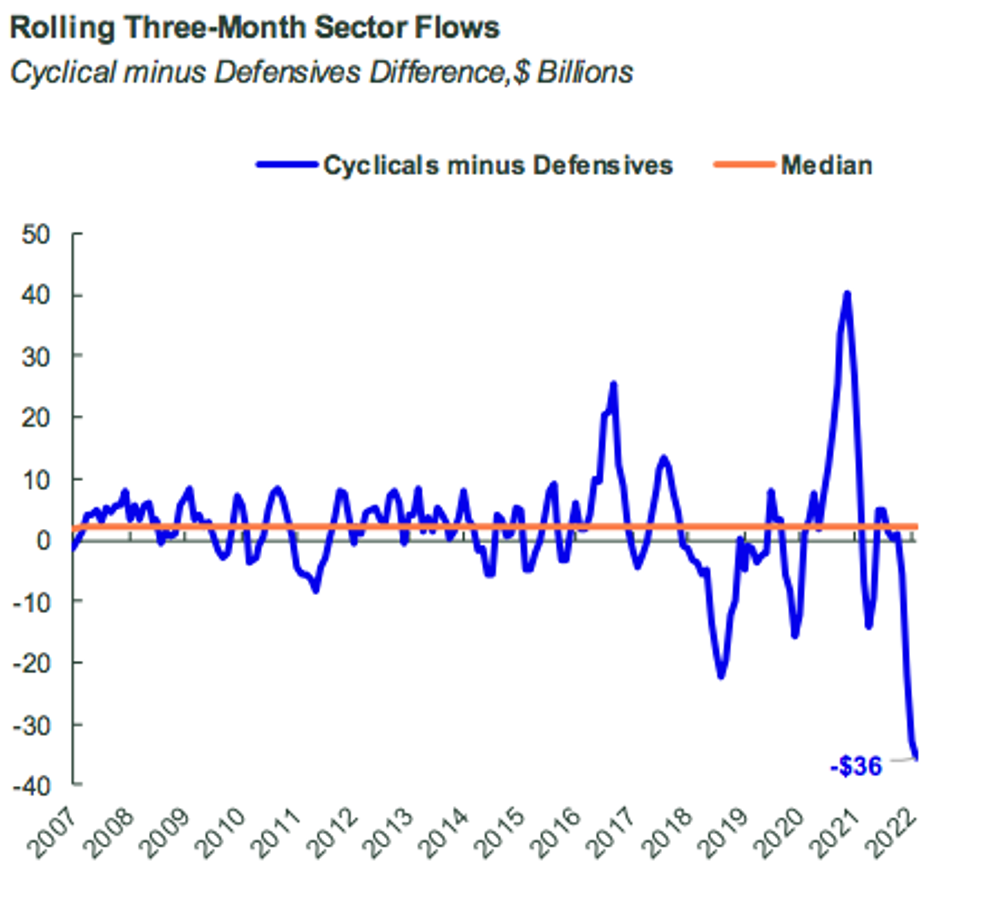

The preference for defensive sector exposures has pushed the differential between the cyclical (equities) and defensive (cash and bonds) to extremes.

Source: State Street Global Advisors, Bloomberg Finance, LP, as of June 30, 2022. Sectors, asset classes and flows are as of the date indicated, are subject to change, and should not be relied upon as current thereafter. This information should not be considered a recommendation to invest in a particular sector shown. It is not known whether the sectors shown will be profitable in the future. All figures are in US dollars.

What We’re Following: Hyperloops

With mentions in both President Biden’s infrastructure bill and EU sustainability studies, Hyperloops, the vacuum-tube-based transport concept, is touted as the next big thing in both public and goods transportation. And, right now, the race is on to turn Hyperloops into a reality.

Combining vacuum tubes with magnetic levitating trains, hyperloops create almost frictionless ultra-high speed travel of up to 750 miles per hour (1207 km/hr). For context, commercial airliners travel at speeds of around 740 – 930 km/hr.

In this short 5 minute video, Wall Street Journal correspondent George Downs explains where companies such as Virgin Hyperloop (which according to their IPO website is looking to go public soon) are right now, where they want to be and what they need to do to make the technology a reality.

How to Enjoy Your Retirement

On winning both the “Best Exterior Design” and “Finest New Superyacht” awards at the Monaco Yacht Show back in 2019, Billionaire Businessman Herb Chambers had this to say

For many people, the journey can be more exciting than the end destination. Markus Persson, the creator of the wildly popular videogame Minecraft, sold his company to Microsoft for $2.5b, only to subsequently lapse into depression. When he sold his company, he also sold his reason for getting up in the morning.

So, what can we learn from these stories of gleeful and melancholy billionaires? The thrill is in the chase. It’s all too common to hear about someone feeling lost after they retire or when their kids leave the nest, as their careers and/or family had been their main source of purpose and daily structure for decades.

As financial advisers, our role is to help our clients live their best life by prudently managing their money. What does your best life look like after work and kids? It certainly requires some deep thought.

To help with one’s pondering, independent publisher FirstLinks recently ran a survey asking its readers to comment on their retirement experiences. A summary can be found here. It is a candid list of observations and worth taking the time to scroll through.

Who’s the Oldest of Them All?

Speaking of a long and happy retirement… Two towns in Sardinia, Italy, are fighting for the distinction of having the longest-living residents, a prize that could bring much-needed economic revenue from longevity tourism.

One town, which has been recognised by Guinness World Records as the municipality with “the largest concentration of centenarians,” has 7 in a population of about 1,780.

The other has only four centenarians. But its residents note that their town has a smaller population: 790 people. That’s not the 1,000 required for Guinness, but density doesn’t lie. “They got their calculations wrong,” one 99-year-old resident apparently scoffed.

The secret ingredients? Reverence for and inclusion of the older generations, a local wine rich in antioxidants, ‘peasant food’ and exercise due to the mountainous nature of the landscape. Read more here.

Adolfo Melis, 99. In 2014, his family won the Guinness record for the highest combined age of more than 800 years for nine living siblings. Gianni Cipriano for The New York Times.

The Wisdom of Charlie Mungar

Readers of the View will know just how much we enjoy the revered Charlie Munger (business partner of Berkshire Hathaway chairman Warren Buffett).

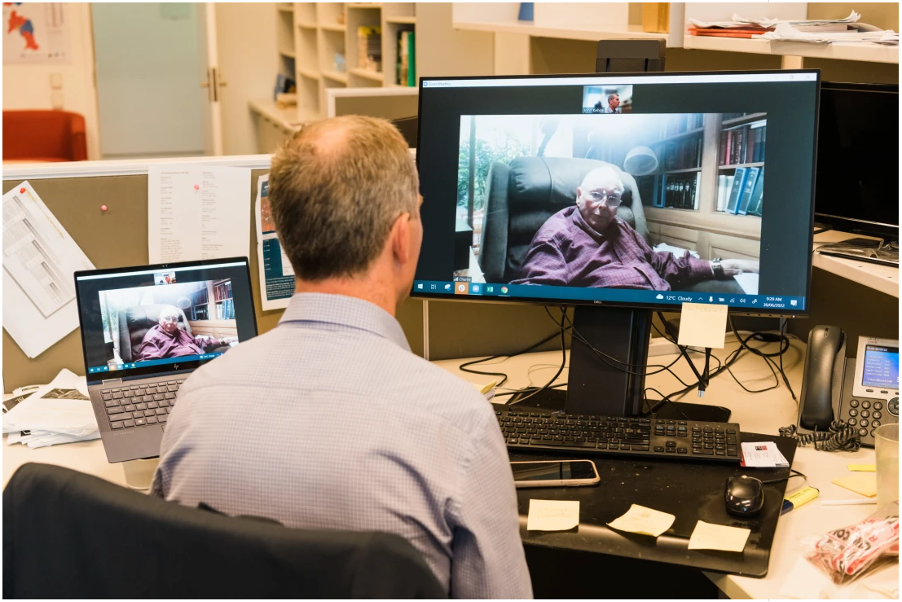

Recently, in an exclusive interview, The Australian Financial Review asked Munger to discuss his investment tips. In short, he says to look beyond the inflation spike, back both fossil fuels and renewable energy, and never touch cryptocurrencies.

It is an article that is, unfortunately, behind the paywall. However, we share some of his more profound quotes below.

“I’m 98½ years of age, and I’ve seen a lot of inflation. I intend to live through inflation. I’ve lived through a lot of it already in my long life. It doesn’t discourage – always with us in an episodic way.”

“I’m just trying to invest my own money and Berkshire’s money sensibly. All these people that are blabbering on television don’t think the way that I do.”

“I think we’re going to be using fossil fuels for a long time ahead, because we have to. If you stop to think about it, the present population of the world couldn’t eat if we didn’t use natural gas to create nitrogen fixer fertiliser.”

“We’re not going to get rid of fossil fuels until our investment in renewables bears the necessary fruit.”

“Crypto is an investment in nothing, and the guy who’s trying to sell you an investment in nothing says, ‘I have a special kind of nothing that’s difficult to make more of’ – I don’t want to buy a piece of nothing, even if somebody tells me they can’t make more of it”.

Charlie Munger talks to The Australian Financial Review’s economics

editor John Kehoe on Zoom.

Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser.