Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Update, Supercharge your retirement, monthly moves and more

|

11th August 2023 |

Analysts of late seem to have taken a cue from a classic suspense movie – dramatic, unpredictable, and leaving us a little scared to look. The script is laced with economic intrigue, with job data serving both as the protagonist and antagonist, inflation stealing the show, and the Central Bank’s next move dripping with tension.

Such is the current nature of ‘things’ that the perpetual output from many of these analysts look like contradictory guesses. Forecasts read a couple of days after publication are already wrong.

A recent headline in the leading global investment publication, Seeking Alpha, reads:

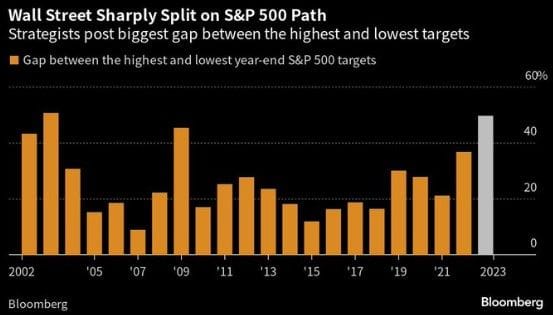

The S&P500 currently stands at approximately 4,500, and it might just be on a trajectory towards 4,700. Bloomberg reveals that Wall Street analysts’ forecasts for the S&P500’s year-end target in 2023 encompass a remarkable 50% range.

The bottom line is the hourly and daily milieu is just noise for most long-term investors, and, whilst it may seem financial markets are changing at a pace never seen before – consider this quote:

“In recent years the pace of change and innovation in financial markets and institutions here and around the world has increased enormously as have the speed, volume and value of financial transactions. The period has also seen a greatly heightened degree of aggressive competition in the financial sector. All of this is taking place in the context of a legal and a regulatory framework which is increasingly outdated and ill-equipped to meet the challenges of the day. This has led to … concern that the fragility of the system has increased, in part because the degree of operational, liquidity and credit interdependency has risen sharply.”

Was this said last week? No, it is, in-fact Gerald Corrigan, ex-President of the New York Fed, speaking in January 1987.

The notion of volatility isn’t novel. There consistently exist factors that prompt selling decisions, and situations that appear as crises can often reveal themselves as ongoing background noise!

On a different note.

For the best part of four years, we have been consistently delivering our View newsletter. What initially started as a fortnightly endeavour to navigate the pandemic has, we hope, evolved into a valuable and informative asset for our readers.

Throughout this time, our marketing specialist (Freyr) has dedicated her Fridays to curating content and crafting the presentation for you to enjoy. Freyr is about to embark on the next chapter of her career, and as a result, this will be her last View. We express our heartfelt thanks to Freyr for her effort and dedication and wish her all the very best for her future.

Freyr’s decision has challenged us to look at an editorial shift and presents a perfect opportunity to transition the View into a monthly communication. This adjustment in no way changes our commitment to providing quality insights while accommodating the preferences and schedules of our valued audience. We look forward to introducing you to our new editor next month.

|

|

August began with a significant event as Fitch, a major credit agency, downgraded the US debt rating from AAA to AA+. This mirrors a similar 2011 decision by Standard & Poor’s. While this news disrupted the market’s calm, the reaction was more muted than in 2011 due to the vast difference in economic conditions.

Fitch’s downgrade highlighted concerns like fiscal deterioration, growing government debt (which peaked at 130% of GDP in 2020), and eroded fiscal confidence due to recurring debt-limit standoffs. While the downgrade isn’t a seismic shift, it could prompt short-term profit-taking and offer markets a breather after a strong equities run, with the S&P 500 up 20% this year – As discussed previously, this uplift is primarily due to the magnificent 7 (it is fair to say the other 493 stocks haven’t done a lot…).

July jobs data a mixed bag for the Fed

Job security and income gains have been a key pillar of support behind the resilient US economy.

However, the tight labor market and strong wage growth have also been a source of concern for the Fed as it aims to bring inflation back to its target. From the lens of the Fed, the July employment data provided mixed takeaways.

The economy added 187,000 jobs in July, slightly less than economists expected and the smallest gain since December 2020, while the payrolls for the previous two months were revised downward. Despite demand for labor easing in the past few months, the unemployment rate ticked down to 3.5%, the lowest since the 1960s, and wages grew at a faster-than-expected pace.

Taken all together, last week’s jobs data did little to shift the narrative. The labor market is cooling but only slowly, consistent with the soft-landing scenario. Wage growth remains a concern for the Fed, leaving another hike still on the table for September. With this in mind, all eyes were on yesterday’s CPI reading.

Inflation numbers

US headline inflation in July saw a slight increase from June, a smaller-than-expected increase. The Bureau of Labor Statistics reported a 0.2% monthly rise in the consumer price index (CPI), reaching an annual rate of 3.2%. Core inflation, excluding volatile components, also rose 0.2% in July, with an annual figure of 4.7%. This data supports the likelihood of the Federal Reserve maintaining interest rates at its upcoming September meeting, with market traders putting the chance of a pause at 91%.

Bond-yields stabilise

Last week 10-year Treasury yields set a nine-month high, and investment-grade bonds gave up most of their gains for the year. The renewed focus on fiscal deficits and the boost in the size of the Treasury’s quarterly bond sales likely contributed to the rise in yields, as have the US economic strength relative to expectations and an uptick in commodity prices. However, recent days have seen bonds rebound.

The historically high yields present a chance for income generation and future lower yields as the Fed eventually cuts rates next year. Historical data shows that after the Fed’s rate hikes, 10-year yields typically dropped by 1% on average six months later, suggesting a positive outlook for government bonds as tightening ends.

The bottom line

The US credit downgrade serves as a reminder that action will need to be taken to keep US debt on a sustainable path, but Fitch’s downgrade won’t alter core drivers of the economy and markets. The evolution of growth and inflation provides a solid foundation for equities to remain in a sustainable uptrend. But downside risks remain, which could lead to higher volatility in the second half of the year.

| _____________________________________________________________________________________________________________ |

|

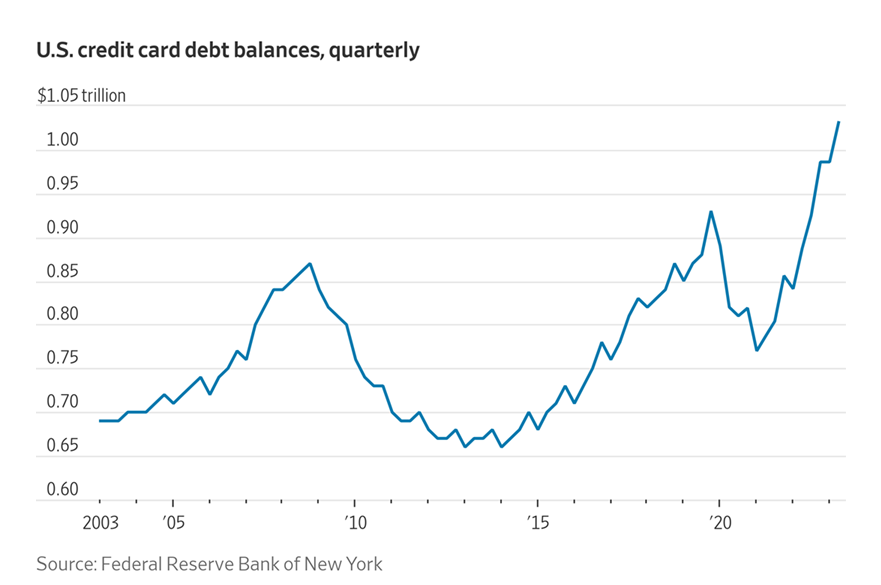

| On the flip side of the soft landing argument, US credit card debt levels have just notched a new but undesirable milestone: For the first time ever, they’ve surpassed $1 trillion, according to data released Tuesday by the Federal Reserve Bank of New York. It is a fresh record that reflects rising interest rates alongside elevated inflation.

Whilst consumer spending is still reported as strong, pandemic lockdown savings have now been exhausted, the credit won’t last forever, and the debt (which gets more expensive with every rate rise and currently sits at a near-record 20.53%, according to Bankrate) will need to be paid. It is an indication that cracks may be forming in some households’ financial situations. Chart #2One high-profile forecast which has defied most analysts is Australian house prices, driven by high immigration and low unemployment. However, as shown below, according to the Westpac/MI survey, perceptions of whether now is a good time to buy a dwelling are at their lowest level since the GFC, yet prices are rising. It certainly questions the durability of the property price upswing. And, with the fixed rate cliff currently peaking, seeing how consumers and banks manage loan defaults will be interesting.

|

|

|

| Dollar-Cost Averaging: Just like your favourite coffee.

Investing’s secret sauce? Think of dollar-cost averaging as sipping your favourite coffee daily. Rain or shine, you order the same brew. Apply that to investments: invest a set amount of money regularly, regardless of market mood. When stocks slump, you will be buying more shares; when they rise, you buy fewer. Over time, your average cost per share finds balance. Much like your dependable morning cup of coffee, dollar-cost averaging makes investing smoother, one measured sip at a time.

|

|

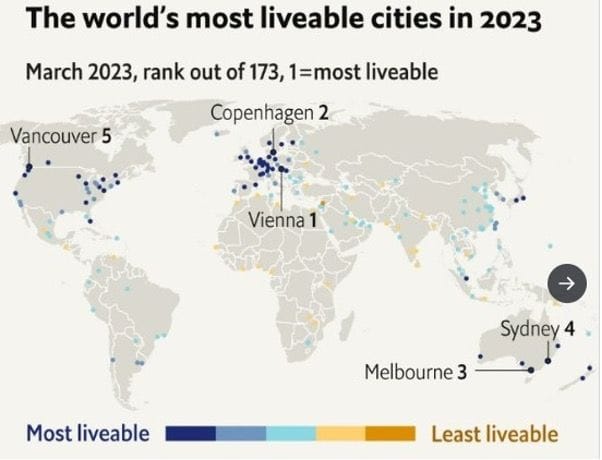

In case anyone doubts that Australia is a great place to live, see the latest global city rankings from The Economist. Tiny Australia holds two of the top four places.

Adelaide (home of FinSec) climbed the liveability ladder from 30th to an impressive 12th.

Rankings consider factors including health care, education, culture, stability and environment.

|

|

|

|

|

With great pride, we announce our latest authorised representatives, Oliver Smith and Kurtis Philips. Both individuals have been valuable members of the FinSec team in various capacities for several years. Having successfully completed their Graduate Diploma of Financial Planning, they now embark on their Professional Year. Our heartfelt congratulations to Kurtis and Oli as they join our adviser team in the roles of provisional financial advisers. Their dedication and experience will undoubtedly contribute to the continued success of the firm.

|

|

|

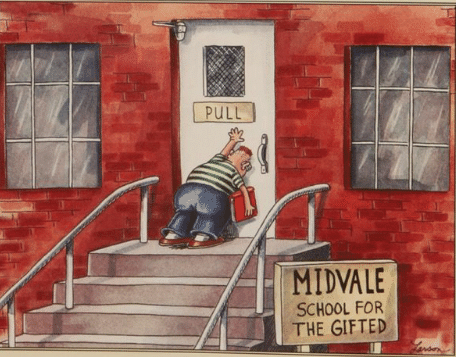

| We’ re now nearly 30 years down the road from when Gary Larson finally put his sketch pad aside, stored his pencils and stopped giving us his daily insight into his unique look at our world. Incredibly, at its peak, The Far Side ran in some 1,900 newspapers and was translated into 17 languages. His work has been compiled into 23 books, 22 of which have made The New York Times best-seller list. It is humour that extends beyond the simple and makes for our Friday funny.

|

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |