Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Markets, Wealth Wisdom, Protecting your nest egg and more…

|

15th September 2023 |

Navigating by the stars under cloudy skies – Jackson Hole’s inflation forecast

The majestic Grand Teton mountain range in Wyoming, US, provided a striking backdrop for the high-profile annual Jackson Hole economic retreat last month, with financial markets watching the event as closely as the area’s native hawks.

The annual get-together of top central bankers (including our own Dr Philip Lowe for the final time before he passed the baton to Michele Bullock) is significant, because it affirms the Federal Reserve’s posture on near-term monetary policy and inflation targets – which, in turn, affects Australian investors.

Federal Reserve Chair Jerome Powell’s remarks that the Fed remained committed to its 2 per cent inflation target but will “proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data” were met by a relatively bumpy reaction from markets, before seeming to settle down again.

Wall Street had been hoping that he’d say they were done with hiking interest rates. That wasn’t to be.

Since March last year, the Fed has lifted interest rates 11 times, moving its official rate from close to zero to a range of between 5.25 per cent and 5.5 per cent – the highest level in 22 years.

“Although inflation has moved down from its peak – a welcome development – it remains too high,” Powell said in his speech, sentiments echoed by European Central Bank boss Christine Lagarde.

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

“We will keep at it until the job is done.”

As we’ve previously remarked, no-one wants to be Arthur Burns, the 1970s Fed chair who eased too soon and let inflation run rampant and whose name has been invoked recently in the financial press as a cautionary tale.

Analysts say while the worst of the inflation shock might be behind them, a global slowdown looms, while China contends with deflation and a difficult pandemic recovery, and US 10-year Treasury yields skyrocket (only to retreat again on August 29 on the decline of job openings in the US again raising hope of an end to rate hikes).

Every morsel of information is creating market gyrations.

AFR columnist Karen Maley makes the point that investors are demanding higher yields on longer-term bonds to compensate for the risk of persistent inflation.

Late last month, the yield on benchmark US bonds reached the highest level since late 2007.

Meanwhile, she says real interest rates – borrowing minus expected inflation – are at their highest level since the financial crisis.

“After falling to a low of minus 1.6 per cent in the depths of the COVID-19 pandemic, the yield on inflation-linked US government bonds – a commonly used gauge of real rates – has rebounded to close to a 14-year high of 2.3 per cent,” she wrote.

We’ll conclude with a final, somewhat poetic word from Powell: “As is often the case we are navigating by the stars under cloudy skies.”

Watched closely by those circling hawks.

Christine Lagarde, Kazuo Ueda and Jerome Powell at the Jackson Hole economic symposium 2023. Photographer David Paul Morris/Bloomberg.

|

Wealth Wisdom – why retirees are reluctant to spend their Super |

Range Anxiety.

It’s the term used to describe a motorist’s fear of an Electric Vehicle running out of battery before getting to their destination – effectively leaving them stranded on the side of the road.

Range Anxiety is touted as one of the biggest barriers to a more rapid take-up of environmentally friendly EVs.

Why do we mention this?

Well, this month we’ve heard resurrection of the term – Longevity Risk – which describes a situation where Australian retirees live too frugally because they often fear they will run out of superannuation before they die.

In releasing the Intergenerational Report, Treasurer Jim Chalmers has rightly pointed out this is an issue that needs resolving.

“Half of retirees draw down the minimum and, on average, people who draw down the minimum will still have about a quarter of their super remaining when they pass on,” Dr Chalmers said on a roundtable hosted by the AFR.

“What that really means is people are living more frugally than they need to. There’s not enough confidence in their balances, there’s not enough diversity or flexibility in products in the market or literacy or advice or strategies to match people with these products.”

Treasurer Jim Chalmers has flagged moves to require super funds to work harder to deliver financial advice, drawdown strategies and interest-bearing investments for the millions of Baby Boomers entering retirement.

Watch this space.

One factor at play is the apparent divide between generational values: Baby Boomers – who may have received relatively small inheritances from their ‘quiet generation’ parents – are wanting to leave more for their adult children, and grandchildren.

What is clear is that retirement products must evolve to match the changing circumstances.

Over the past 20 years, a combination of falling interest rates, high economic growth and the rise of China has provided a significant tailwind for markets which has meant account-based pension products have, in the main, delivered for retirees.

But in this brave new world of rising interest rates, lower growth and a troubled China, there must be more options and a sharing of longevity risk with providers.

A year after the start of the Retirement Income Covenant requiring super funds to develop a strategy to help their members handle retirement, there’s mounting pressure on the (laggard) industry to step up its urgency and investment in customer solutions.

In other words, it’s time for them to put their foot on the accelerator to incorporate effective retirement income strategies (and new products) into their business models.

In a bid to avoid anxiety all round.

| _____________________________________________________________________________________________________________ |

|

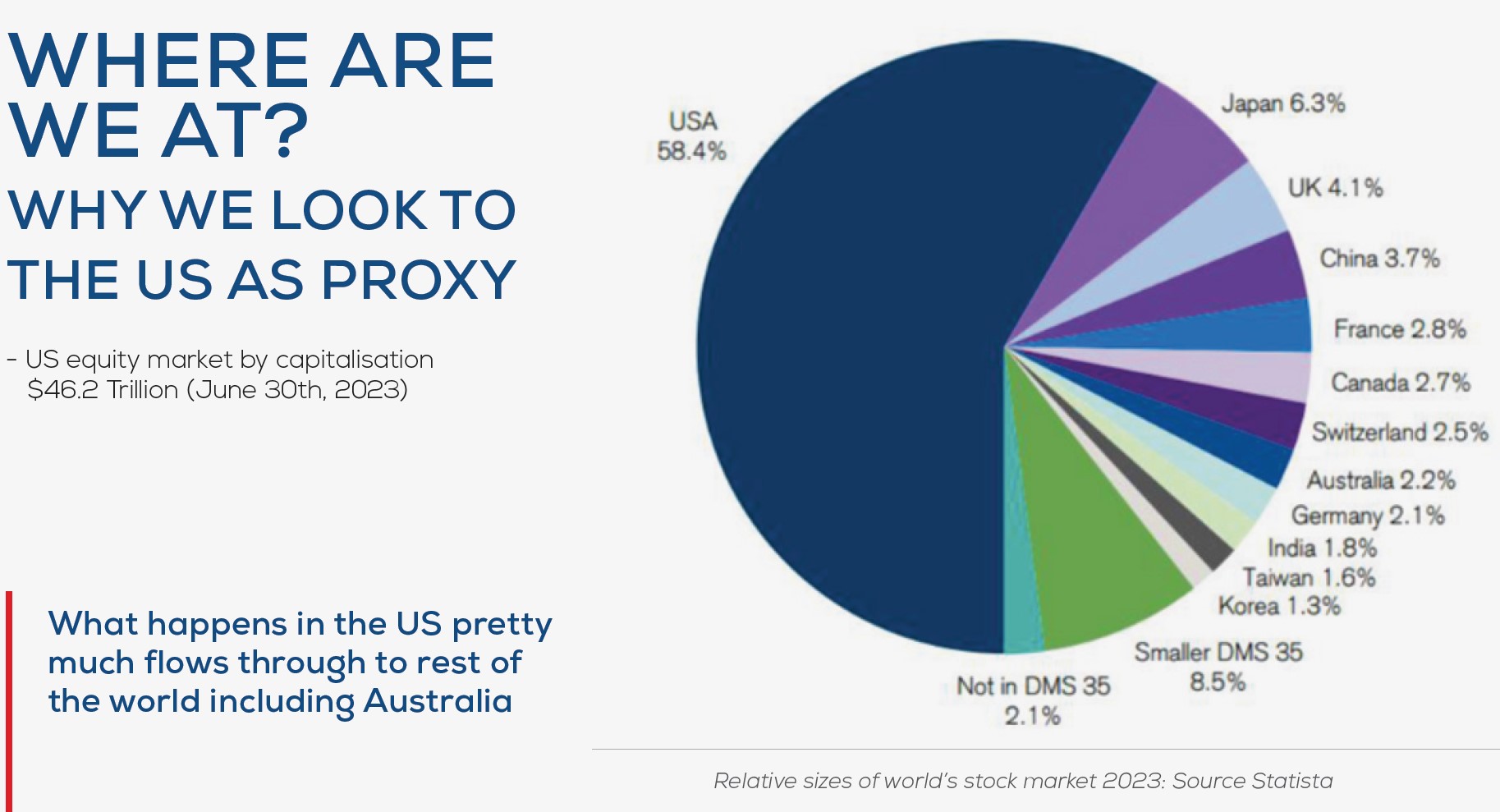

You’ve heard the saying when the United States sneezes, we catch a cold.

Well, this chart helps to explain why.

The US equity market by capitalisation is worth a staggering $46.2 Trillion (as at June 30, 2023) – or 58.4 per cent of the world’s stock market.

That’s more than all other countries combined.

By comparison Australia represents 2.2 per cent of global stocks.

|

|

Someone call a doctor – productivity needs revival |

| American entrepreneur Tim Ferriss – author of the New York Times best-seller “The 4-hour Work week” – often tells us we need to “focus on being productive instead of busy”.

Well, it seems not many of us have got the memo because productivity here is collapsing. If it were a patient, you’d be wheeling it into Emergency around about now. Between March and December last year, Australian productivity – GDP per hours worked – fell 4.1 per cent. Taken from before the pandemic, it’ s been flat. When you take into consideration that Treasury has based its budget forecasts on productivity growing 1.5 per cent a year, and the Reserve Bank factoring in declining inflation based on pre-pandemic productivity growth of 1.2 per cent, the outlook’s not looking good. Productivity is inextricably linked with inflation, interest rates and economic growth. We need high productivity for the overall prosperity of our country and the economy. So, what’s to blame? As is often the case, it’s not one factor but many that have conspired to create this cliff – with productivity growth declining from a peak of 3 per cent a year during the late 80s and 90s to just 1.2 per cent in the past 20 years and, lately, zero then negative. This decline has coincided with a fall in real wages and a cost-of-living crunch – a jaded post pandemic workforce that’s worn out, wrung out and being asked to work harder with pay rises of 2 to 3 per cent. Employees have become rusted on to the idea of working from home and are showing great resistance (even revolt) to efforts to get them back to the office. While it’s true that some people can be more productive working from home, without face-to-face communication, team camaraderie and cultural engagement, the benefits will inevitably ebb over time. Add to this mix, the straight jacket of bureaucratic red tape, compliance and lack of tax reform among other business hurdles, and it’s a productivity handbrake. As they say, bureaucracy is the enemy of outcomes. |

|

|

Is your nest egg being (unwittingly) poached?

| There are only two certainties in life, as they say – death and taxes.

And while we may not be able to avoid them, we can certainly do our best to delay the onset and/or minimise our exposure to them. Which is why it is concerning to learn that more than 1 million older Australians may be paying extra tax on their superannuation even though they are eligible for a tax-free pension account. Money held in super is taxed at 15 per cent while people are working and saving (the so-called accumulation phase) – but once people qualify for retirement and move into the pension phase, there is no tax. However, Challenger reports that around 1.3 million super accounts worth $225 billion belonging to people aged over 65 have not been switched over. “Many people are left in the accumulation phase paying unnecessary taxes simply because they are not aware of the options available to enjoy a tax-free income in retirement,” Head of retirement income research at Challenger, Aaron Minney, was quoted in the AFR. “While there are valid reasons, a lack of awareness and the focus on the nest egg of super mean that many people don’t know when they should crack their egg open.” While there will be some aged over 65 who haven’t started a tax-free pension because they’re still working, others will be simply unaware of tax-free pensions or that they’re being taxed because it’s paid directly by the super fund. Either way, it underscores the critical importance of having a trusted financial advisor, who can ensure that those who’ve worked hard all their life get to keep what’s rightfully theirs. |

Footy finals a money spinner – but will the RBA be cheering?

We’re in the grip of footy finals fever and, two weeks’ out from the AFL Grand Final, the games are already proving an economic and tourism boon for the host states.

From hotels, pubs, clubs and restaurants to the airlines (some have been accused of jacking up airfares to capitalise on the finals frenzy), economists expect footy to deliver an economic sugar hit off the field to rival the on-field spectacle.

But will the RBA be cheering from the sidelines, or will they be “spoilsports”, viewing the finals as fanning the flames of inflation?

(We know they had Taylor Swift and Paul McCartney firmly in their sights as evidence that people still had too much discretionary spending power).

Professor Tim Harcourt – Industry Professor and Chief Economist at the Institute for Public Policy and Governance at the University of Technology Sydney – says while the AFL finals is a money-spinner enough to make “travel agents and hotels salivate”, the RBA won’t be too concerned.

“It’s mainly hospitality packages, tickets and interstate tourism plus the broadcast rights that are factored in,” Professor Harcourt said.

“There’s a bit of price gouging but it’s transitory so won’t affect long term inflation.

“The big surprise this year was the economic success of Gather Round in Adelaide that boosted tourism more than expected.”

In 2018, the estimated total net-economic contribution of all AFL matches to host cities was $700 million, including nearly $340 million just for Melbourne, he said.

Friday Fun

As the saying goes, don’t give up your day job.

And as ten-pin bowlers, we make excellent financial advisors.

This month, while the colour and excitement of the Royal Adelaide Show rolled into Wayville near our offices, we spent two days off-site in the Barossa Valley for some quality planning and team building.

Hail – (yes hail in Spring!) – put a dampener on our plans for mini-golf, but there was plenty of strike action to keep us in good spirits.

Welcome Belinda Heggen – our new Editor

Before we go, a very warm welcome to The View’s new Editor, Belinda Heggen.

Founder of FLUENT Media, Belinda brings a wealth of experience as a journalist and presenter across print, TV and radio and as a media strategist and advisor to senior politicians (including a former South Australian Treasurer) and leading CEOs.

In her early 30s she tells us she woke at 2am each weekday to present the finance bulletin on Channel Ten’s national Early News which, she says, more than proves her commitment to the world of finance!

| Stay safe and look after one another. As always, if you have any concerns or questions at any time, please reach out to your FinSec adviser. |